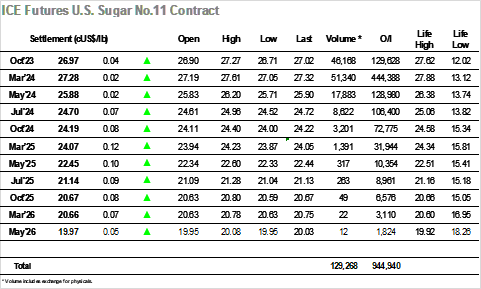

An initial dip in prices was soon reversed and the market then embarked on a push higher with specs leading the way as March’23 extended to 27.61, positioning itself within striking distance of the 27.88 contract high. There was an expectation that the push would continue into the afternoon and so having set back into the range ahead of the US morning it was surprising to find that the decline continued as a lack of buying from US based specs/funds led to some liquidation from morning buyers. The fall extended to 27.09 and while the market was never in danger of collapsing it was sufficient to set the tne for a calm afternoon of consolidation. With the market moving along within existing parameters the only point of interest became the Oct’23 spreads, and ahead of next weeks expiry the Oct’23/March’24 was recovering some of its resent losses with a push back up to -0.27 points. Some of this ground was given back during the latter stages with settlement made at -0.31 points, while the March’24 flat price continued to drift to a quiet conclusion at 27.28.

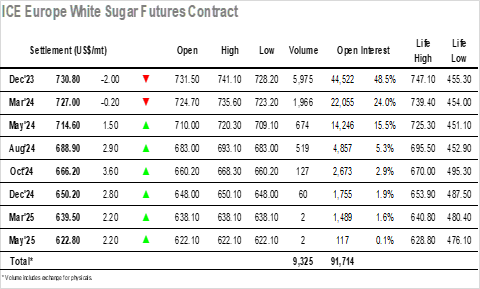

There was a fresh enthusiasm from buyers this morning, possibly motivated by the ‘Friday factor’ with spec longs wanting to try and dress the market ahead of the weekend and ensure the ongoing technical strength. With little resistance being met this movement extended up to $741.10 by late morning, though the buyers then backed away to allow prices to ease back into the range ahead of the busier afternoon period. Unexpectedly there was no continuation of the morning intent from the US specs and so prices continued to slide to a session low $728.20 before finding some support, though this only drew prices back to mid-range with the morning momentum long forgotten. This was also impacting on the white premiums which were proving unable to continue yesterdays recovery leading March/March’23 to slip back to trade either side of $125.00. The market revisited the lows ahead of the closing call, with settlement made at $730.80 to conclude the week quietly.