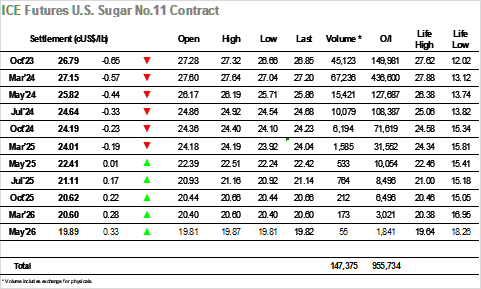

A lower opening left a small gap on the intra-day chart, and with consumer buyers showing no interest the March’23 contract continued to slip with trades seen down to 27.40 before attempting to stabilise. The lower levels were discouraging the spec and algo interest that has been the backbone of the recent strength, and without their support another drop to 27.27 took place during the late morning, then moving sideways as we awaited the arrival of US traders. There was no sign of a positive reaction from the specs with the market continuing to hold the 27.30 area, the calm only broken by a brief spike to 27.59 which failed to gain any traction. Instead, the market fell back to again sit in the 27.30’s until the final hour drew some fresh selling (longs reducing their exposures maybe) to send the price plunging to a fresh daily low of 27.04 ahead of a settlement at 27.15. Oct’23/March’24 also settled weaker at -0.36 on the back of front month liquidation ahead of expiry, though the weaker settlements remain well above Mondays lows and do no significant damage to the broader picture.

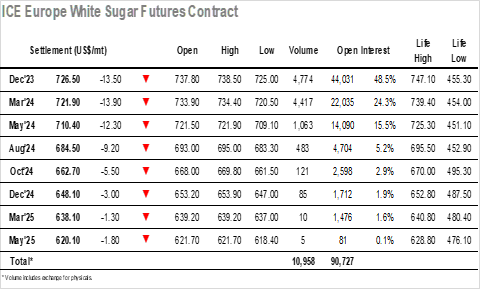

There was suddenly no support in place for the market resulting in an opening slump to $731 for Dec’23, and though this fall did then draw out some interest it was only sufficient to lead to a period of consolidation with specs not prepared to push the price back upward. This left the market looking a little lost ahead of the US morning, and unlike recent sessions there was no interest emerging to change the situation leaving the market to continue in the $730 area, making intermittent new daily lows along the way. There was a brief defensive move by specs to try and regenerate some upward movement midway through the afternoon, however the failure of this move appeared to destroy any hopes of recovery for the day and the rest of the day saw a return to struggle. This culminated in new lows being recorded at $725.00 as we moved towards the close, leaving Dec’23 settling only just above this mark at $726.50. Overall, it was a day which changes little, as seen over recent weeks where corrections have been quickly reversed by the longs. We await to see if this move will result in a similar outcome over the rest of the week.