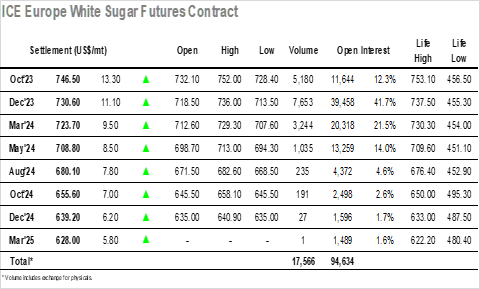

Recent sessions have seen the whites take more of a backseat in the sugar stakes, and the range bound trading which saw Dec’23 edging along in the mid-teens for much of the morning was to be expected. What appeared set to be a quiet session came to life suddenly during the early afternoon, driven by some sharp spec led buying for No.11 that spiked the market to new daily highs as white premium values tracked the movement. Volatile trading was back on the agenda as buying continued to flow in and by mid afternoon Dec’23 was holding in the high $720’s and appearing strong despite a lack of any meaningful reason for the movement. Technical strength will always draw support and the move continued all the way to $736.00 (just $1.50 shy of the contract high) before pausing as buyers took a step back to reassess. The wider macro was not showing the same strength, with only crude trading firmer on its news of reduced Saudi production, but that was not deterring the specs who ensured prices remained within proximity of the highs moving through the final hour. Oct/Dec’23 saw another solid volume with rolling continuing into the final few days of the Oct’23 contract life, widening the spread to $16.50 late in the day. Closing activity saw prices retreat a little with Dec’23 settling at $730.60, while the white premiums ended at $155.00 for Oct/Oct’23 and $127.00 for March/March’24.

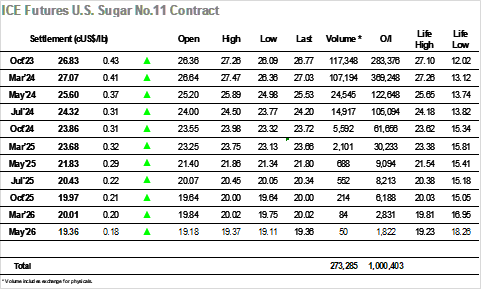

The market resumed this morning by trading a similar band to that seen yesterdays as Oct’23 slipped back from opening prints at 26.39 to be trading down to 26.09. Volumes were light as prices continued to track along in familiar ground, with the only interest for the rest of the morning being seen in the Oct’23/March’23 spread where the index roll continues to tick along. The 1pm US “opening” drew in the usual increased volume, and it had a dramatic impact as specs drove the market rapidly higher as Oct’23 rallied to 26.64 before pausing. Suddenly there was interest being pulled in from elsewhere and a second push saw system buying increase to leave the market holding in the 26.90’s and suddenly eyeing up the recent contract highs at 27.10. The carrot was too big to ignore and with selling still proving to be limited there followed another spec push which led Oct’23 to spike to 27.26 on around 4,000 lots, though an immediate correction back to the 26.80’s suggested that some specs were whipped around as these new lifetime highs were made. The index roll was meanwhile continuing to generate the bulk of another day’s volumes with the spread value remaining largely in check as Oct’23/March’24 ranged between -0.29 points and -0.21 points against a large 73,000 lot volume (making up around 70% of the screen volume total for the two nearby prompts). There was some end of day spec liquidation which sent the market back below 27c, Oct’23 ending at a still firm 26.83 as the wild swings continue.