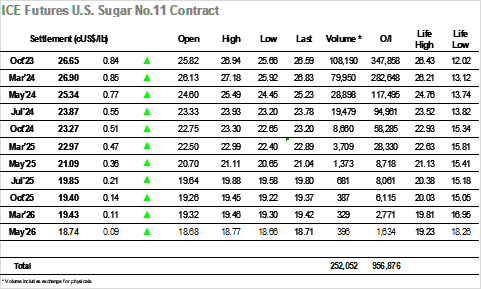

Returning from the 3-day weekend the sentiment was still firm, London whites having recorded modest gains in our absence yesterday. Initially this had little impact upon proceedings with the bulk of the morning spent holding either side of unchanged, though this was a positive base from which the specs could again look to build and challenge above 26c for the first time since June. Fridays COT report showed a healthy growth in the net fund long to 154,620 lots, showing that the appetite from the speculative community has increased, and they duly continued with their current pattern of buying in taking Oct’23 above 26c very early in the afternoon. Progress has been assisted by the lack of overhead producer selling recently, and that remained the case as the price action accelerated ahead to break April’s 26.43 contract high, triggering some aggressive buying to reach 26.80 quickly afterwards. There was further spec/fund interest to follow and an eventual high was recorded at 26.94 before the market saw some late afternoon profit taking, coupling with a little buyer fatigue to leave values holding the upper quarter of the range through the final stages. Settlement for Oct’23 was at 26.65 a mighty strong technical close still with values above the former contract highs and indeed at new 11-year highs overall, leaving the ground set for continued upward progression should the fund/spec appetite remain.

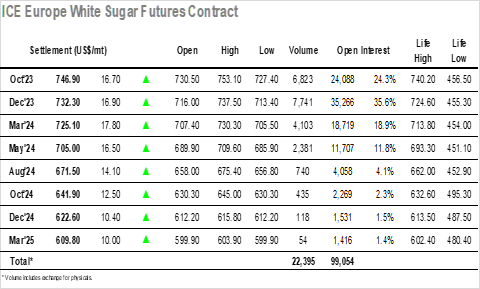

The early part of today’s session saw the market holding little changed before dipping briefly back down to $727.40, however the tone was generally positive with the nearby white premiums holding onto the gains achieved when No.11 was closed yesterday. While volume remained light there is strong upward sentiment continuing in the market at present and by late morning the nearby prompts were pushing ahead, Oct’23 targeting last weeks contract high at $740.20 while Dec’23 was similarly aiming toward $726.40. It did not take much longer for these levels to be reached, the bulk of the buying now coming into the Dec’23 contract to reach $728.00 before pausing. Sentiment remains so strong both technically and against physical supply concerns for the first half of 2024 that there were further spec led pushes higher to follow as the afternoon progressed, resulting in a new contract high for Dec’23 at $737.50 while Oct’23 reached to $753.10 with the Oct/Oct’23 white premium working towards $164. Inevitable after making daily gains in excess of $20 there was a degree of profit taking seen, and this sent prices back from the highs during the final 90 minutes with Dec’23 levelling out to end the day in the lower $730’s. Settlement was made at $732.30, maintaining the technical strength which the specs seem likely to try and build upon further.