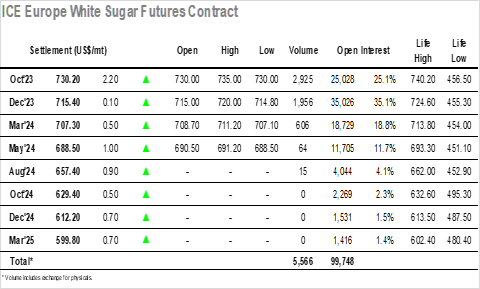

With No.11 closed for a US holiday there was a subdued activity level around the market this morning, though that did not deter the longs who maintained the movement from Friday with an early nudge into the lower $730’s. Volume soon fell away to very low levels with the market content to consolidate the early range, Oct’23 holding above $730.00 while the Oct/Dec’23 spread widened out to $14. With most of the paltry volume being generated by the spread the differential saw a further widening to $15.20 during the afternoon as Oct’23 extended to $735.00, though the outright highs were not maintained with the price eroding back down through the range. Small trader liquidation seemed to be the reason for falling back to $730.00, however there was limit order buying in place from this level and so the market was able to hold through the closing stages to ensure another positive settlement, Oct’23 ending at $730.20, while Oct/Dec’23 closed firmly at $14.80 having made a new session high of $15.60 late in the afternoon.