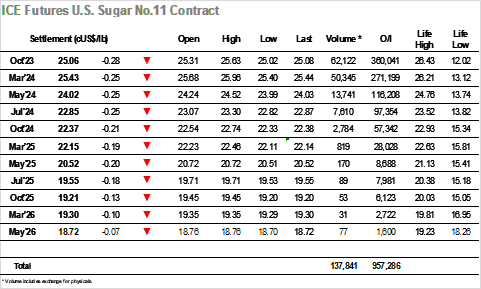

Today, No.11 trading started opening at 25.31, 3 points lower than the yesterday’s settlement price. However, shortly after the opening, the market experienced a decline, touching at 25.12. Subsequently, buyers entered the scene, initiating constructive positions. By 9am, the market recuperated its opening levels, and at 10h15am, it reached its daily high until that point trading at 25.52. Over the following two hours, the market maintained a sideways movement until noon. At this point, buyers gained momentum, propelling the market to a peak of 25.63, achieved around 12h45pm. From that juncture, the market underwent a corrective phase throughout the afternoon. By 2pm, the trading value had receded to 25.45, and this correction persisted at 3pm, with the market trading close to 25.30. Around 5pm, an effort for a recovery was witnessed, as the market briefly touched 25.42. However, this uptick was short-lived, as the market quickly reversed course, concluding the day’s trading at 25.08. The settlement price was 25.06, a decrease of -0.28 (-1.10% change). The total trading volume amounted to 62k lots, while the V3/H4 spread experienced a decline of 0.03, now trading at -0.37.

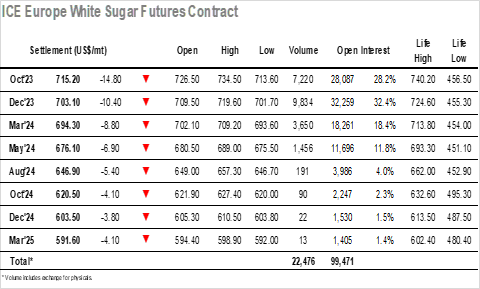

Today, the Oct’23 contract opened at a price of $726.5, reflecting a slight decrease compared to the closing figure of $730, which was recorded on the prior trading day. In the first 30 minutes of the market, the price kept rising slowly until it reached the $728 level. Subsequently, the market experienced a lack of negotiation, with only a few lots being negotiated over the next hour. After this moment, more volume was showed heating up the market and pushing the prices slightly higher and reaching the day’s high at $734.50. However, this was followed by another period of low trading volume for the next few hours. Around 12pm, the market started to show more activity, with more seller volume appearing. This gradually brought the market down, and more activity occurred in the last 15 minutes of the trading session. The settlement price was $715.2, marking a decrease of $14.8 from yesterday’s settlement, a -2.03% change from the previous session. Oct’23 saw a total trading volume of 7,000 lots, and the V3V3 white premium closed at $162.52, down $7.33.