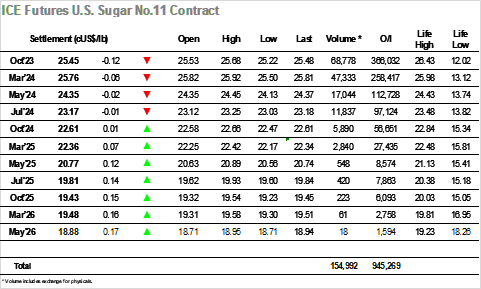

Today No.11 market opened at 25.52, 4 points below yesterday’s settlement. Just after the opening, market tried to make some upside move however resistance was found. The daily high was touched near the opening at 25.68 but soon market lost power and started to trade sideways between the 25.20-25.60 range from 9am until noon. At that time, with Americas opening, more selling activity was seen and by 1pm, market was trading at the daily low of 25.22. The next trading hour was market by some volatility, market touched 25.48 around 1h30pm. At 2pm, it came back to the 25.30. At 2h30pm, stronger volumes and enhanced buying interest pushed the market and by 3pm, it was trading back to the 25.65 zone. The next 2.5 trading hours were market by a lateral movement around the 25.50 zone. No.11 closed at 25.48 and settled at 25.45 (-0.12, -0.47% move from yesterday’s settlement). Volume traded was 69k lots and V3/H4 spread closed valued at -0.31, down -.06 from yesterday.

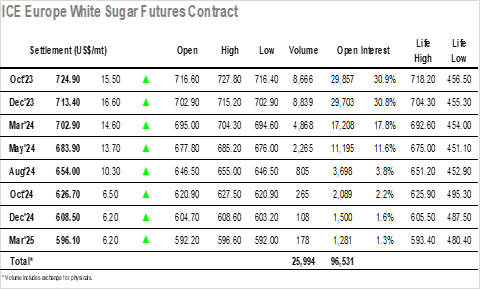

Today Oct’2023 opened at $716.6, $7.2 above Friday’s settlement, in a gap opening adjusting market levels from yesterday’s holiday. In the beginning of the trading session, there was further power seen by whites, touching $726 at 10am. By 1pm, there was some correction and market came back to opening levels trading at the $718 zone. The lower buying interest did not last for long, and market went up again near 1h30pm and with further pressure, reached the daily high at 3pm, trading at $727.8. From that time until closing, market corrected a bit, with some upward correction in the end, closing valued at $725.5, remarkably closing at the year high for the Oct’23 contract. Settlement price was $724.90 (+$15.5), volume traded was 8.7k lots and V3V3 white premium closed valued at 163.76.