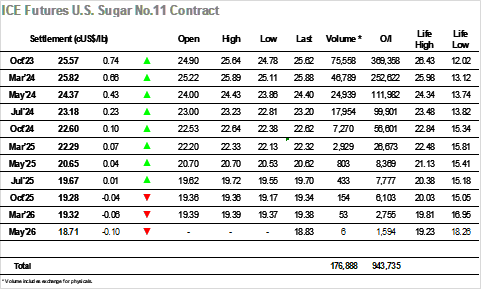

Today we had a late opening for No.11 due to the UK bank holiday, with Oct’23 opening at 24.90 , +7 points gap from Friday’s settlement. Concerns over Indian exports, in addition to CS Brazil rains during the week contributed to a bullish session for No.11. From late 12h30pm opening until 1pm, market breached the 25c mark. There was some selling interest at that point, which brought the market down to daily low (24.78), but buyers quickly resumed and with ease, around 1h30pm market was trading near 25.35. From that time until 3h30pm, market relieved a bit, coming back to trade near 25.20. In the late afternoon, stronger volumes made another bullish run, leading market to 25.45. That level was pretty much maintained until 5h45pm, with small retracements to the 25.30 zone around 5pm. The last 15 minutes of trading recorded even bigger trading volumes, and market made it last run of the day, to close valued at 25.62. Settlement price was 25.57, +0.74 move from Friday’s settlement (+2.98%). Volume traded was 75.5k lots and V3H4 spread closed valued at -0.25 (+0.08 move). It is worth mentioning the strong upside move in the 2024 spreads over the last sessions and that we are back to the 2-month high on the first trading prompt of No.11, with 4 consecutive bullish sessions for sugar, with resistance levels broken and strong technical power showing up.