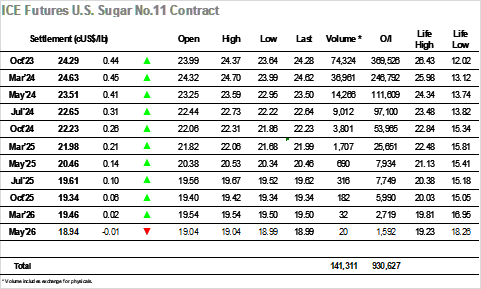

The market started the day trading with an opening at 23.99, exhibiting a 14-point gap from the previous day’s settlement. However, right after the opening, the market did not maintain its initial levels for long. There was selling activity, driving the prices down to its daily low of 23.64 by 9 am. The decline was short-lived and within the subsequent 15 minutes, the market managed to recover its opening levels and touched 24.04. As the day progressed, worked in a sideways movement pattern, showing some upward bias. Around 1 pm, when the market reached 24.12, a significant surge in buying volumes occurred. This resulted in a market spike, pushing the value to 24.24. Following this peak, a slight correction brought prices down to the 24.10 range. The prices then remained relatively steady, trading within a 15-point range from 1:30 pm to 5 pm. The final phase of the trading day witnessed a price recovery. The market surpassed its earlier high reaching 24.37. A minor correction followed until closing which happened at 24.28. The settlement price was 24.29, indicating a 44-point increase (+1.84%) compared to the previous settlement. The trading volume totaled 74k lots, while the V3/H4 spread weakened slightly, settling at -0.34 points.

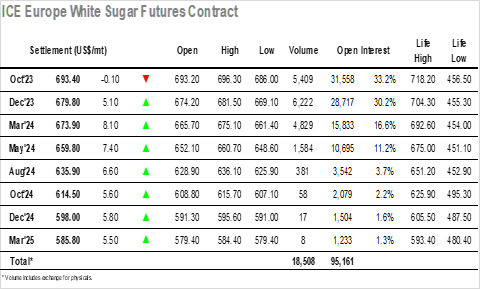

Today Oct’2023 opened at $693.2, $0.3 below yesterday’s settlement. After the opening, sellers brought the market down to trade at $686.4 near 9 am. The next hour marked a recovery towards opening levels which then, after some correction, market traded sideways from 10h30 am to 1pm. At 1pm, a big push made the market rise to $696.3, which happened to be the daily high. Subsequently, prices went down again. At 2pm, Oct’23 was trading at $691 and around 2h30pm, daily low was reached at $686.00. The trading session followed un upward move, which led the market to recover a bit and close valued at $692.6. Settlement price was $693.4, volume traded was 5.4k lots and VZ white premium settled at $143.8.