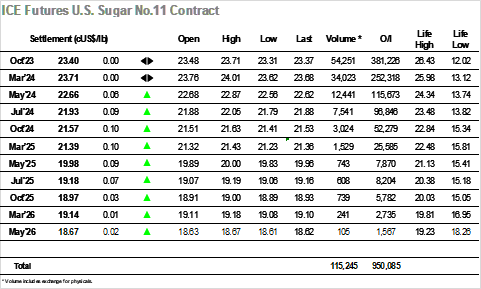

Today, the No.11 market opened at 23.48, marking an increase of +8 points from yesterday’s settlement. The market commenced the day with upward momentum, pushing to the 23.60s level within the first 30 minutes of trading. However, during the subsequent hour, sellers took control, erasing the earlier bullish sentiment and causing the market to dip below the opening levels, reaching 23.34 by 9:30 am. A notable surge was observed until 10:30 am, propelling the market to touch 23.65. Despite this, these gains were short-lived as the levels steadily receded until 1 pm, when the market retreated to 23.50. Up until that point, trading volumes remained low, allowing minor pressure to drive the market to its daily high of 23.71. This peak was rapidly erased and in the next 30 minutes, the market regressed back to the 23.50s, signaling that these levels were unlikely to hold throughout the session. Between the daily high and 3 pm, the market retreated to the 23.30s range, maintaining proximity to that level until closing. Although there was a brief attempt around 5 pm to push the market upwards, it quickly met resistance. Ultimately, the No.11 market closed at 23.37. The settlement price was 23.40, mirroring yesterday’s settlement figure. A total of 54k lots were traded, and the V3/H4 spread closed unchanged at -0.31. Today marked the fourth consecutive decline in sugar prices. The 23.30s level stands out as a crucial support threshold, followed by 23.00, where stronger buying interest might emerge, as we would be returning to levels not seen since mid-June.

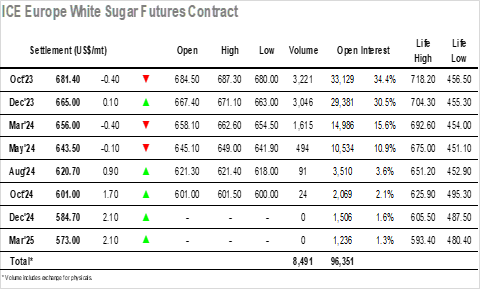

Today, the October 2023 contract initiated the trading session with an opening price of $684.5, marking a $3.5 increase compared to yesterday’s settlement. The market exhibited strong upward momentum right from the opening, reaching its daily high within the first half-hour of trading at $687.3. However, in the subsequent hour, prices experienced a swift retracement to $681.4, followed by a period of volatility before stabilizing near the $685 mark. At 1 pm, a robust push was observed as the market tried to breach the earlier daily high, but quicky come back again to the earlier trading levels. After this, the market encountered persistent downward pressure. The daily low point was reached by 4 pm, with prices hitting $680. Ultimately, the market concluded the day trading activities at $681.5, settling at $681.4. The total trading volume was approximately 3.2k lots. The VZ spread found its settlement at $16.4, while the VZ white premium concluded trading at $149.8.