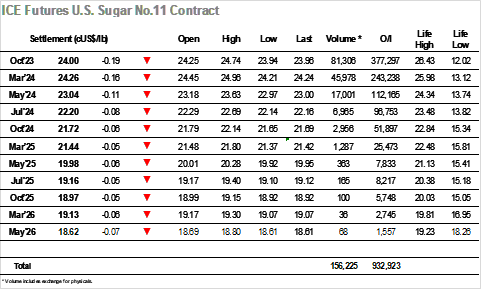

A minor dip following the opening was quickly gathered and the market soon set about continuing yesterday’s recovery with a push to challenge overhead resistance. It did not take long to trade beyond last weeks 24.42 mark and with the specs determined and selling light the market made steady progress to be trading at new monthly highs before the morning was out. This set the tone nicely for a continuation during the afternoon but despite pushing to 24.73 there remained little interest from hedge funds in joining the move, and so as specs took profits and jumped back out of their longs so the market tumbled back down the very same range. It was not until we reached unchanged that some supportive interest emerged though that soon faded, and the market made a second leg lower that sent the price negative. Spreads suffered on the slide with Oct’23/Marchg’24 back to -0.28 points from an earlier high at -0.20, while the flat price fell beneath 24c ahead of the close. Mixed activity for the call led to a settlement at 24.00, keeping the market back within its same broad range, and with the trade and hedge funds still disinterest it may be that we will see some calmer days unless the spec desire to get whipped around continues.

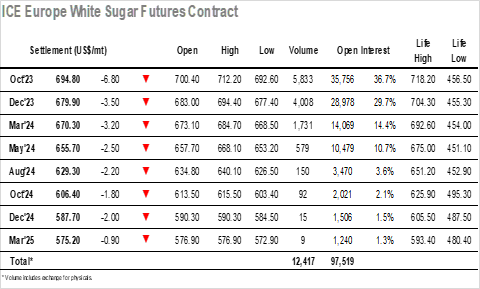

Yesterdays close had brought the initial resistance area ahead of $705 back into view and it was not long before the specs were again pursuing a positive movement and testing this area. The market quickly worked beyond this area and by late morning was trading up to $712.20, the highest level seen for Oct’23 since 16th May and providing technical strength to move further. The one question which continues to hang over the market concerns who buys at the higher levels, and this again proved to be an issue as the spec buying merely held the highs for a couple of hours until they ran out of ammunition. The inevitable long liquidation followed and by mid-afternoon the market had erased the earlier gains to leave Oct’23 struggling to hold above $700. The market briefly dug in with a return to $704.00 however that recovery proved to be short-lived and by the time we reached the end of the session the market was trading only a small way above the $692.60 low. Nearby spreads and premiums gave back some ground during the afternoon to close at $14.90 for Oct/Dec’23 and $165.70 for Oct/Oct, with Oct’23 close at $694.80 leaving values firmly ensconced within the range following the latest unsuccessful effort to break.