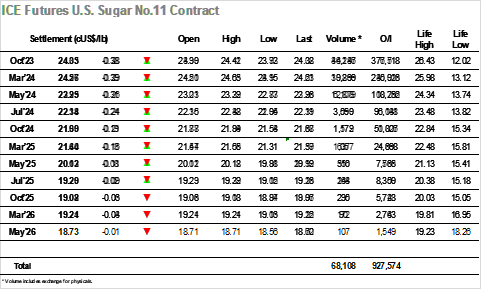

The new week started calmly with the first couple of hours seeing Oct’23 trading a small distance either side of unchanged, and while there were some efforts being made to try and resume the upside, they only managed to take Oct’23 to 24.41, a point shy of Fridays high mark. The latest COT report showed a reduction in the net spec long to 111,626 lots, coinciding with the decline to 23.40, and with the market having moved up by a cent in the days since it seems likely that some of these longs have been reinstated, emphasising a current market issue with the specs dominating the activity. Price action continued either side of 24.30 into the early afternoon, however with no support emerging from US specs a slide began to develop. The fall was based on both long liquidation and short selling from day traders, leading the market down to 23.99 before finding a degree of end user support in the vicinity of 24c. This area held until the final hour when there was a nudge through to 23.93, though the market dug in before ending the day at 24.05 following some late short covering keeping Oct’23 entrenched within the range.

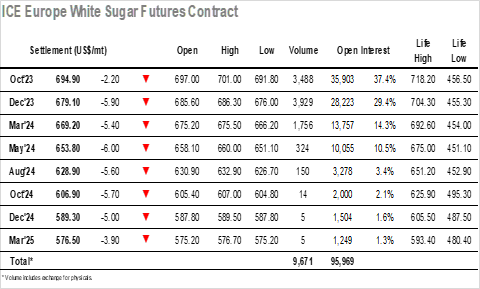

A mixed start to the day saw Oct’23 initially losing some ground, however buying then picked back up with specs determined to try and challenge the $703.70/$705.00 resistance, resulting in a mid-morning high at $701.00. This proved to be the high point with the failure of No.11 to keep pace acting as a hinderance to the market, and while there was a mid-session effort to push back upward it fell short of $700.00 leaving the market to retreat to new lows on long liquidation. Buyers were few in the $690’s which allowed the market to ease by several dollars against relatively low volume, and while the Oct/Oct’23 white premium value was increasing back to $164.00 the mood felt rather flat. Efforts continued to be made to get the market back to a firmer footing however they proved fruitless despite a further widening of Oct/Oct’23 to $165.00 and some unexpected strength for Oct/Dec’23 as it surged back to $16.40. Oct’23 meanwhile recorded new session lows during the final hour before settling at $694.90 following some late position covering, still firmly rooted to the range.