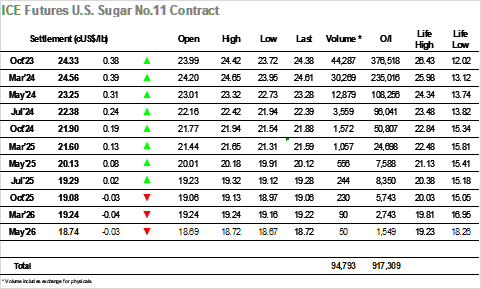

It was a slow start to the day as Oct’23 traded marginally higher before slipping back down into the 23.70’s, the low volumes again leaving any movement in the hands of day traders. The situation remained the same as we moved into the early afternoon, providing the feeling that most participants were content to allow the market to drift quietly into the weekend. The arrival of US based traders changed this perspective to an extent with the specs pulling Oct’23 back up through 24c and into the teens, though a smattering of producer pricing down the board provided sufficient resistance to limit the move in front of yesterdays 24.20 high. An inside day seemed to be on the cards until the final hour when a more aggressive push upward sent Oct’23 surging into the 24.30’s, an unlikely move given the lack of fresh news though one which set the tone for positive end of week technicals. New session highs were recorded at 24.42 on the post close, with settlement having been made for Oct’23 at 24.33 and for Oct’23/March’24 at -0.23 points. Overall, this provides some strength to test the August high at 24.61, though the lack of strength in the spread and low volume nature of this weeks recovery suggest that we are most likely playing back through the range with the necessary consumer and hedge fund buying not in place to drive the move longer term.

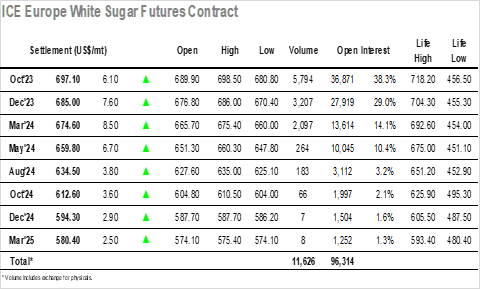

There was very little support around for Oct’23 whites as we got underway and the early stages saw values moving lower, only finding support in the $683.00 area. Buyers still appeared reluctant though and across the rest of the morning the price edged a little further down to a low at $680.80, while the Oct/Dec’23 continued yesterday’s lower trend in slipping to $10.30. With the macro providing no assistance the market looked to be heading quietly towards the weekend, however US based specs had other ideas and with No.11 pushing upward the market followed diligently behind. Over the next few hours, the price climbed steadily back through the range and into new ground to be trading in the upper $690’s by late afternoon. This action also bought some support back to the white premium which had struggled badly during morning trading, Oct/Oct’23 extending back above $160.00 having earlier traded towards $156.00, still lower on the day though. The close played out around the highs to provide a settlement value at $697.10 and bring the market closer to the $703.70/$705.00 resistance, though with the Oct/Dec’23 spread closing weaker on the day at $12.10 the signals remain inconclusive for a sustainable rally.