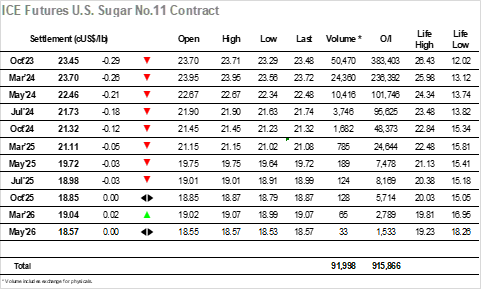

Yesterday’s weak close still appeared to be weighing upon the market as we commenced lower and combined with a generally lower macro picture served to send Oct’23 down to sit ahead of 23.50 during the early stages. Morning volume remained light, and with scale buying starting ahead of 23.40 there was something of a stalemate either side of 23.50 for the rest of the morning as traders hoped that the Americas could bring some fresh impetus to proceedings. There was only limited movement during the early afternoon, and with the market showing no prospect of rallying the attention of day traders turned back to the short side and a test of 23.40. For a period, this level was protected by the consumer pricing in the lower 23.40’s, but eventually the efforts of the spec sellers yielded some small success with a short-lived punch down to 23.35. A small, short covering bounce followed before settling back down into the 23.40’s, the interest by now fading again from many which in turn reduced volume back to very low levels. Another aggressive push lower (spec?) saw Oct’23 trade down to 23.29 as we neared the final hour though the short covering that followed merely sent the market back up into the range. A day which saw another mild extension down to 4-week lows ended mid-range with Oct’23 settling at 23.45 and the market seeming set to continue the broad range seen through July and August for a while yet.

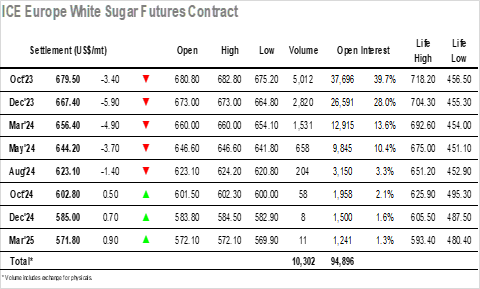

The market opened with a sharp dip to $677.00 for Oct’23 and while there was a brief recovery the tone was being set by the No.11 market and so prices retreated once more. A narrow trading band then developed in the mid/upper $670’s, and this held for several hours with the market seemingly suffering from the apathy that is so often prevalent during the European summer holiday season. The sideways pattern maintained through the early afternoon, before ending abruptly as an aggressive push higher took place, taking Oct’23 up to $682.80 on still low volume and in the process strengthening the white premiums back out with Oct/Oct’23 briefly back to $164 having been trading $159 early in the session. The rally was not sustained, and the market returned to the lower end of the range where it remained until the final part of the day. End of day short covering / position tidying occurred during the final 30 minutes, serving as a pre-amble to the call on which Oct’23 reduced its daily losses with a close at $679.50, while Oct’23/March’24 was also strong despite the market showing net losses and settled at $12.10.