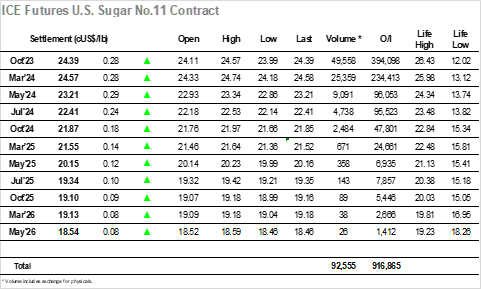

Having concluded July with a sharp punch back above 24c the market picked up where it left off with the early part of t6oday’s session finding spec/day trader interest which kicked Oct’23 up to 24.33. Activity calmed following this initial flurry though the supportive efforts continued to underline proceedings with a small extension of the range to 24.38 by mid-morning. The general apathy which has prevailed over recent sessions then resumed and over the next few hours Oct’23 retreated into the red to briefly touch beneath 24c and hinting at a quiet afternoon. At this point, the market received a boost from Dalmia Bharat with headlines regarding a potential diversion of 4.5m tonnes from sugar to ethanol and lower year on year output, invoking a reaction from specs that quickly drove prices up through the morning highs and on to 24.57, though the Oct’23/March’24 spread remained unmoved by the activity and continued around -0.17 points. A similarly rapid fall against long liquidation saw Oct’23 trade back to 24.14 soon afterwards, and though the specs were determined to push the story and buy again through the later stages they were unable to mount a challenge to the existing highs. Oct’23 ended the day at 24.39, a steady performance though being based on known news there is a likelihood that it simply marks the latest movement within the broader range rather than the start of another rally.

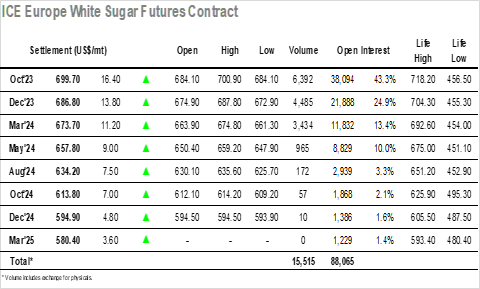

The new month commenced with buying for Oct’23 bringing the market quickly up, with the gains then accruing steadily to reverse more of the recent losses and reach $693.50 midway through the morning, more than $10 higher. This movement sent the Oct/Oct’23 white premium back up to another recent high of $156.00, a level which was maintained with the flat price consolidating the upper end of the range. Prices began to ease back through the range either side of noon and it felt as though the move had run out of steam until headlines regarding India’s potential shift of 4.5m tonnes to Ethanol jolted the market back into life. Specs chased the Oct’23 price upward to a high at $700.40, while simultaneously pulling the white premium to $160.00, an impressive push given that this is not new speculation to the market. There was a retreat to follow against the inevitable short covering however the specs remain keen to push against bullish headlines and so they returned to take prices back upward ahead of the close. Marginal new highs were recorded at $700.90 ahead of a settlement for Oct’23 at $699.70, almost erasing a weeks’ worth of losses in a single day in bringing prices back to the area where producer pricing will again be anticipated.