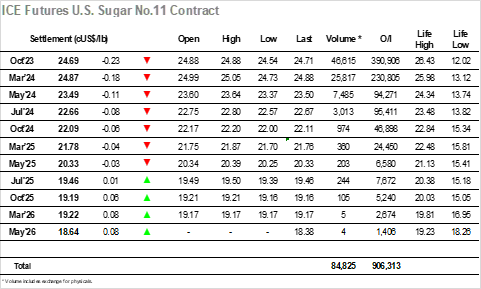

A mildly weaker opening quickly gave way to selling with Oct’23 tumbling through yesterday’s lows and trading down to 24.66 within the first 30 minutes. There can be no doubt that sentiment remains positive, emphasised by the climb back from the lows during July, and so as buying emerged to hold the market through the rest of the morning it was of little surprise with the technical potential of recent efforts so tangible. With no upside reaction following the start of the US morning there was a sharp dip to 24.54, possibly due to long liquidation while the anticipation of the latest numbers from UNICA for the first half of July was also a likely factor. Prices moved a little away from the lows ahead of the UNICA announcement which saw cane production at 48.373mmt / Sugar 3.241mmt / Mix 50.01% / ATR 140.58. mostly in line with market expectation. There was no immediate reaction to either side from this news, though any leaning was initially positive with the market pulling back to match the opening highs at 24.88 during the hour that followed. Maybe this was just an effort from the specs to re-engage the long side as some position squaring followed as we neared the close to leave Oct’23 remaining in the red and showing double digit losses through the closing stages ahead of a settlement at 24.69 that leaves the market showing signs of a short-term top on the charts.

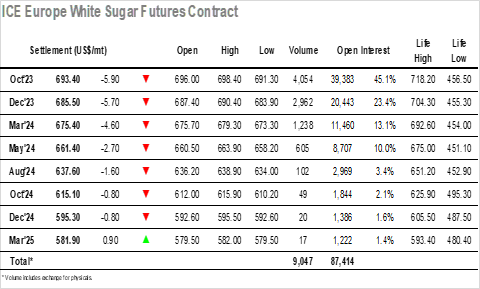

A weaker showing yesterday was by no means negative for the charts; however, it did not prevent the market from opening poorly with Oct’23 gapping down on the intraday chart to trade at $692.50 during the early stages before looking to consolidate. Volumes remained thin through the morning as slowly but surely the overnight gap was filled, but despite being on a firmer footing as the US morning commenced the market remained unable to push forward. Instead, a sharp drop to new lows was seen, the general macro apathy/weakness in contrast to recent days a likely factor in discouraging a continuation of the recent spec efforts. By mid-afternoon Oct’23 had dipped to $691.30, but despite the apathy and association to UNICA data the market continued to dig in with prices working back up through the $690’s as the session progressed. There remains a desire amongst the specs to pursue the long side however having rallied so far this month already the market is showing signs of some near-term fatigue as became apparent during the late afternoon. Oct’23 slipped back down through the range to end at $693.40, a weaker close though one which does little damage to the longer-term potential.