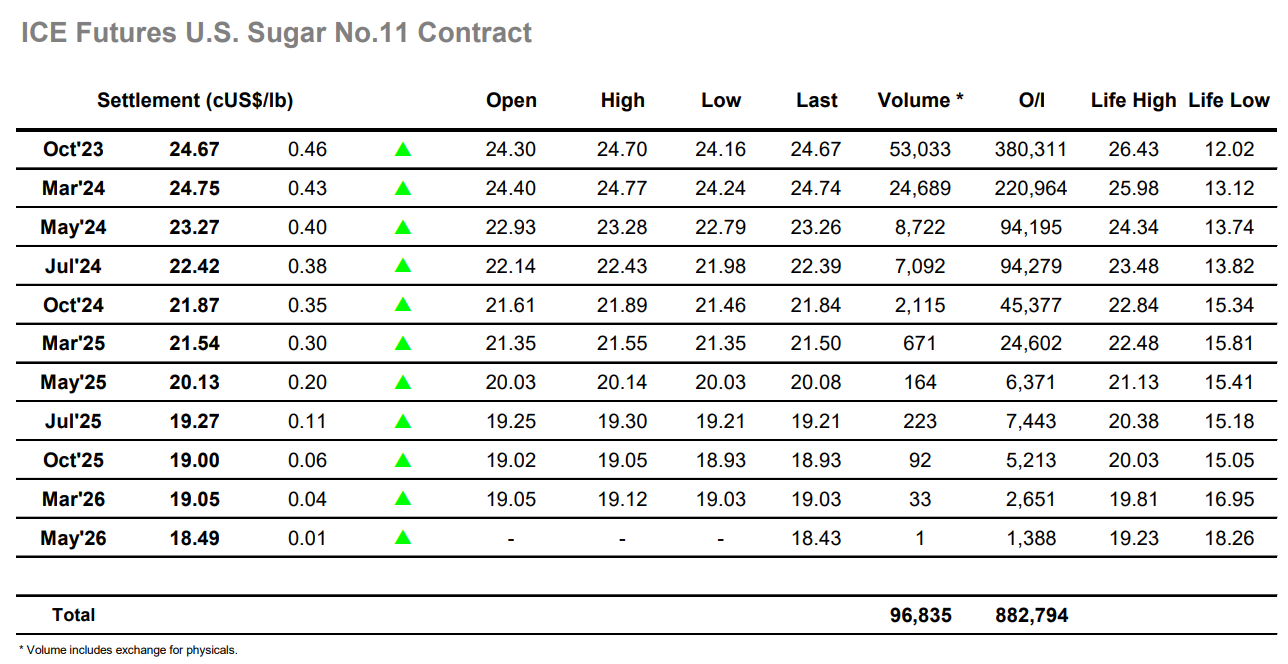

Building upon the recent efforts from specs the market looked to continue higher this morning, building steadily to soon push beyond this months 24.40 high and continue climbing not fresh ground. It was very much a grind higher with volume remaining light, with suggestion that amongst it there is trade buying interest re-joining the specs as they endeavour to take prices back up to the high levels seen during the second quarter. By noon, the gains had extended to 24.58, and while some position trimming then took place alongside the arrival of a little hedging the market did not fall by too far with the 24.40 area now acting as an area of support. Following a period of consolidation, the market once more began to forge higher, a little more scale selling now being encountered though that did not hinder by too much as the price extended up to 24.69. In pushing the market there was also a narrowing of the front spread with Oct’23/March’24 firming to -0.07 points, though the continuing discount shows that this is more a feature of the spec activity than a shift in the structure. A marginal new high was recorded at 24.70 and the market continued to bang its head against this level through the final hour, leading to a positive settlement level at 24.67 which should now provide ongoing impetus to the bulls.

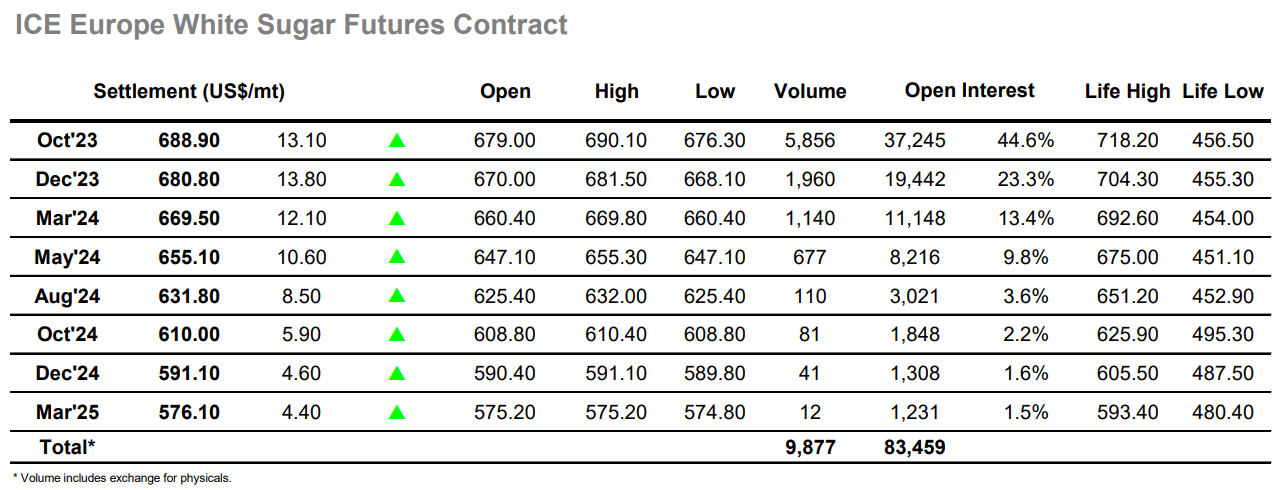

Having slipped back earlier this week the whites have been impressive in finding fresh momentum yesterday, and the trend continued with prices pushing upward from the outset today. There was precious little selling in place as Oct’23 moved easily into the $680’s, with the climb being maintained through the next couple of hours to work beyond the recent highs and reach $689.90. It was not just the flat price which was buoyant as the movement provided support for the white premium to also return toward its own recent highs with Oct/Oct’23 returning to the $148.00 area while March/March’24 was above $124.00. With morning gains of $14 there was an understandable cooling of the momentum through the early afternoon which allowed prices to consolidate back into the mid $680’s, however the sentiment remained positive with the unwinding of some day trader positions through this period providing the capacity to move back upward as the afternoon wore on. Marginal new highs were recorded at $690.10 during late afternoon and prices remained firm through to the close, with Oct’23 settling at $688.90 to provide technical strength which brings former highs above $700 back into view.