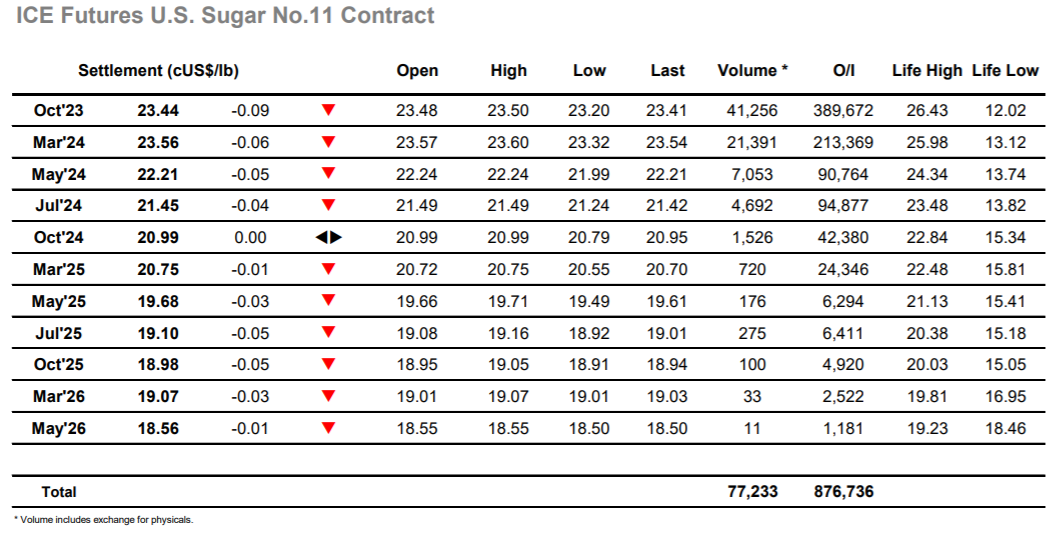

A marginally lower start saw Oct’23 trading in the mid 23.40’s, and with a lack of fresh news it quickly felt as though the price action has truly settled into a range for the time being. A mid-morning dip did follow though it was on low volume, and as some consumer buying started to show in the 23.20’s it proved sufficient to prop the market up. Fridays COT report showed that there had been another reduction in the net speculative long to now stand at 120,088 lots (-21,438 lots) and on the evidence of the subsequent activity it seems likely that number remains a fairly accurate guide to the current situation with smaller specs/algos dominating activities. That same sector led to a small spike to 23.50 during the early afternoon as traders attempted to generate some momentum however the move was over as quickly as it had started with the price action returning to crawl along at the bottom end of the day’s range. The 23.20 low mark was matched on a few occasions without collapsing, and in diminishing volume it was only the spreads providing any interest with Oct’23/March’24 sliding again to -0.14 points. The final part of the day saw the market pull back up through the range, though it changed little as Oct’23 concluded a quiet day at 23.44.

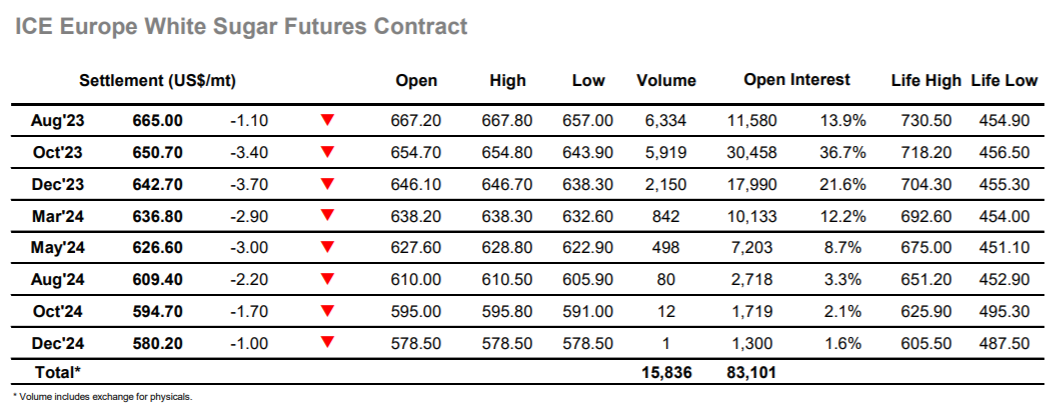

The week got underway with some aggressive selling quickly pushing Oct’23 back by $6 from its opening print, and while there was some buying uncovered that provided a brief pause to the decline it soon resumed with prices falling all the way to $643.90. This placed the market beneath last Fridays lows however buying emerged through profit taking and some consumer interest to pull the price back to $649 by noon, enabling things to stabilise. Only low volumes were being seen for the Oct’23 spreads and premium, with the only spread doing any significant trade being the Aug/Oct’23 as it enters its final week of trading. Here there was steady interest from both sides to conclude position rolling ahead of expiry (though Aug’23 open interest at 11,580 lots suggests this is mostly done) and it was buyers driving the aggressive path once again with the spread moving out to reach $14.20. The flat price meanwhile calmed to sit in the upper $640’s through the afternoon, quietly trading water to maintain the broad sideways trading of the past week. Oct’23 did leg up slightly to be trading back above $650 heading into the close, with settlement at $650.70 to conclude a slow session.