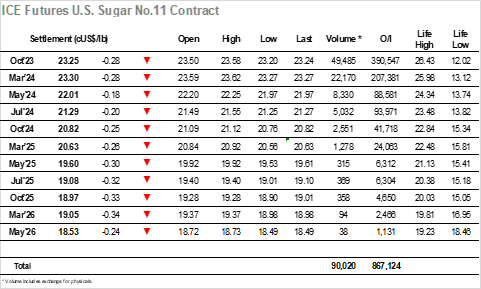

No.11 started on the backfoot today with a dip to 23.37, and though it soon recovered back up to overnight levels the move was unconvincing and failed to sustain. Instead, a second dip followed, this occasion extending down to 23.25 before finding light trade/consumer support that allowed the market to consolidate. We noted yesterday the signs of fatigue in the recovery and so as Oct’23 drifted along in the 23.30’s into the early afternoon it was of little surprise, with questions as to who pushes the market higher at the present time. The most likely sector would be the funds; however, they remain largely detached at present (aside from some long liquidation on the recent decline) and so with only the smaller specs trying to force a move the market lost momentum for a second time having rallied to within a point of the morning high. Long liquidation quickly sent the price back to the lows and the later part of the session saw prices drifting to the bottom of the range on low volumes. Even the spreads did not bring any interest today with Oct’23/March’23 seeing a low volume and ranging from -0.07 to -0.03 points. Marginal new session lows at 23.20 were recorded during the final hour ahead of a settlement at 23.25, concluding an inside day with the possibility of more “sideways” trading to follow.

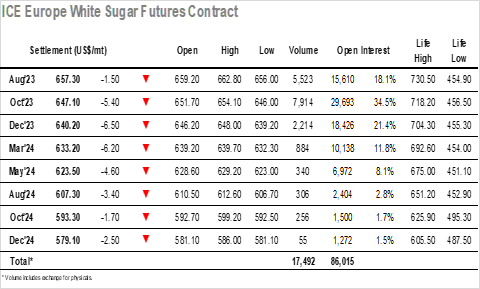

The market was rather muted on todays opening with prices holding a reasonably tight band, and though some light selling sent Oct’23 down beneath $650 midway through the morning it did not slide much further with the sideways pattern being maintained for the next few hours. We were into the afternoon before there was any fresh movement, and even then, it was only limited movement for the flat price as the range extended marginally with a dip to $647.40 before pushing up to $654.10. Unlike recent sessions there was not the required level of buying from spec or trade entities to maintain the resurgence and so on lower volumes the flat price simply drifted along to register an inside day. Similarly, the spreads and white premiums were quiet, Oct/Oct’23 continuing near to $135.00 for long periods while Oct/Dec’23 was a touch firmer and moved towards $7.00. One area that saw more movement was the Aug/Oct’23 spread which continued to strengthen and reached $13,.00 today on more than 3,400 lots of volume. The flat price made marginal new lows during the final hour before concluding a slow, calm day at $647.10, and ending the recent run of highly volatile sessions.