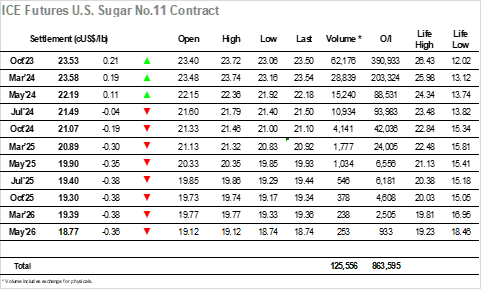

Nearby London white’s contracts had recorded solid gains while No.11 was closed yesterday, but despite an early push to 23.48 for Oct’23 there was no appetite to follow suit with Oct’23 quickly commencing a slide which extended down to 23.06. It was only here that a little more support started to be uncovered and after some tiptoeing around in front of the lows the market found some fresh buying to drive the price bac upward to new daily highs. There was a pause in the market through the middle of the day which allowed prices to drift back down into the range, however specs then returned to provide a shot in the arm and drive Oct’23 upward to a session high at 23.72, 1.88 points above last Thursdays lows as the choppy trading patterns endures. As with Monday’s move to 23.61 there seems to be a reluctance from the specs to maintain a push as 24c comes into the peripheral vision, something that should it continues may to cap the market and leave values caught within a broad 22c/24c band for the time being. Values eased back into the range with Oct’23 sitting near to 23.50 through until the close, and bulls may have been concerned by what they were seeing down the board as the solid gains for Oct’23 and March’24 were not being matched, Oct’24 trading 20 points lower while 2025/2026 positions were 35 to 40 points weaker for the day. An aggressive push that took Oct’23 to 23.64 heading into the close had little impact with settlement made at 23.53, another positive performance though one which also showed signs of fatigue.

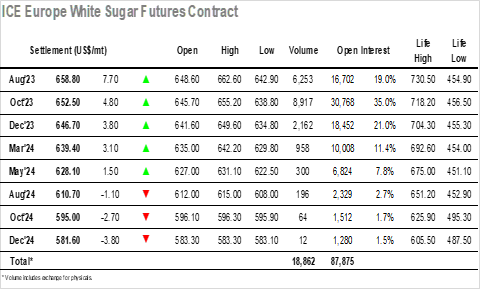

The failure of No.11 to match the gains seen during the Independence Day holiday left the market vulnerable as we opened and with buyers retreating the early stages saw Oct’23 slip all the way back to 638.80 before attempting to stabilise. With resting orders few and far between there was a subsequent push back up to overnight levels by mid-morning, aided by some spread and white premium interest with both strengthening from previous levels, but particularly the premium. There was some strong volume being seen for the Aug/Oct’23 as rolling ramps up ahead of next weeks expiry, and this too was influencing sentiment at the front of the board despite the Oct’23 holding the mid $640’s. There was a more aggressive punch higher moving through the afternoon with some smaller specs playing the long side once again, though there did not appear to be any reaction from end users to chase the market with them. Still a new ‘high’ for the current 4-day upward streak was recorded, maintaining the corrective bounce for another day at least. With Oct/Oct’23 back out to $134.00 the market started to lose some of the buying interest, and this led to a quieter period with some position squaring dropping values from the highs to hold near to $650.00. The front of the board remained positive heading into the close with some MOC buying strategically bidding Oct’23 higher to leave a settlement value at $652.50 while Aug/Oct’23 went out firmer at $6.30 with Oct/Oct’23 at $133.75.