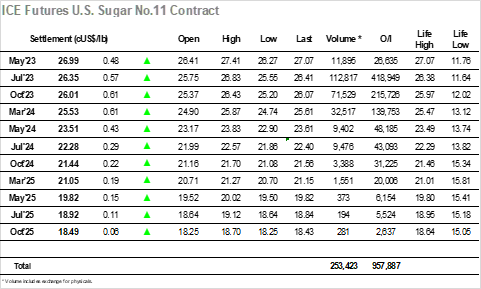

Jul’23 slipped back to 25.55 as we opened today, however the lows were only briefly seen with buying creeping back in to send prices back into positive ground within the first hour. This set the tone to continue higher through the rest of the morning, erasing yesterday’s moderate losses with the price moving back above 26c to re-engage the squeeze. The pace picked up around noon and it was not long before July’23 was trading at new contract highs for a magnificent seventh consecutive session, and as with recent days there was no sign of the move abating with the drive continuing all the way to 26.83, an incredible 1.05 points higher for the day. The push was being fuelled of a poor start to the Brazilian crop ahead of the UNICA figures being published, and while this has been known and expected due to the rains this market needs no excuse to rally at present and so forged ahead. The UNICA numbers showed the crush at 13.605million tonnes cane / sugar production at 0.542 million tonnes / sugar split of 38.58% all near to the consensus but triggering a retreat that extended all the way down to 26.11 over the next hour. May/Jul’23 meanwhile was finding a little more movement that of late as things thin out ahead of tomorrows expiry and ranged between 0.74 and 0.53 points. Open interest remains above 26,000 lots and with volumes reducing it seems we may see a tender in the region of 800,000 lots. The later part of the day played out within the upper half of the range, and despite being almost 0.50 points shy of the highs the Jul’23 settlement level at 26.35 represents another strong gain and maintains the squeeze.

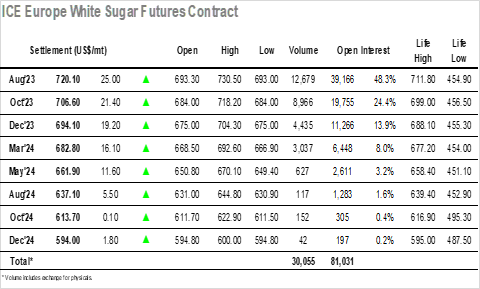

Opening buying pushed Aug’23 immediately up above $700.00, and there was to be no return as the buying continued to flow in, taking the price to $712.10 before pausing. It was not just the outright market finding buying as white premium interest was also being seen, fired by rumours of an Indian export ban, and with sellers as ever proving hard to find the premiums widened, reaching to $140 for Aug/Jul’23 by the end of the morning as the flat price spiked to $720. Although the premium activity eased with levels retreating by a few dollars from their highs the same could not be said for the flat price where the latest burst of buying sent values spiking to yet another life of contract high at $730.50. Prices retreated alongside the No.11 following the publication of UNICA data, however with premiums maintaining a good percentage of their morning gains and selling limited there was no major decline and prices consolidated comfortably in the upper half of the range. The final couple of hours played out quietly to leave Aug’23 valued at $720.10 going out, another hugely strong showing that leave the technical picture as strong as ever.