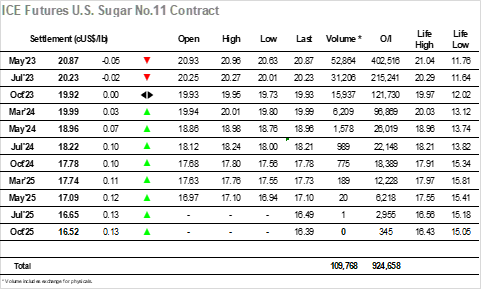

Positive opening prints were quickly forgotten as the market retreated from 21c this morning, but though initial losses will have flagged some concern from longs and saw some long liquidation from smaller traders the price soon levelled out in the vicinity of 20.70. There were few signals being provided by the macro which sees many markets broadly continue to move along within ranges, so today’s pullback was likely just taking stock following the huge step forward made on Friday, particularly given that COT data remains three weeks out of date. That most recent data (as at February 7th) showed a small reduction in the net fund/spec long to 204,756 lots, though with the market having moved up significantly during the ensuing period it is likely that they are longer than this number as we now stand. The losses were mostly incurred at the front of the board with to emphasise how the movement was spec dominated, and so while the afternoon push back into the 20.80’s limited the losses for May’23 and Jul’23 the rest of the board was showing moderate gains. Supportive buying continued into the close and ensured that May’23 limited its losses with settlement at 20.87, maintaining the recent technical strength through a quiet session.

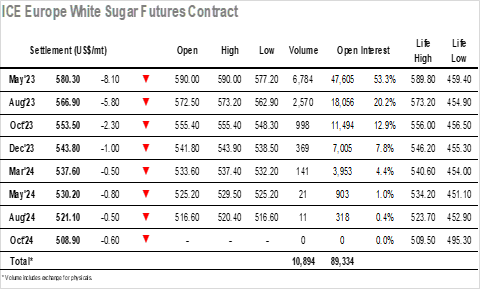

Opening prints saw May’23 record the latest in its series of contract highs at $590.00, however it was instantly followed by a fall to $584.00 as the lack of resting buying at the higher levels led the market lower at the first sign of market selling. Though the pace of the pullback slowed the decline continued into mid-morning with the price back into the upper $570’s before an element of calm emerged and the market was able to track sideways. With confidence clearly dented the pattern of sideways consolidation was maintained for several hours, with volumes at minimal levels most of the time and traders clearly non-committal as they await some sign as to the next move. Although the No.11 market was making efforts to recover as the afternoon progressed there was no such enthusiasm for the whites as they maintained just beneath $580, causing the white premium values to give back significant ground as May/May’23 fell to $120.00 at one stage. Nearby spreads were also weaker with May/Aug’23 seeing lows at $13.00 and Aug/Oct’23 at $13.30, still unconvincing showings in the context of the positive flat price views emanating around the market presently. There was a minor move away from the lows during the final hour which ensured that May’23 settled at $580.20, though overall it was a disappointing performance in the wider context of the market which shows an element of fatigue.