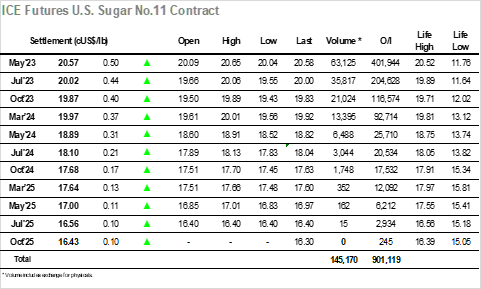

May’23 began its tenure at the front of the board calmly with the morning trading initially taking place either side of 20.10 on low volume. By late morning, the picture began to change, and it was in a familiar direction as the market started its recovery back through the recent range, bringing prices back to the 20.30 area ahead of the Americas day getting underway. A huge continuation gap sits overhead however specs set about filling some more of that in soon afterwards with a push that took May’23 through its contract high to 20.60 before pausing. The momentum was coming despite a neutral macro picture (which had weakened since the morning), and with the market into fresh ground there was no immediate sign that the specs/funds would let up in their efforts. A second push extended the highs to 20.65, but though the environment remained supportive for the duration of the day that proved to be as far as it reached, intermittent profit taking and some assorted pricing preventing further progress. The closing stages played out at the upper end of the range, leaving May’23 to record a strong close at 20.57, leaving an interesting session ahead tomorrow to see if this time it can build upon the foundations. A total of 11,551 lots (586,820t) was tendered against the Mar’23 expiry, details as per the notice below.

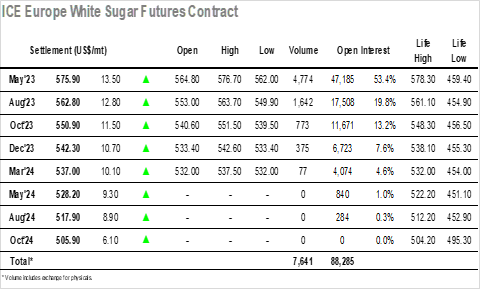

As we alluded to yesterday, for a week now we have seen ever more volatile movement within the $560’s/$570’s and today saw that trend continue as following some initial consolidation May’23 pulled up through the $560’s to sit positively by the end of the morning. This in turn prompted some interest from the US which set prices spiking back into the $570’s during the early afternoon, and despite there being no significant news to effect things we were once more within striking distance of the contract highs. May’23 continued to find supportive buying as it remained in the $570’s through a generally quiet afternoon, leaving the technical picture well placed as we moved towards the close. Nearby spreads meanwhile were only showing moderate gains and remain slightly contradictory to the flat price strength, May/Aug’23 only reaching $14.20 today, still a few dollars shy of recent highs, while for the premiums May/May’23 fluctuated with side of $120.00, solid though suggesting it was the No.11 that has taken the lead with today’s movement. Session highs were recorded around the close as May’23 settled only just below at $575.90, posing the question as to whether this occasion will see the momentum continued or if it is simply another false dawn.