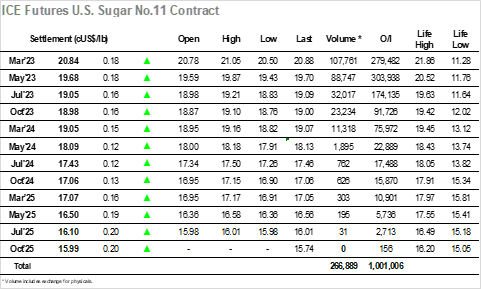

A quiet start saw the market initially edging along sideways, and though some defensive buying then started to creep in there were only modest gains being seen. With today representing the first day of the main index fund roll window we were seeing some pressure exerted over the March/May’23 spread during the morning and the differential narrowed to 1.06 points in anticipation of heavier selling to follow. Having lifted into the 20.70’s we saw the flat price start to run out of steam during the early afternoon with continuing spread pressure helping the flat price to a low at 20.50, but unlike the last couple of days there was no significant liquidation following in and the market was able to restabilise. This provided longs with a good deal of encouragement and the rest of the afternoon saw a wildly different picture evolve. Defensive buying of the outrights saw a succession of price spikes which led March’23 as high as 21.05 as we reached the final hour, while alongside trade spread buying emerged to bring March/May’23 back to 1.16 and allowed the index / fund sellers to scale into the move. There was some profit taking / position squaring ahead of the close which left prices a little way shy of the highs, though the day still ended positively with March’23 settling at 20.84, averting a third consecutive down day as the market looks to dig in.

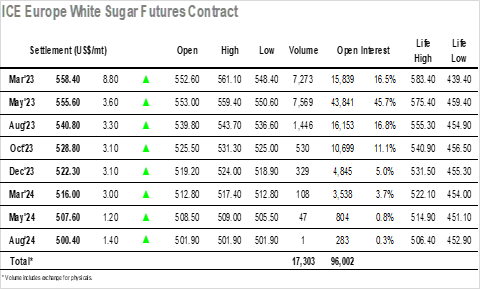

A very choppy opening soon calmed with the early part of the morning seeing Mayc’23 attempt to consolidate within a dollar of overnight levels. This provided the basis for a little more buying to creep into the market with prices edging back into credit before spiking to the $558.00 area during the later morning as some additional interest emerged. Through this flat price movement we were still seeing the largest volumes trade through the March/May’23 spread, which was enjoying its first positive showing for a while with buyers pushing the price back to a premium with a high recorded at $5.00. This spread recovery was aided by a sharp reduction in selling interest with a large part of the fund roll now concluded, although March’23 open interest at 15.839 lots suggests there is still a little more to follow over the rest of the week with expectations that we will not see a significant receiver against the tape. Moving through the afternoon we saw continued upward intent as longs looked to try and maintain a positive footing and reinvigorate the upside, to which end they were only marginally successful with the market stalling only just above yesterday’s highs at $559.40. Day trader liquidation then followed ahead of the call to leave prices settling to the centre of the range, May’23 ending at $555.60 with continued flat price consolidation appearing the more likely way forward as we head towards the March’23 expiry.