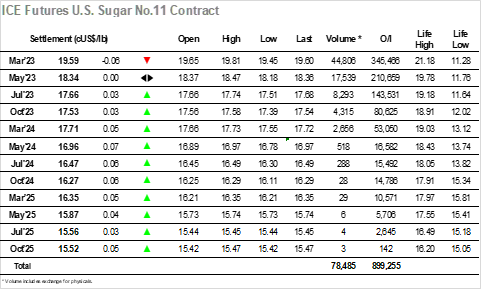

As ever there was some early noise in the market however the picture soon calmed and in contrast to recent days trading became confined to a narrow band. This pattern continued throughout the morning, the calm providing some welcome relief after the recent volatility until eyes turned to the US morning to see whether the wider spec community would continue to try and force the movement. Some light interest did emerge though it likely emanated from day traders/algo’s, which took the price up to 19.81 before falling at an equally rapid pace against long liquidation. This seemed to confirm that the requisite volume to take the market back through 20c is not in place, leading values to consolidate the 19.50 area once positions had been squared away. Spreads were by now giving back a small proportion of this weeks sweeping gains with March/May’23 back to 1.25 points, though the continued view over Q1 tightness ensured that they did not collapse. The market remained comfortable in the 19.50’s as we moved through the final couple of hours seemingly having found a level at which both longs and shorts are content, eventually making settlement at 19.59, and with a market holiday to follow on Monday a continuation of the calmer action tomorrow would be anticipated.

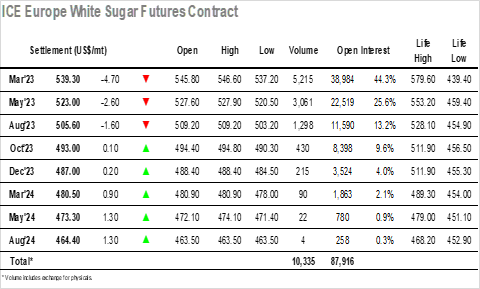

Opening gains quickly turned into early losses, yesterday afternoons action setting the tone and leaving the market to struggle. Volumes were relatively light as March’23 consolidated a narrow $540.40/$543.10 band for the next few hours leading many to breathe a sigh of relief with the calm allowing the opportunity to take stock following recent movements. Early afternoon did bring a small push back up to $545.00 though this quickly failed and the resultant long liquidation down to $537.20 suggested that the buyers efforts had down more damage than anything else. Whatever the motives of the move had been there was clearly no desire to attempt a repeat of the move with prices then settling back down at the lower end of the range to see out the remainder of the session. Closing values were a little off the lows with March’23 settling at $539.30 while March/May’23 ended at $16.30.