There was no sign that the weekend may bring a change in fortunes for the market with macro weakness already apparent this morning, and March’23 duly started the day by trading down to 19.20 before encountering some hedge lifting and spending a period consolidating near to unchanged levels. A couple of hours of stability ended with some long liquidation sending the price lower once more, and across a couple of waves of selling March’23 worked back to 19.05 where a little more consumer buying started to emerge. This placed the market just a few points above 18.99 and the 50% retracement of this month’s rally though as the spec liquidation eased and things calmed down that level remained out of reach with price action settling down into a narrower band. Through the afternoon all seemed set to continue sideways until from seemingly nowhere the market sparked back to life with a push back up to new daily highs at 19.45. Most likely this was just defensive buying from longs who are looking to reverse the current decline, however the weighting of the buying to the spot month also reinvigorated the March’23 spreads, with March/May’23 back out to 1.04 points. Position squaring ahead of the close took prices back down from the highs, though the run of negative sessions was still ended as March’23 settled 5 points firmer at 19.38.

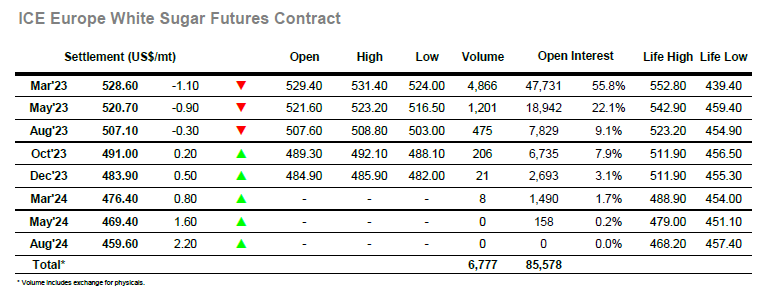

Having ended las week disappointingly the market continued in the same vein this morning with an unchanged opening quickly eroding away. Things settled after the early volatility with prices holding a couple of dollars lower, however with little encouragement being found elsewhere in the commodity world and former technical strength long forgotten the market proceeded to step lower still against some intermittent spec liquidation. Session lows were registered during the early part of the afternoon with March’23 touching $524.00, and though the picture subsequently re-stabilised it merely left prices drifting along to the centre of the range. White premium values were showing some strength as buying took March/March’23 back to towards $105.00 during the afternoon, though there was little interest for other positions as shown by the low volume figures. The afternoon monotony was broken as March’23 was spiked back to $529.70 on only 150 lots, providing a platform for additional defensive buying to follow in over the final hour. The late volatility saw March’23 reach $531.40 before falling back late on, long liquidation meaning that the prior efforts yielded no result and left us with a mildly lower settlement at $528.60.