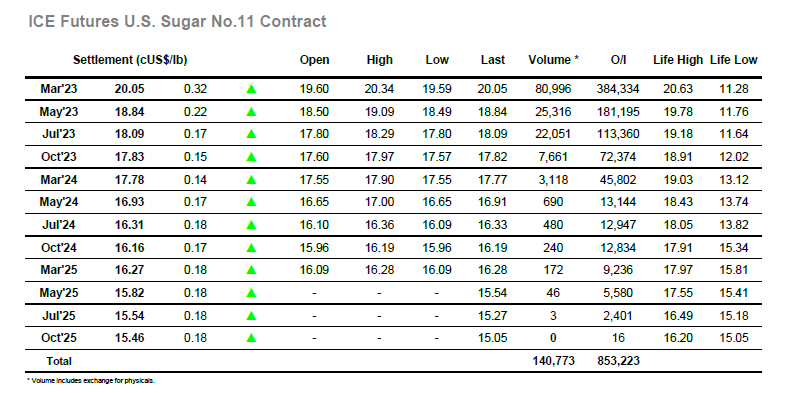

With the market failing to maintain its upward trajectory yesterday all eyes were on whether the recent impressive performance would continue or whether we would fall back into the recent range. With the market running out of fundamental reasons to trade over 20c we started to see more pressure from the open, March’23 gapping down to 20.20 before slipping back to 19.85 over the first hour. Volume was not overly significant on the decline, though a little more buying was noted beneath 20.00, and with both trade and spec buyers absent the market moved into a consolidation pattern ahead of the early lows. Spreads were also weaker on the decline with March/May’23 slipping to 1.11 points, though these losses were modest and do little to damage the structure of the market at this stage. The bulls tried valiantly to push the market back over the 20c mark on three occasions, however with none proving successful we instead drifted lower, settling 50pts down at 19.70.

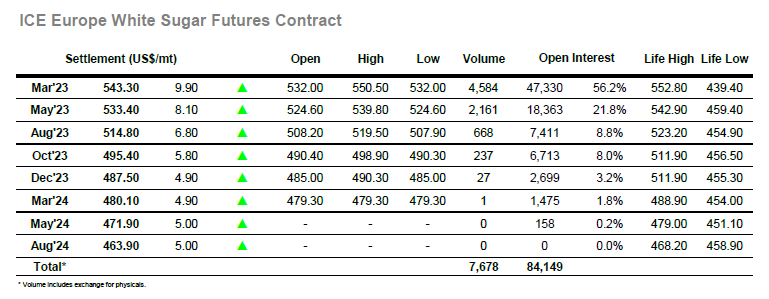

March’23 continued its wobble into a second day with a lower gap opening today, quickly slipping back to the upper $530’s with buyers few and far between. The pace of decline then slowed with some light scale interest through the mid $530’s providing a semblance of support to the market. Spreads were also weaker against these early movements with March/May’23 trading down to $6.50, suggesting that the upward trend will be harder to maintain with Dec’22 off the board and the market still overbought. Things remained quiet until the early afternoon when further selling appeared to send March’23 down to $532.40, though of technical interest was that there was support to maintain the $532.00/$531.10 gap which remains just below. That only lasted into the early afternoon with a small pop down to $528.50 filling this gap. The market continued to drift, eventually settling at $532.6. A notable day for the March/March white premium, weakening to the mid $90s before recovering to settle at $98 – the volatility in the white premiums clearly here to say for the foreseeable future.