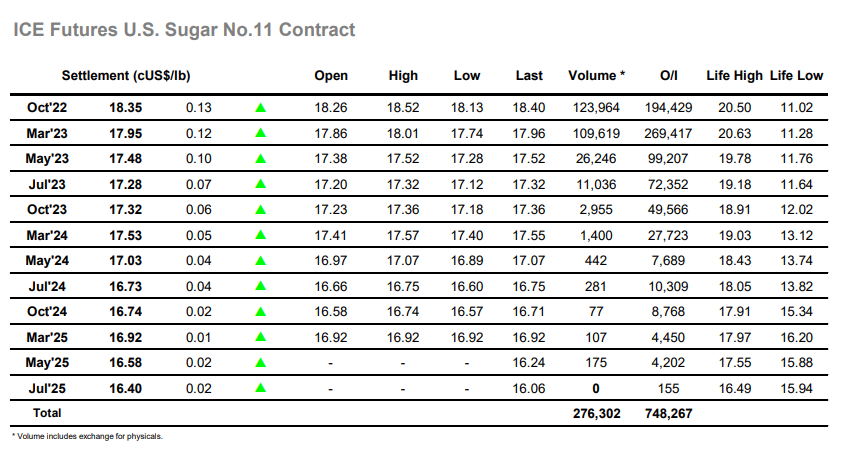

The week began slowly with early losses gathered back up but the front of the board maintaining a narrow 18.13/18.26 band throughout the morning. Initially the arrive on US traders brought little change to the picture however a rally then gathered pace, aided by another set of wild gains in the whites, with the buying pulling V22 all the way up to match the late August 18.52 high before pausing. It was not just the flat price that was buoyant as nearby spread values also surged, Oct’22/March’23 reaching a widest 0.57 points as the market peaked. It was a familiar story for the spread as the rest of the afternoon played out however with increased index rolling emerging, placing pressure on the spread, and narrowing it back into the 0.40’s by late afternoon. The Oct’22 meanwhile flipped around within the range for the rest of the day, momentum lost against the increased spread selling and ultimately settling at 18.35. The spread meanwhile closed at 0.40 and with the roll period now approaching its end raises the question as to whether we may see a continuing squeeze as without one this may just be another false dawn / failure for Oct’22 in the 18.50 area.

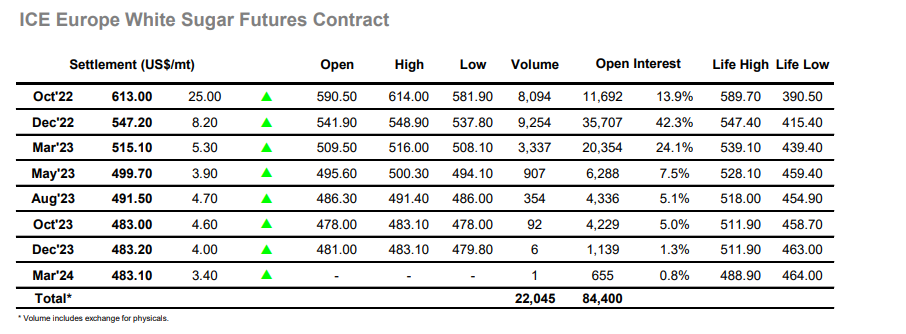

It was a quiet start to the new week as values traded either side of overnight levels, movements proving to be limited also for the spreads which tracked near to unchanged. By early afternoon prices were at least gaining some momentum to investigate recent overhead highs and as the pace gathered so Dec’22 pushed ahead to move through these marks and challenge June’s contract high at $547.40. While this movement was impressive it was nothing in comparison to the ever-strengthening Oct’22 contract which moved into its final few days with yest another set of new highs, bring $600 into view. It was not long before this level was reached and dispatched with continuing buying taking the market through very limited selling to reach a new Oct’22 high at $614.00 while the Oct/Dec’22 spread reached a mighty $65.00. Premiums meanwhile were off the charts with Oct/Oct’22 trading beyond $208.00 late in the afternoon while March/March’23 was a ”modest” $119.00. Dec’22 closed positively at $547.20 and there is no indication that the recent surge in prices is over just yet.