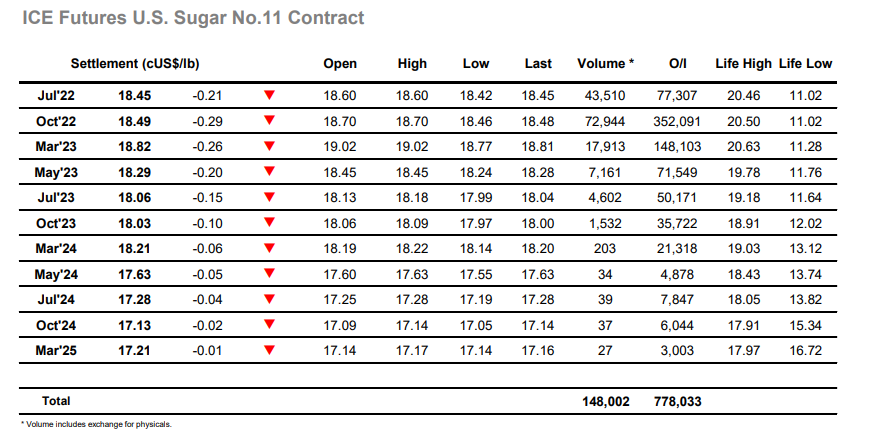

Recent struggles/failures to maintain rallies continue to weigh heavy upon the market, and with the macro showing weakness today (led by further losses in crude) the market slumped lower on the opening before finding consumer scale support from the 18.50’s to provide something of a base. Holding this area through the morning drew a little buying interest back out, though the recovery was brief, and the arrival of US based specs drew fresh selling interest and sent the price down to new session lows. There remains decent scale buying in place from 18.45 onwards (this level representing the near-term double bottom), and an extend period in this vicinity failed to yield any more than an 18.46 low, although there was limited interest in pushing back upward, a sure sign that short term traders have had a tough time recently. Jul’22 meanwhile continues towards next week’s expiry with a strengthening spread as steady buying through the session led Jul/Oct’22 up to parity at one stage in the afternoon, before slipping back marginally and ending at -0.04 points. Outright values maintained just above the 18.45 support for the duration of the afternoon, leaving Oct’22 to settle at 18.49. This represents another weak performance, and the support seems likely to be further tested though with the specs now carrying a much reduced long and funds still appearing reluctant to turn short trade and consumer buyers are likely to remain keen to continue accruing at lower levels should the opportunity present.