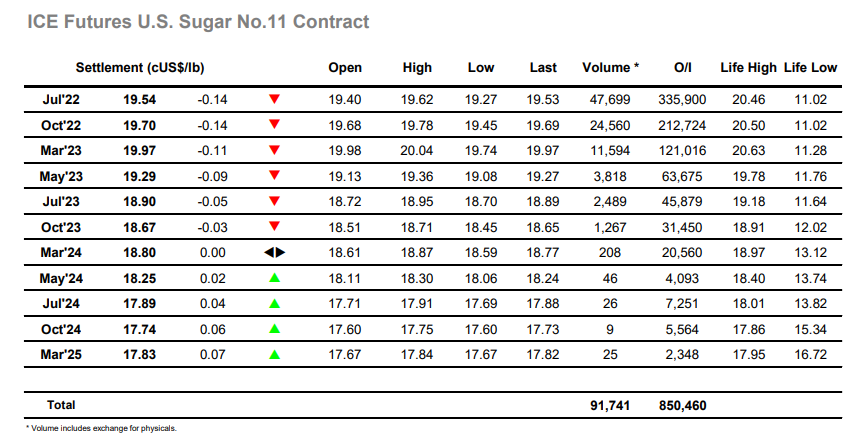

The market gapped lower at 19.40 on the opening in reaction to a Brazilian tax cut on gas which will reduce the Ethanol parity level, and though a small recovery followed there was no impetus to continue leaving a chart gap between 19.48/19.54. The concerns weighed upon the market throughout the early part of the day leaving the downside gap between 19.20/19.28 from 16th May as the initial target. Over the following hours we filleted around between the two gaps and when during early afternoon prints were seen at 19.27 it served not to fill the rest of the gap but as a bottom from which prices could climb back toward morning highs. With the wider macro by now turning more positive the market continued a little further to fill the morning gap and reach a high at 19.62, though this was still below last nights settlement. The outside encouragement failed to pull the market any further north during the final couple of hours, and another session in which the current broad range remained intact concluded with Jul’22 settling at 19.54.