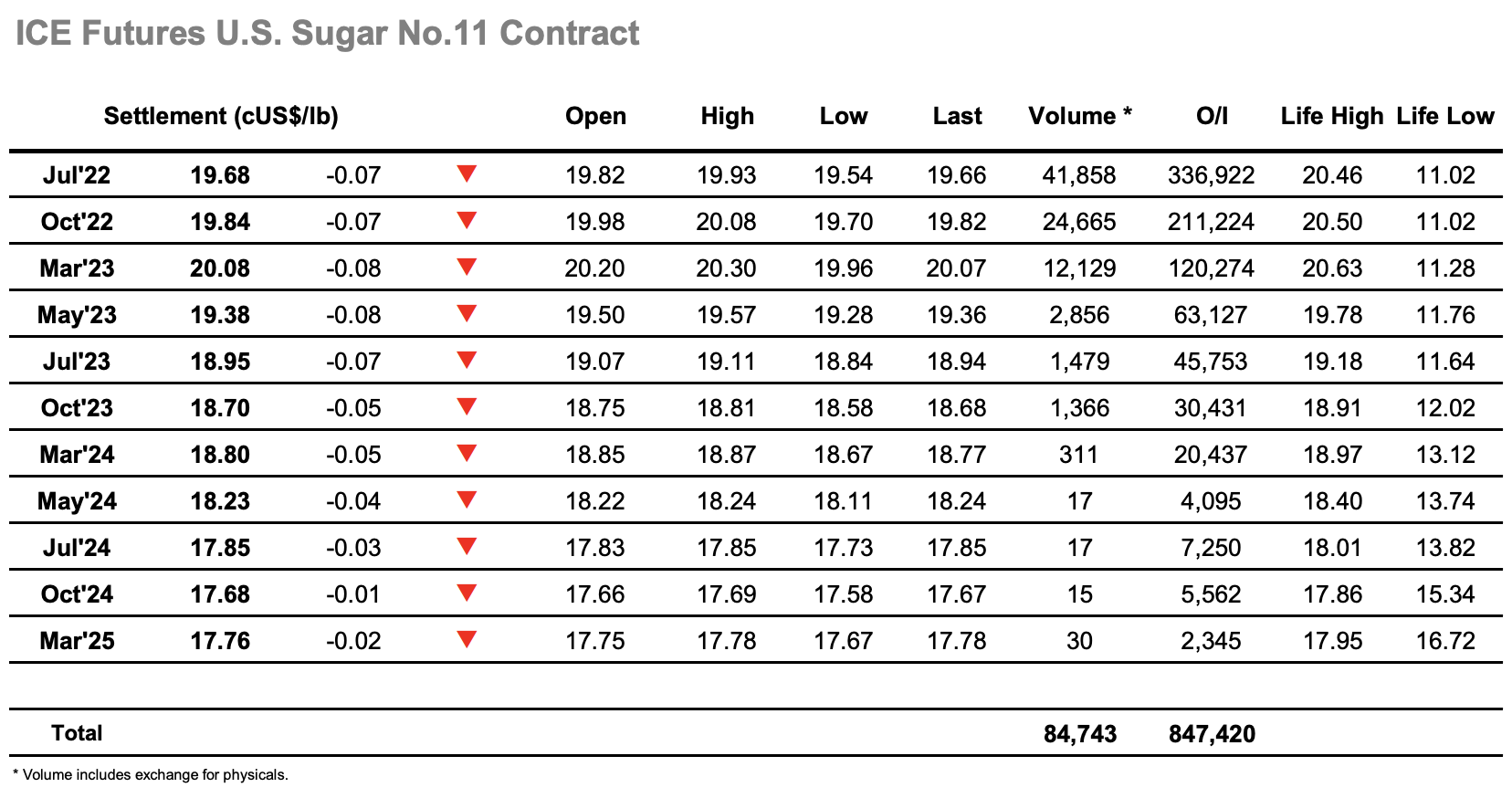

Despite trading as high as 19.93 on the opening there was little buying on show for Jul’22 and once the initial burst was complete, so the price slipped quickly down towards 19.70. Recent efforts to break from the current range have proved fruitless and so the lack of action from day traders seemed a sensible approach even if it did leave the market edging along within a tight band for the rest of the morning. The failure to continue above 20c in recent days is increasingly weighing upon the market and so it was that some spec selling occurred to try lower once more, reaching 19.54 though failing to test yesterdays lows. Mid-afternoon brought the announcement of UNICA numbers for the first half of May, showing 34.371mmt cane crushed, producing 1.668mmt sugar at a mix of 40.77%. This was largely in line with expectations and so saw only a limited response from the market with a gentle push back into the 19.70’s. We remained here until the closing stages when light selling pushed Jul’22 back to settle at 19.68, ending an inside day which leaves the short-term picture unchanged.