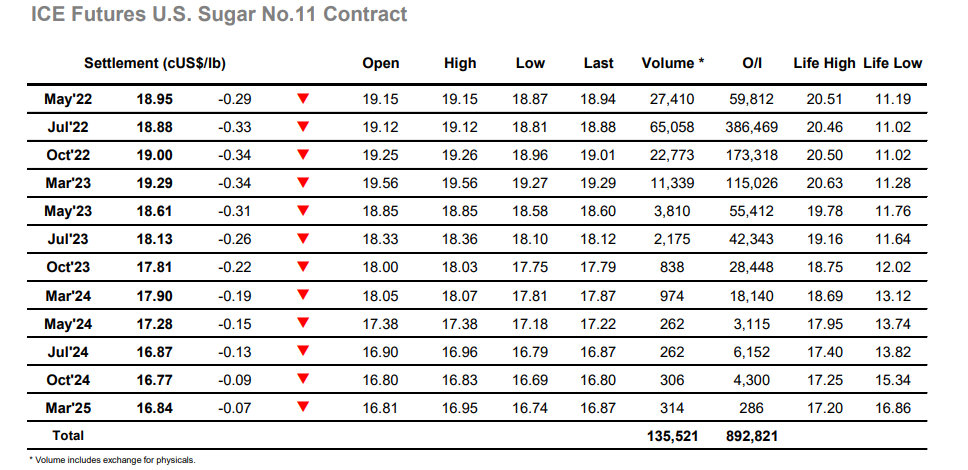

The week got off to a poor start as Jul’22 gapped lower on the opening, quickly gaining momentum to print beneath 19.00 before attempting to stabilise. The macro was a significant factor in this early movement with most commodities showing red, continuing the weakness from last week as the market further corrects the recent move to contract highs. Despite a degree of long liquidation from specs on Friday, there can be no doubting that there are many longs still being held above the market with Friday evening’s COT report only showing a modest reduction in the net spec long to 175,008 lots (-12,462 lots), which could lead to additional liquidation in the near term unless the market finds some supportive factors. For today at least the pace of decline was rather sedate with small extensions lower to 18.81 finding scale support though any attempts to pull back higher stalled ahead of 19.00. Steady spread volume continued to flow as May’22 moves through its final week ahead of expiry, yet another reduction expected from today’s open interest figure of 59,812 lots as more positions are rolled forward and AA’d out. Prices continued to track just ahead of the lows through the final hour, and though a modicum of MOC buying pulled Jul’22 up by a couple of points to settle at 18.88 the picture remains negative.