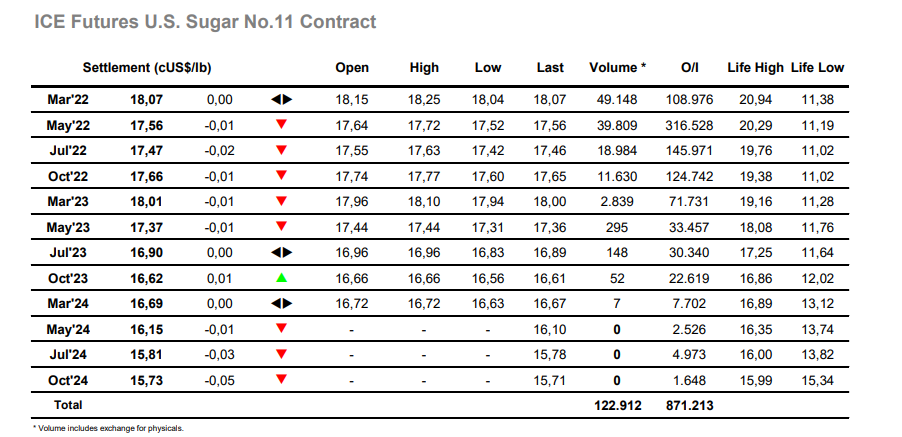

Sugar #11 May’22

A choppy opening saw March’22 traded as high as 18.25 and May’22 reach 17.72, before falling back downward towards overnight levels. Though volumes have now shifted towards May’22 as we move closer to expiry the March’22 contract performed favourably during the early hours with the March/May’22 spread widening to 0.58 points before encountering some heavier pricing. The May’22 contract continued to show single digit gains though into the early afternoon at which stage spec selling emerged to pressure the market down to 17.52. The recent familiar pattern continues to play out with the scale buying to the downside protecting against further losses, leading to short covering which again failed to gain any real traction with the rally topping off having match the morning low. The flat price then retreated into the range before being sold back down toward the end of the day and matching the earlier low, providing some symmetry with the double top for the intra day chart. March/May’22 had meanwhile slipped back into the high 0.40’s but found buying late in the session to return to 0.53 points. Given that it was a quiet inside day we closed rather appropriately with March’22 unchanged at 18.07 and May’22 just a single point down at 17.56.