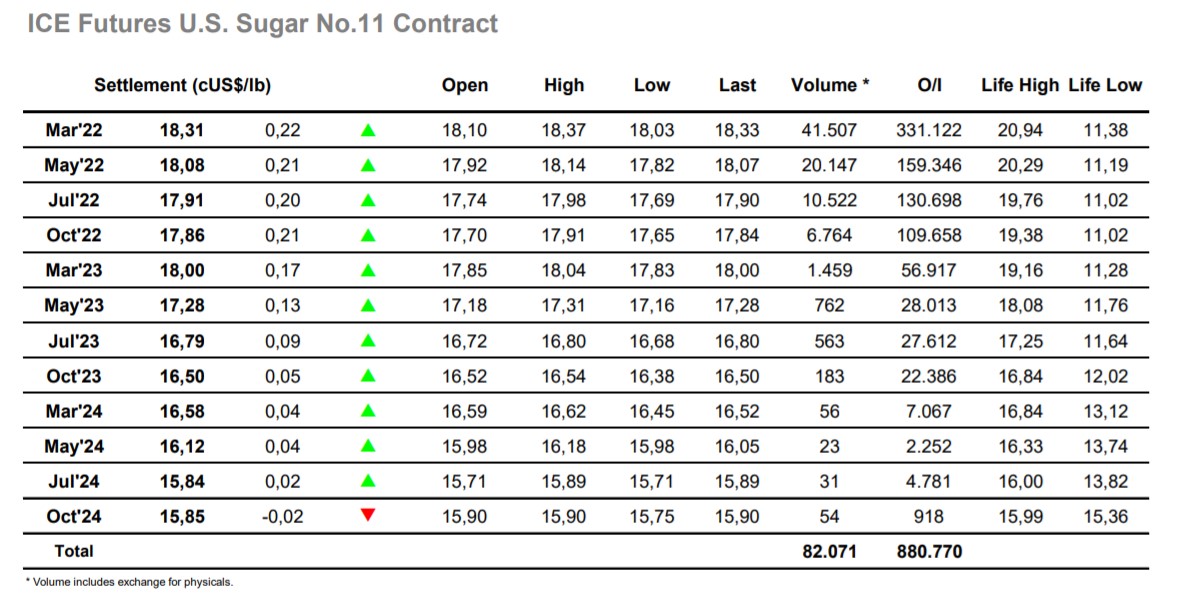

Sugar #11 Mar ’22

There was some early hedge lifting that took prices a little higher however this soon eased leaving values to ease back to sit either side of overnight levels throughout a very slow morning. The early afternoon brought little change with US based specs initially showing no interest in proceedings, however as time passed so the positive showing elsewhere in the softs and energy sectors drew some buying back in to pull the price back upwards into the 18.30’s. The intent was clearly to try and challenge Wednesday’s 18.47 high and the resistance area either side of 18.50 but the move lacked the size required and as some scale selling emerged through the 18.30’s so progress stalled. There was also a lack of support from the spreads which were only very marginally up despite the flat price gains (March/May’22 at 0.24 points) and this lack of conviction led to some pre-weekend profit taking during the final hour. An effort to end the week at session highs was rebuffed as selling on the call left March’22 at 18.31 heading into the three day weekend, and though it paints a positive turnaround for the weekly chart there remains work to be down if this is to be more than simple bottom building and consolidation.

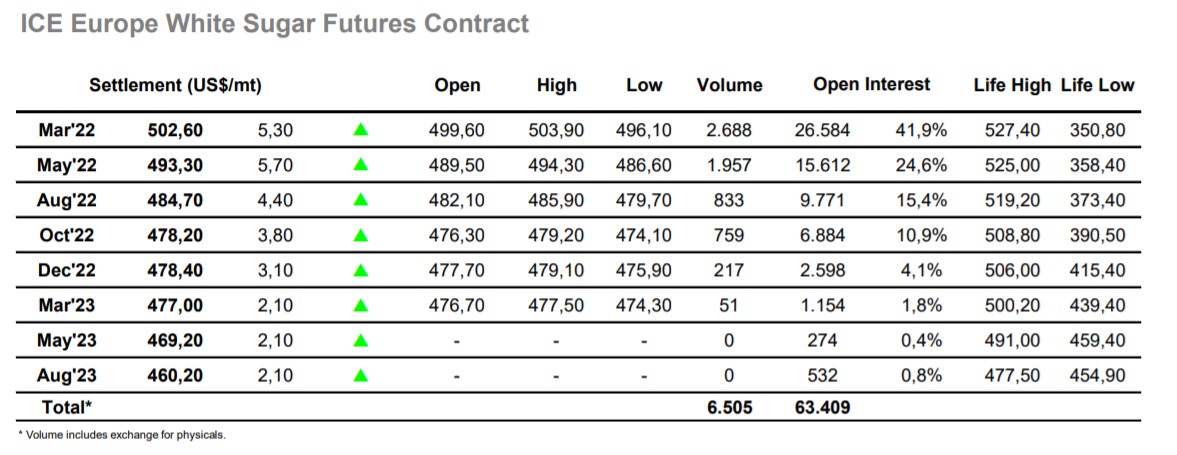

Sugar #5 Mar’22

A firmer opening soon gave way to selling and a very quiet morning ensued with March’22 drifting quietly either side of $497.00. Most of the activity was being seen through the spreads (particularly from May’22 forward) and it was not until the early afternoon that some light buying appeared to pull March’22 slowly back towards $500. Having seemed set to be a very slow end to the week the situation changed during the final three hours as specs found some fresh enthusiasm to push through $500 and back up in the direction of the weekly highs. Despite the best efforts of the longs we fell short of $504 and unable to generate additional buying interest some long liquidation followed to send the price back into the range. Another brief push higher ahead of the close stalled short of the earlier mark before late position squaring left a settlement value at $502.60. This brings a positive week to a conclusion despite a second successive inside day, maintaining a platform to potentially try and continue higher next week.