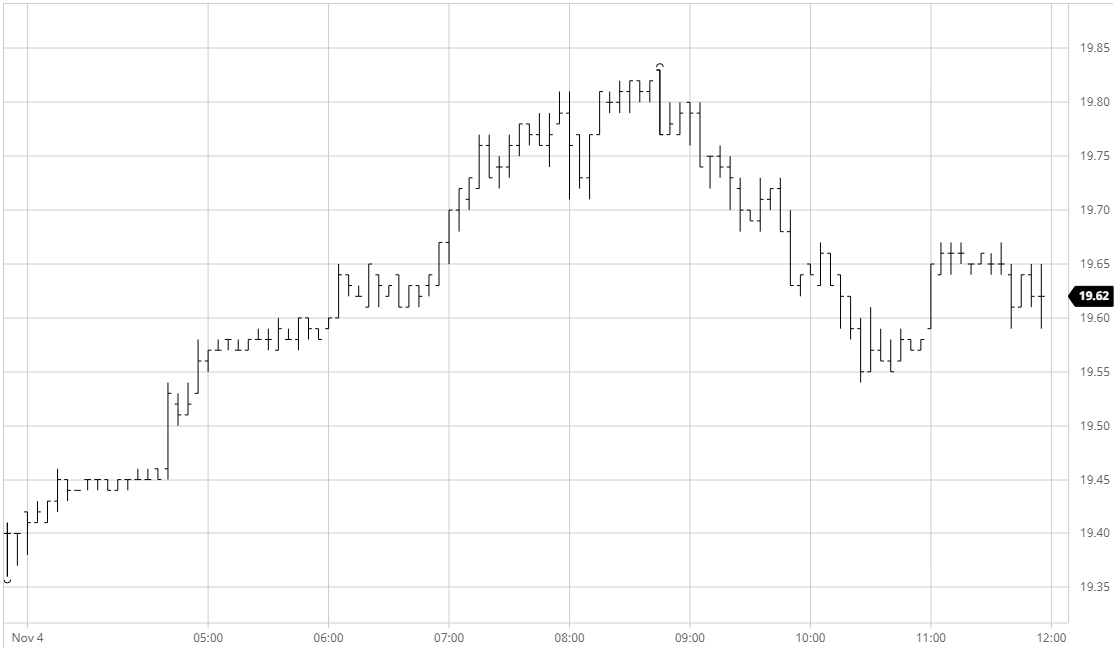

Sugar #11 Mar ’22

A slow but steady start soon began to gather pace as a firmer macro picture encouraged some of the smaller specs and day traders to push up through the relative vacuum in the hope that we can again probe beyond 20c. While progress was always rather orderly the climb over the course of some four hours took March’22 all the way up to 19.83, with a little more resistance then beginning to be seen ahead of last weeks 19.86 high mark. The macro was eagerly awaiting the news from OPEC+, and while the announcement fell short of the increase requested by the US it still approved a 400,000 barrel per day increase for December which was sufficient to impact the USD and bring markets back from their highs as specs liquidated longs. Sugar fared better than some over the rest of the afternoon in holding onto some of its net gains, although the spreads were less willing to do so with March/May’22 heading all the way back to 0.22 points from a high at 0.33 points just a couple of hours earlier. Calm late trading led to a mid-range close at 19.63 with the broad rangebound conditions showing no sign of ending.

Sugar #5 Mar22

A marginally higher opening led us into a very quiet first hour before a little more buying began to emerge, leading the March’22 contract back up through $500. There continues to be no fresh sugar news to provide impetus however today the macro was building a head of steam led by gains in the crude markets and it was this impetus which drew some spec interest through to continue the push upward over the course of the morning. A second wave of buying followed as the US day got underway which led the price up to the $507 area, but though we remained in this area for a couple of hours we were unable to make the additional gains required to challenge last weeks highs. News from OPEC+ that a 400,000 barrel a day increase had been approved for December reversed the macro picture and pulled markets back from their highs and in most cases into net deficit for the day, with the ripple effect bringing long liquidation to the fore and sending us bac into the range. We remained mid-range through the final couple of hours to leave March’22 settling at $502.20, a close which while higher will have disappointed the bulls and leaves us continuing sideways.

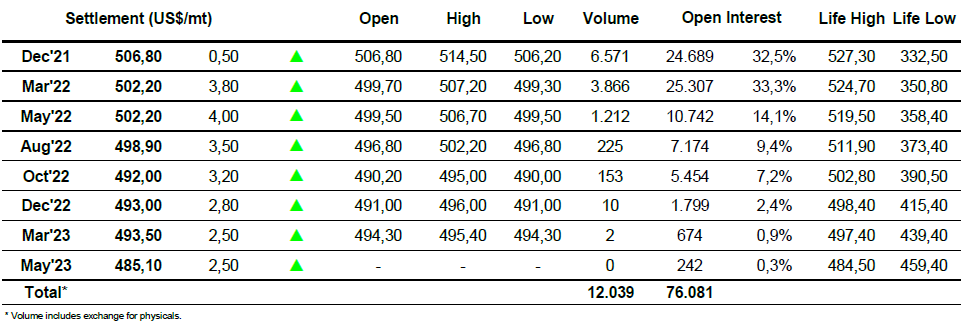

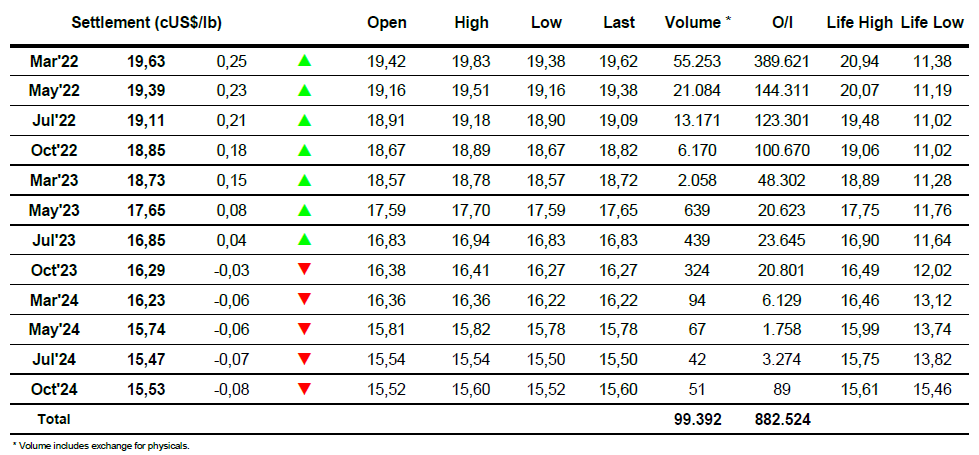

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract