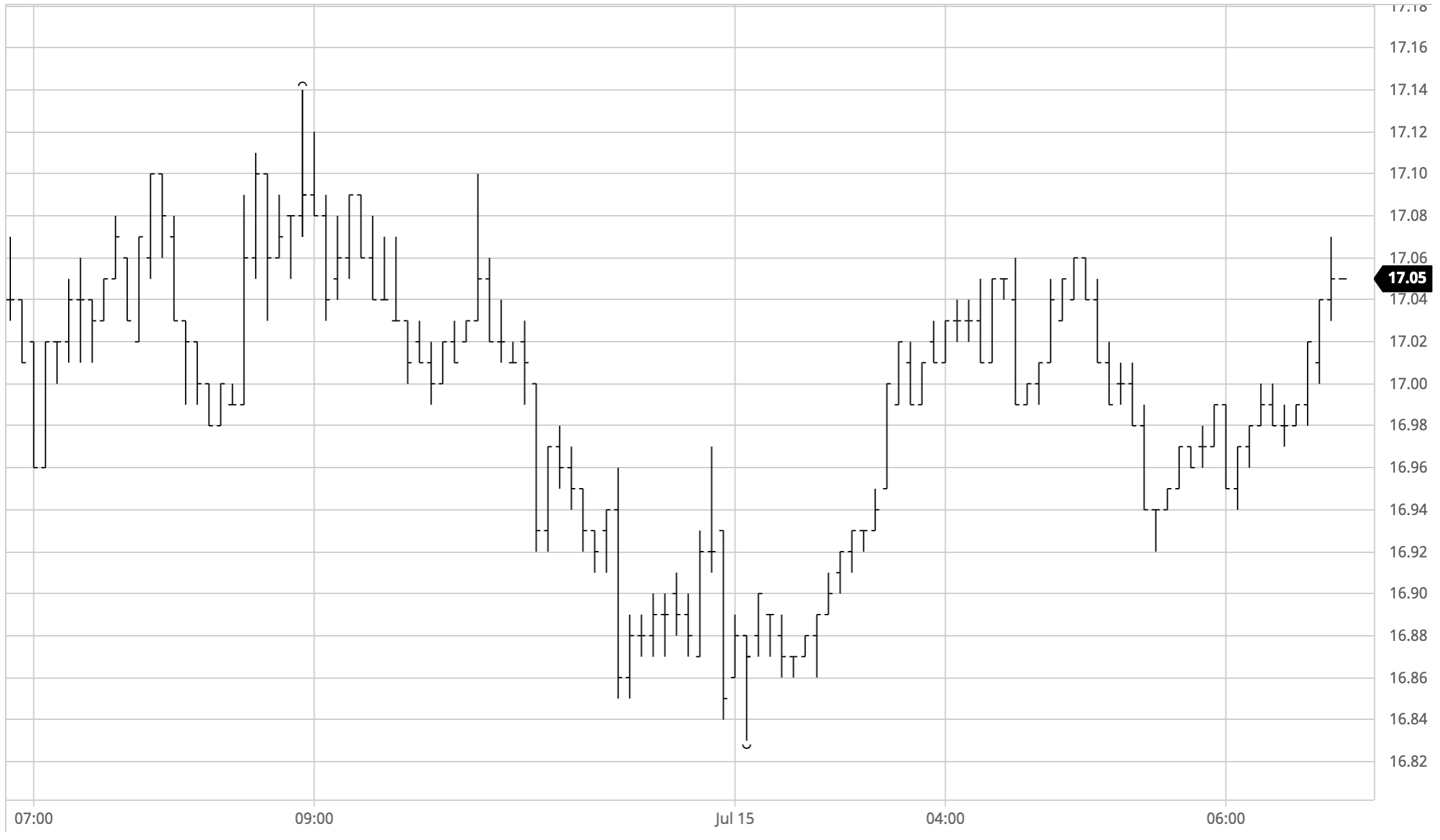

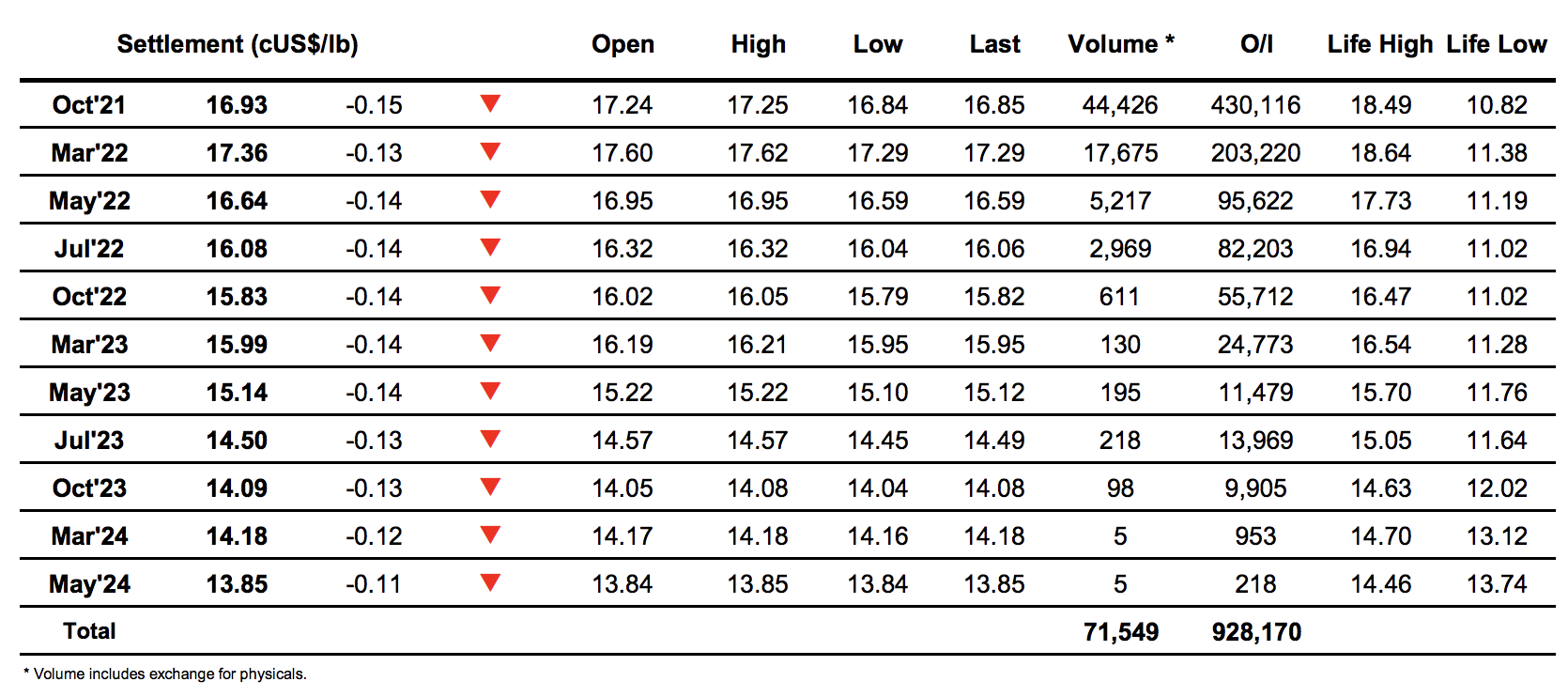

Sugar #11 Oct’21

Opening prints as high as 17.25 for the Oct’21 contract quickly gave way and with only limited buying on show the price soon fell back to unchanged levels. Having seen some stronger buying for the first time in a while yesterday afternoon the situation had unfortunately reverted to more expected morning conditions with the market showing very little movement for a few hours and finding support on any occasion that a 16c handle showed. It was not just the flat price that was quiet with spread volume also lower than of late where Oct’21/March’22 seemed content to hold near to -0.40 points on limited volume of just a few thousand lots. There was no discernible change to the pattern as we moved into the afternoon and as time progressed it became increasingly clear that the specs are content to stand aside for the time being despite the initial signs of some bottoming. The final couple of hours saw new daily lows recorded in the mid 16.80’s though recent lows did not come under threat with the start of some consumer scales providing sufficient support. A little short covering from day traders into the close left us settling at 16.93, providing a little of something for everyone with bears able to interpret as a negative day while bulls will point to consolidation having ended a sequence of lower lows extending back to 5th July.

Sugar #5 Oct’21

A marginally higher opening immediately gave way to lower levels and despite initial efforts to hold the market up the Oct’21 gradually settled down into a band beneath $450. With so little buying on show the Oct’21 continued to struggle and the situation was not aided by a relative resurgence in the Aug/Oct’21 spread which climbed back above -$20 as the final position shakedown takes place ahead of this week’s Aug’21 expiry. With the white premium also coming under some pressure the market tracked a little lower as we moved into the afternoon with a dip towards $446 before again consolidating, though volume remained moderate. Moving onward into the final three hours the draw of challenging yesterday’s $443.00 low encouraged some additional selling into the environment, leading losses to increase for all position except Aug’21 which maintained a mild green with the Aug/Oct’21 spread now holding at -$18.00. The decline finally saw new recent lows as we entered the final hour though scale buying limited the decline to $442.00 before late position squaring appeared to leave settlement a couple of dollars above at $444.10.

· The weakness of white premium values throughout today left all positions nursing losses, with closing values placing Oct/Oct’21 at $70.90, March/March’22 at $76.20 and May/May’22 at $87.30.

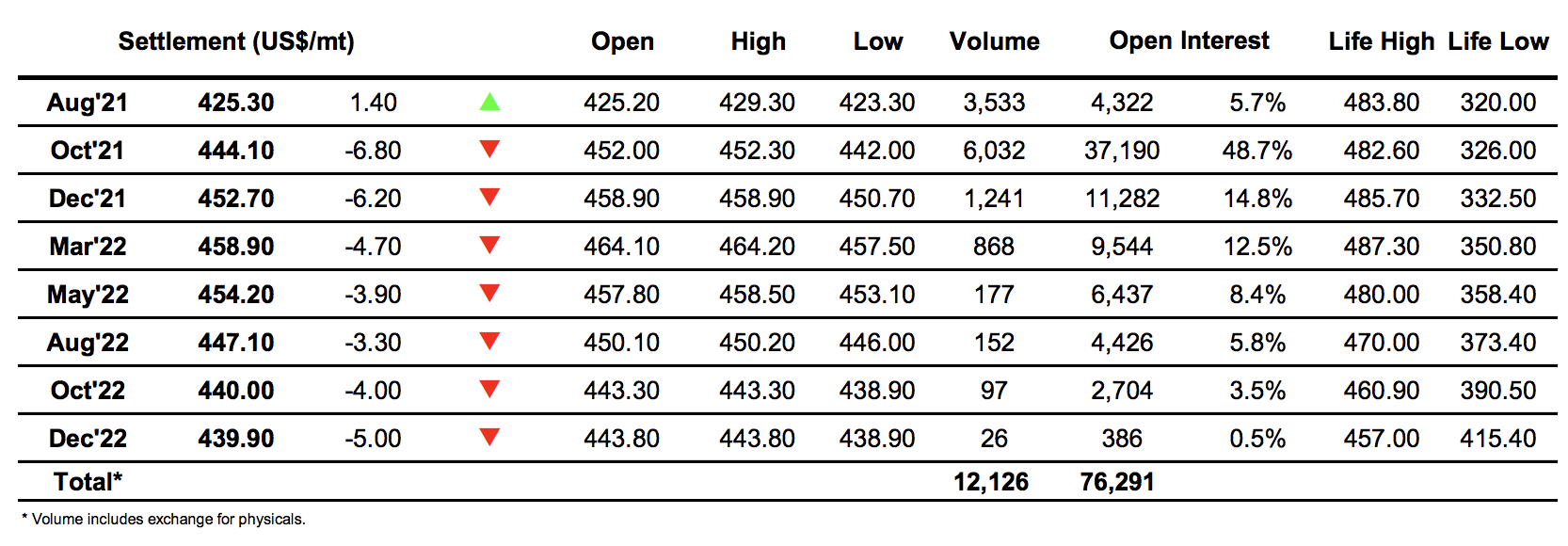

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract