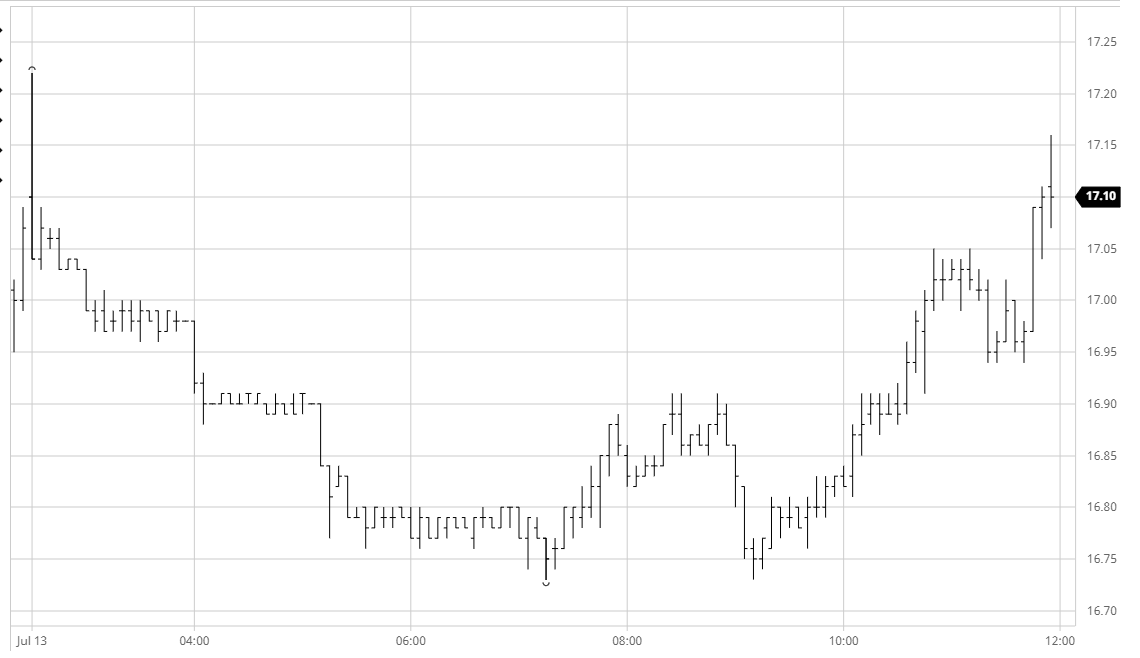

Sugar #11 Oct’21

A high volatility opening saw Oct’21 trading as high as 17.22 however it did not last and as overnight hedge lifting was concluded so the market stepped back to be holding unchanged levels an hour into the day. A week of decline has undermined confidence amongst short term traders and with scale buying insufficient to hold the market we saw a couple of steps lower occur to leave us struggling once again near to 16.80 reaching the end of the morning. The start of the US day did bring a small amount of fresh buying to the fore to nudge prices back away from the lows but still the market lacked impetus and by the middle of the afternoon we had returned to match the day’s 16.73 low mark. While buying had been limited earlier in the day there was a little more interest showing at these levels with consumers positioning against the 16.72 low mark from May while others are encouraged to up their pricing as we draw closer to the June low mark at 16.44. Having recorded an intra-day double bottom the market began to build once again and on this occasion with greater success as the price pulled up to the 17c area to be back in small credit. There were question marks as to whether it would hold but these were put to rest during the final 15 minutes with some late spec activity (more likely through short covering rather than new longs) which took the price as far as 17.16 on the post close. While shy of the opening high it was sufficient to establish a positive settlement for the first time in more than a week, Oct’21 finishing at 17.08 which while not overly significant may at least represent the first sign of the market attempting to bottom out and consolidate.

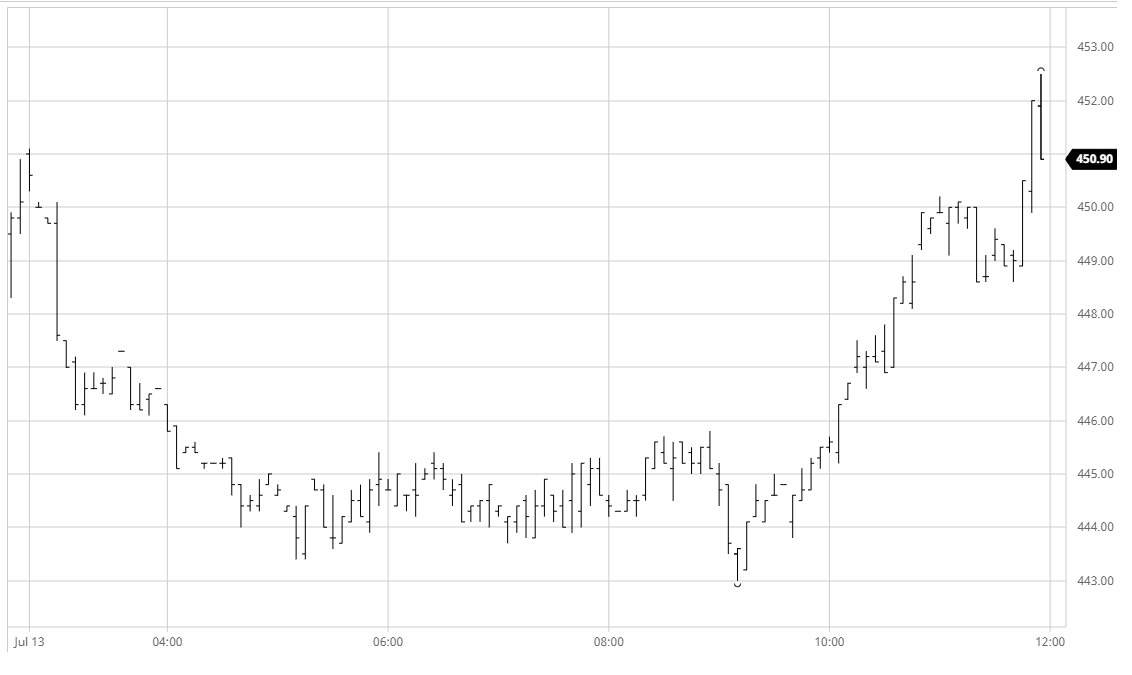

Sugar #5 Oct’21

Recent weakness has left the market vulnerable once again and following brief higher prints a continuation of the recent selling through the early part of today’s session sent Oct’21 down beneath $444.00 to be almost $35 beneath the high of last Tuesday. The trend has been relentless however with both our market and the No.11 beginning to find some trade and consumer buying interest emerging as the price moves nearer to the June’21 lows. Settling down in the lower to mid-440’s a period of calm ensued which lasted for a few hours through until the middle of the afternoon, and in the absence of any flat price movement we turned attention to the Aug’21 spreads which ahead of Thursday’s expiry were weakening with Aug/Oct’21 dropping to a new low at -$32.00. Light buying emerged for the final couple of hours and with little depth to the range we comfortably pulled back towards $450 though topped out before being able to reach the morning highs. Remining steady as we headed to the close there was a final burst of buying reserved which enabled new session highs to be recorded on the call, continuing a little further on the post close as Oct’21 settled at $450.90.

White premiums are maintaining fairly constantly with the late buying ensuring that Oct/Oct’21 ended at $74.30, March/March’22 at $78.00 and May/May’22 at $88.20.

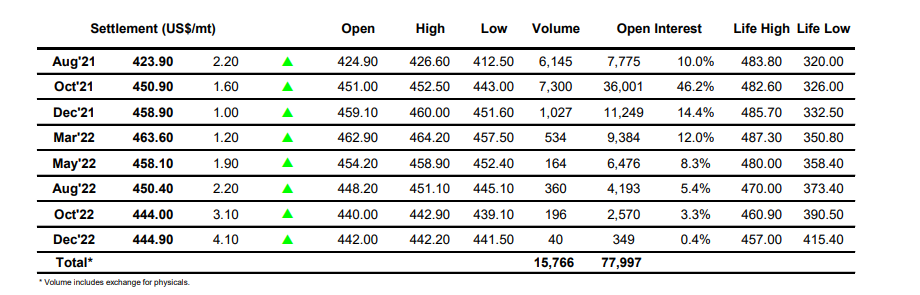

ICE Futures U.S. Sugar No.11 Contract

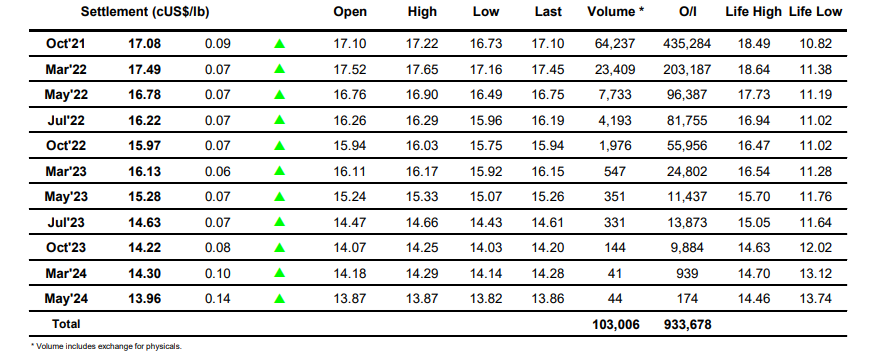

ICE Europe Whites Sugar Futures Contract