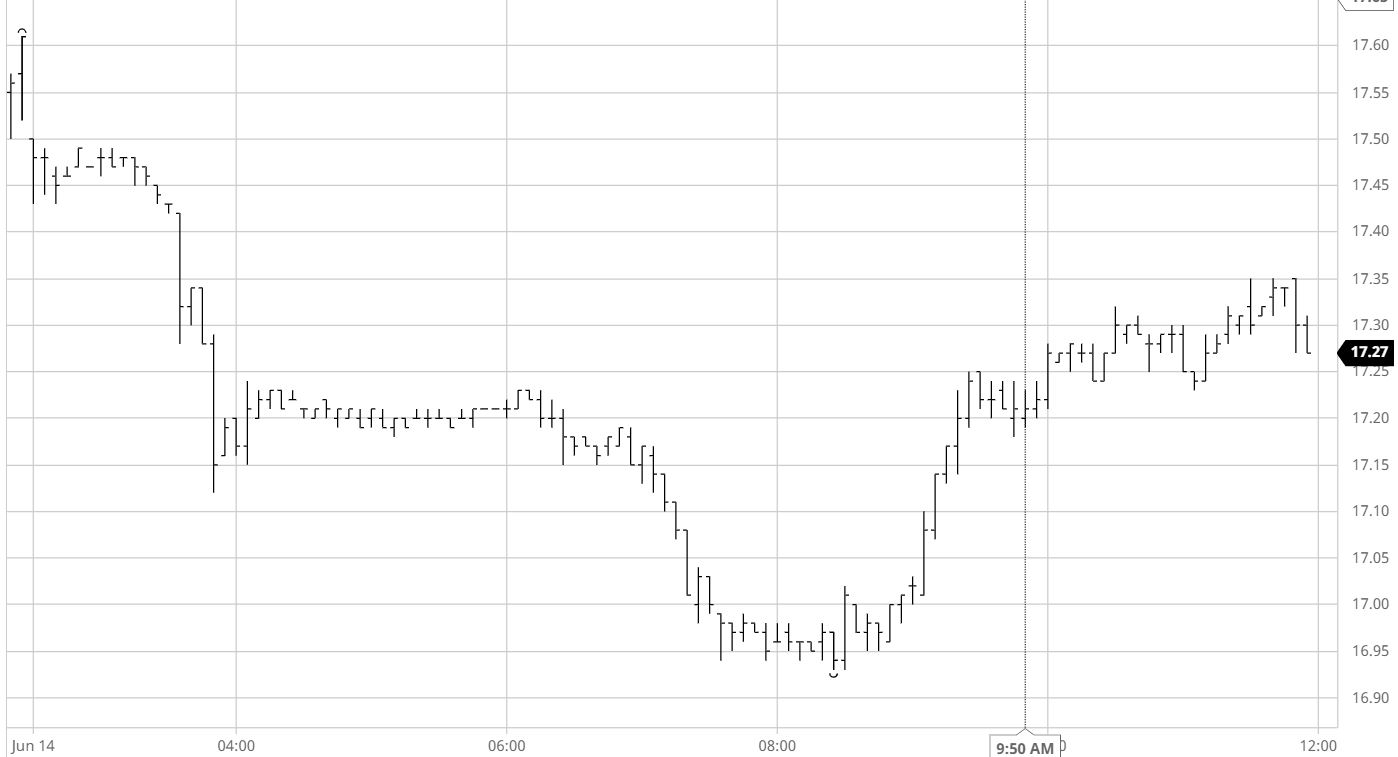

Sugar #11 Jul’21

The week commenced with values slightly weaker and in calm trading Jul’21 edged along quietly in the 17.40’s for the first hour. The sudden change of pace that followed came from nowhere as increased selling then kicked Jul’21 down to test the recent 17.29 low mark and as we traded below so a host of sell stops were triggered to send the price tumbling to 17.12 before short covering and consumer buying brought some calm in the form of sideways consolidation. Little changed until the early afternoon when the arrival of US based specs generated another round of selling which sent the price down to test the 17c area. While we saw the price erode into the 16.90’s against this pressure there was a good level of support continuing to flow from consumers/end users which enabled the market to build a bottom, and with day traders having built up short holdings when the market broke it was back upwards with the short covering sending the price back norther to look back at the former 17.30 support from where we had fallen. This area drew interest from both sides and the last couple of hours saw price action centred at 17.30, while another day of strong Jul/Oct’21 volume saw the spread back from -0.15 points early in the afternoon to a high at -0.07 points. Closing activity eventually left Jul’21 settling right on the former support at 17.29 and with the Jul’21 option expiry to follow another day of volatile activity may be in the offing for tomorrow.

Sugar #5 Aug’21

A relatively calm start to the new week was soon broken by a burst of sharp selling which sent Aug’21 quickly down into the mid $440’s before encountering support from buying placed ahead of the April and May lows. This support held the market in a sideways pattern for a few hours and also provided some support to the white premium following last weeks significant weakening, Aug/Jul’21 pulling back up above $66. Increased selling started to flow back in during the early afternoon as weakness elsewhere in the macro and our own technical vulnerability combined to send Aug’21 beneath $443.50 and on to a low at $440.60. One may have anticipated that more sell stops would have been triggered on the way down however following a period in which we levelled off the market rallied back just as quickly as it had fallen with short covering from day traders apparent on the recovery. Finding ourselves back in the mid $440’s the picture looked far less negative and the last couple of hours were spent holding comfortably towards the upper end of the day’s range, eventually posting a settlement at $448.50 which while lower on the day will be greeted positively by spec longs who will feel that the market has shown some good resilience today.

White premium values maintained their earlier recovery to post firmer settlements today with Aug/Jul’21 settling at $67.30, Oct/Oct’21 at $73.10 and March/March’22 at $77.90.

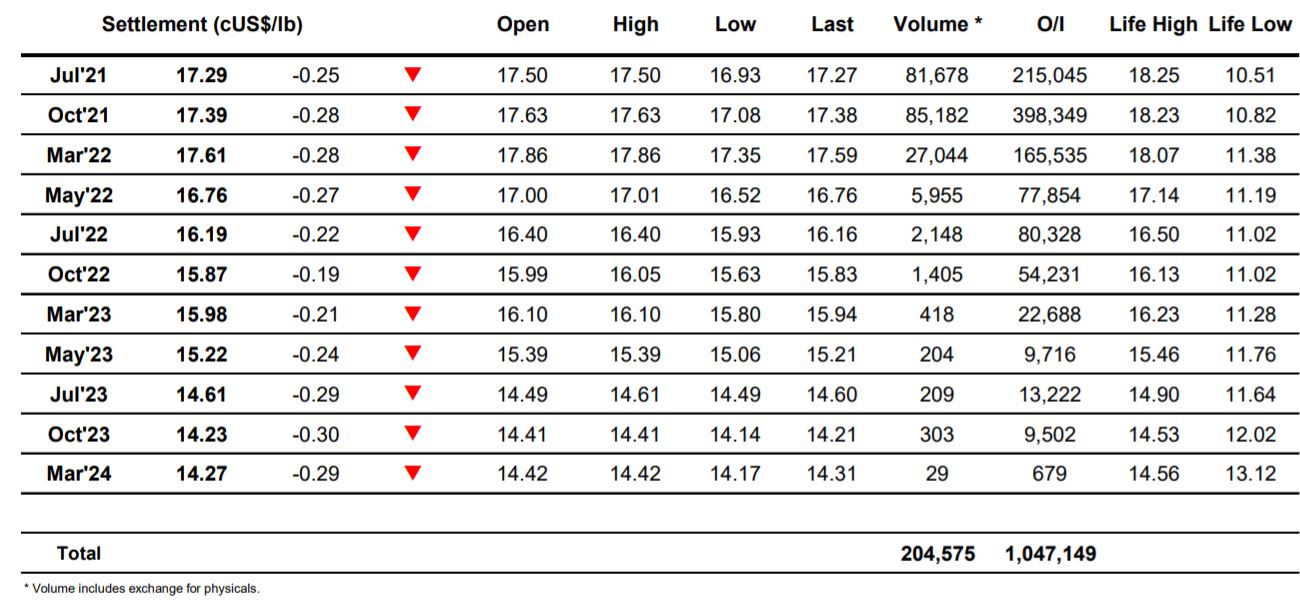

ICE Futures U.S. Sugar No.11 Contract

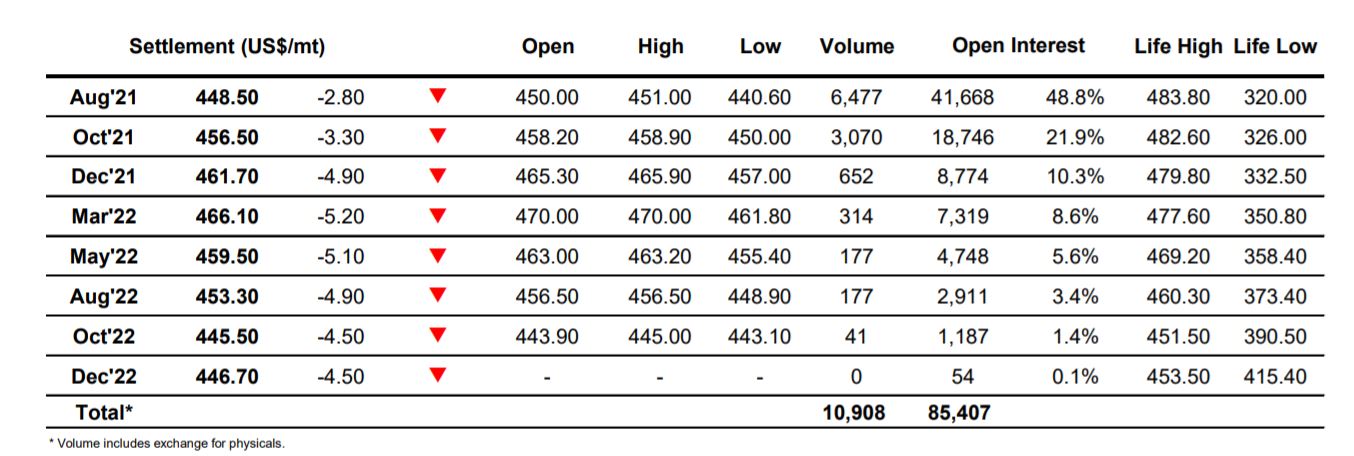

ICE Europe Whites Sugar Futures Contract