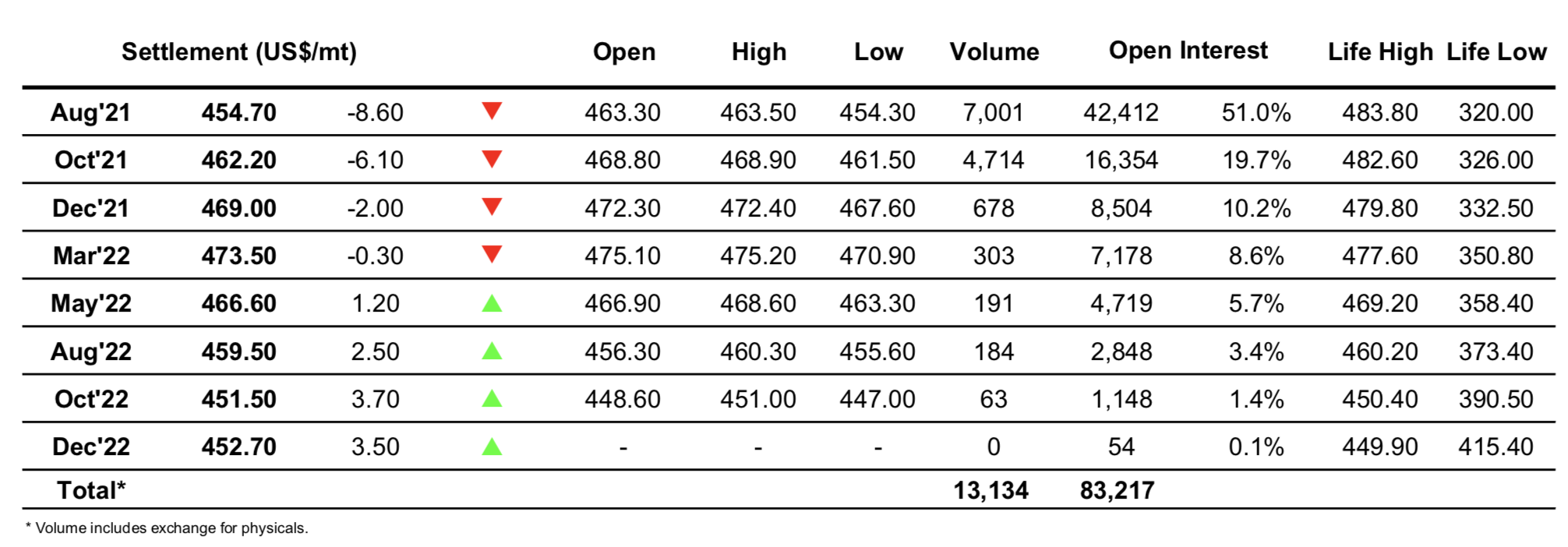

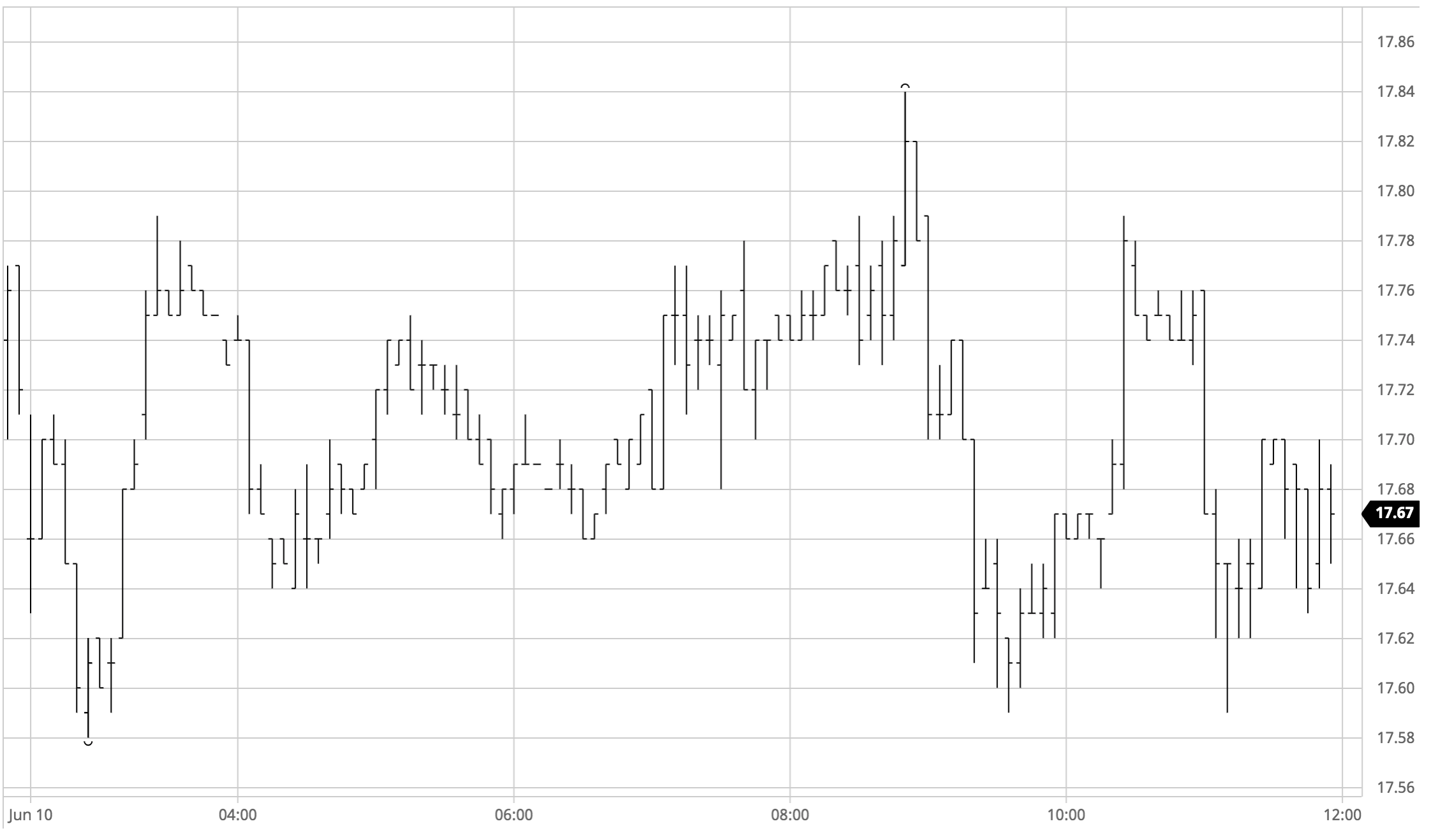

Sugar #11 Jul’21

The failure to break above 17.90 yesterday had an impact on confidence with an initial burst of selling sending Jul’21 down to 17.58. A sharp recovery soon followed however and though it was not sustained it sent out the message that maybe the initial thoughts were premature in showing that the specs may not be finished with the long side yet. Having failed to sustain the momentum in either direction activity then settled into a band wither side of unchanged levels and this was maintained into the early afternoon despite the white sugar market experiencing losses which on many occasions would have acted as a drag factor and pulled values back. In a featureless environment focus turned to the Unica figures due to be published at 3pm and though there was a pre-emptive push which sent Jul’21 to 17.84 ahead of publication the report showed that for the 2nd half May21 the crush was 43.23m tonnes, with 2.623m tonnes of sugar produced and a sugar split at 46.34%, in line with expectations and leading prices to fall back to the 17.60 area against long liquidation. The remainder of the session saw prices continue to chop about within the range and though we came within a single point of the morning low we were unable to break fresh ground with the majority of the volumes again seen for Jul/Oct’21 as the index roll moved through its penultimate day. Settlement levels were marginally lower with Jul’21 at 17.66 and Ocxt’21 at 17.73, still firmly within the recent range.

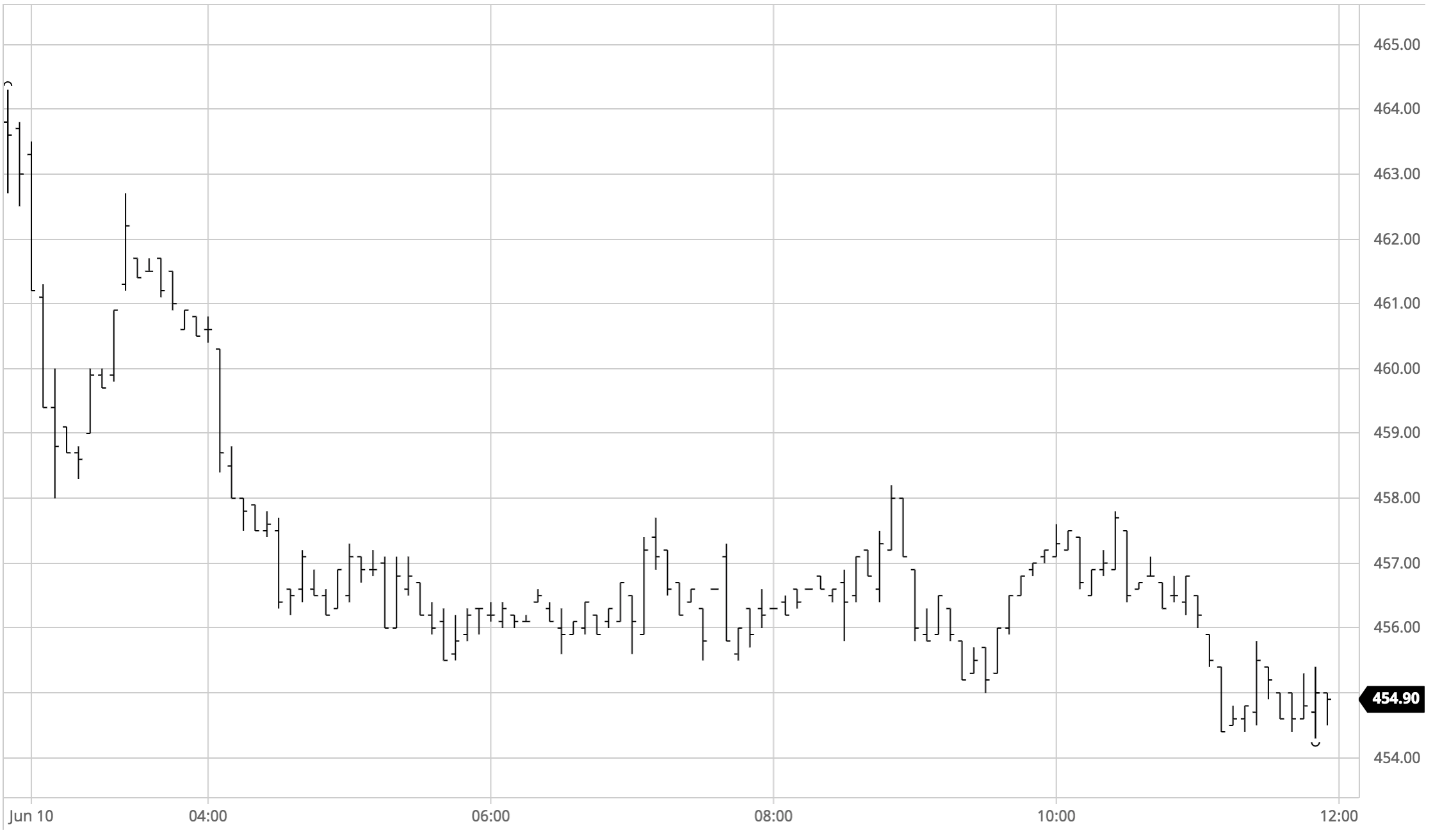

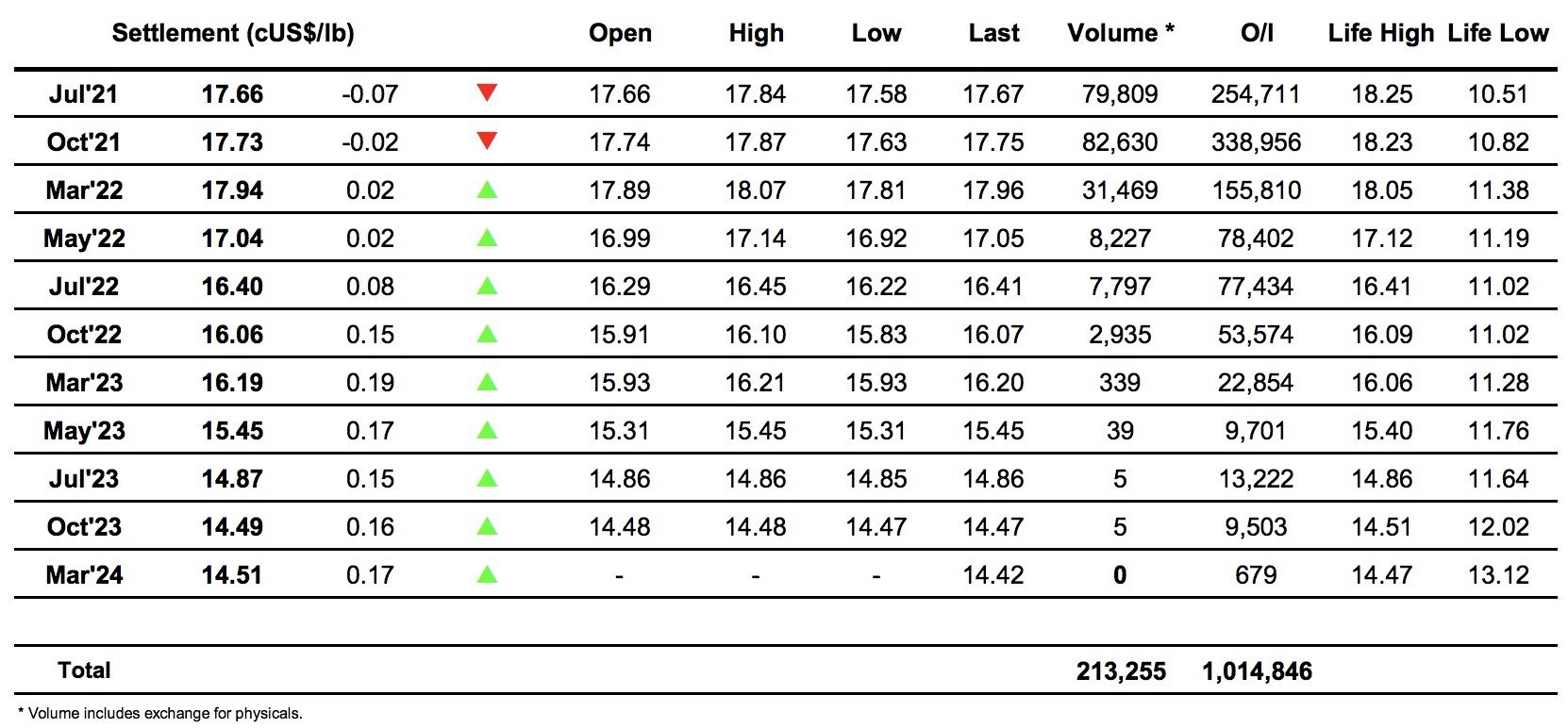

Sugar #5 Aug’21

Mixed early trading saw Aug’21 slip as low as $458.00 before encountering buying while pulled the value back towards $463.00, however it seemed that the damage was done and selling soon resumed to send the price lower once more. The weakness was in stark comparison to our No.11 counterpart with the pressure heaviest upon the front two prompts and some aggressive selling impacted upon the spread values too with Aug/Oct’21 falling to -$8.00 which the Oct/Dec’21 slipped to -$5.50. Having broken beneath the recent $457.00 low things were looking rather shaky however the refusal of the No.11 to slide in the same way which had led the Aug/Jul’21 white premium value to crumble towards $65 proved sufficient to bring in some supportive buying that held the price within a tight band either side of $456.00 for several hours. With no significant buying being felt the market continued to meander until the final hour when the range was extended a little further to the downside as Aug’21 traded to $454.30. It continued at the lower end of the range heading into the close and settlement at $454.70 sends out negative signals with support needed from the wider macro if we are not to re-test last months lows in the $440’s.

· White premium values lost significant ground today and posted lower settlements down the board with Aug/Jul’21 settling at $65.40, Oct/Oct’21 closing at $71.30 and March/March’22 at $78.00.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract