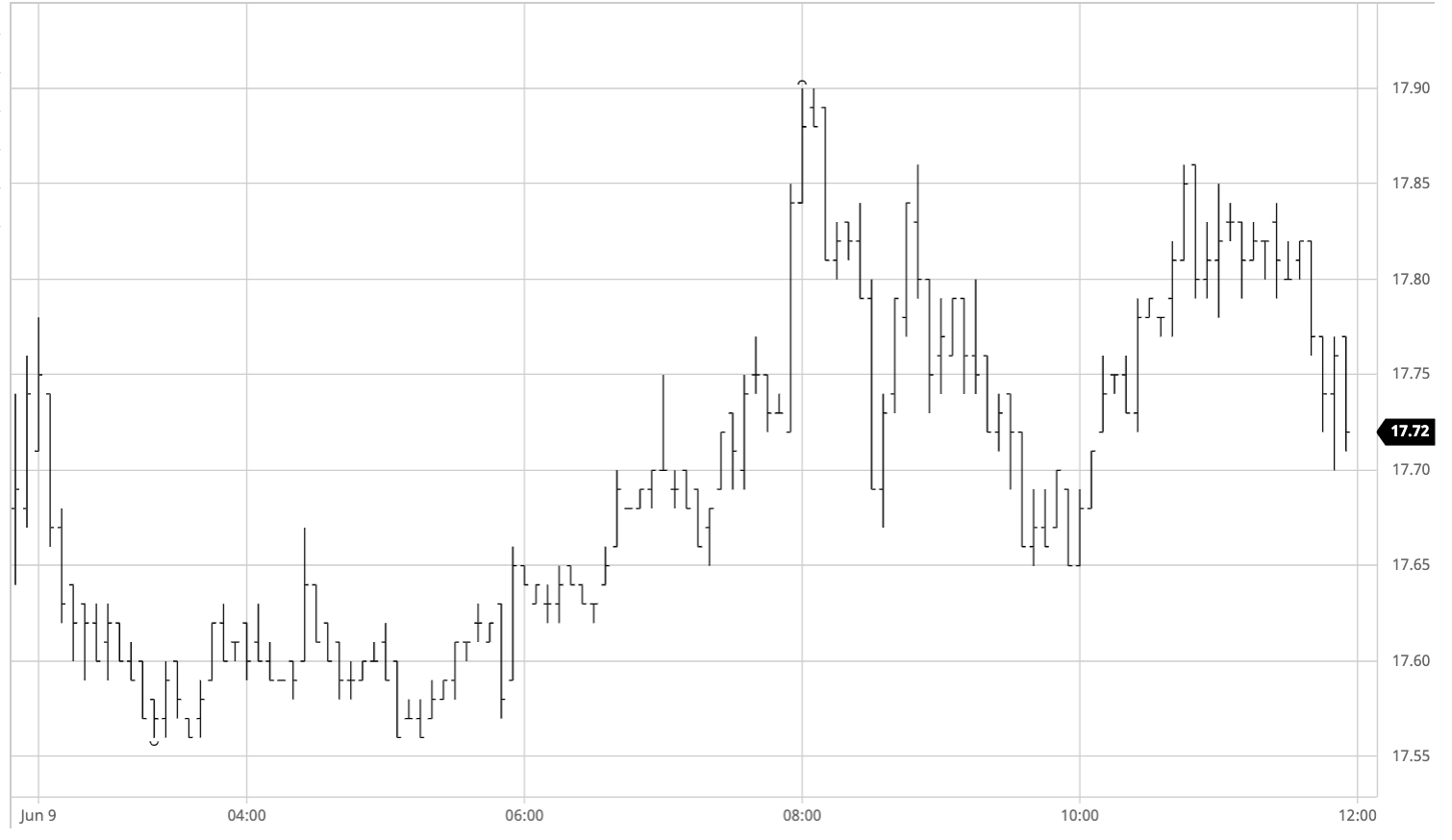

Sugar #11 Jul’21

Initial positivity quickly eroded and most of the morning was spent holding a narrow band either side of 17.60, firmly planting the market back toward the centre of the recent 17.29/17.93 range. Volume was minimal with what little size there was coming via the Jul/Oct’21 as the index roll reaches its mid-point and when we approached the US morning hopes were pinned on some increased spec and algo interest to see whether that could provide sufficient spark to break prices from the current malaise. Buying certainly increased as specs began to drive the price north and over the course of an hour we returned to positive ground and were nudging at the opening high. Soon the price broke above 17.78 with buy stops generating a sharp spike up to 17.90 before some equally sharp corrective action took place in the form of long liquidation. Tellingly for the current situation this high was just three points shy of the mark set last Wednesday and having traded a single point above the recent low only yesterday one can conclude that we are likely set to hold the range for a little longer yet. Though prices swung within the range during the final third of the session at no stage to we seem likely to challenge to either end, ultimately seeing a neutral settlement value for Jul’21 just 2 points higher at 17.73 following late position squaring.

Sugar #5 Aug’21

The positive conclusion to yesterday’s session failed to garner any continuation this morning and instead prices retreated back down a little into the range with broadly sideways morning trading seeing a low mark at $461.40. The lethargic nature of the morning was gradually broken as we moved beyond noon with buyers emerging to take the front positions back above last night’s closing levels, which in turn set off some more enthusiastic buying which saw Aug’21 push on to a high of $467.90. Again falling short of recent highs and with nearby spread and white premium values under pressure a period of choppy trading followed as specs pinged in and out of the market, though all the while there was a reluctance to let values slip too far back into debit. Some calmer positivity resumed for the flat price during the final couple of hours despite the Aug/Oct’21 spreads remaining offered at -$4.00, though with the earlier momentum lost there was no fresh challenge to the session highs. A calm pre-close period cam to an abrupt end with late long liquidation sending values back lower, the sharp decline seeing Aug’21 beneath $463.00 and the Aug/Oct’21 spread weakening to -$5.50 with settlement established at $463.30.

The late decline impacted nearby white premiums and left the Aug/Jul’21 settling much weaker at $72.40 having dipped beneath $72.00 late on. The rest of the board made more modest losses with Oct/Oct’21 closing at $77.00 and March/March’22 at $78.70.

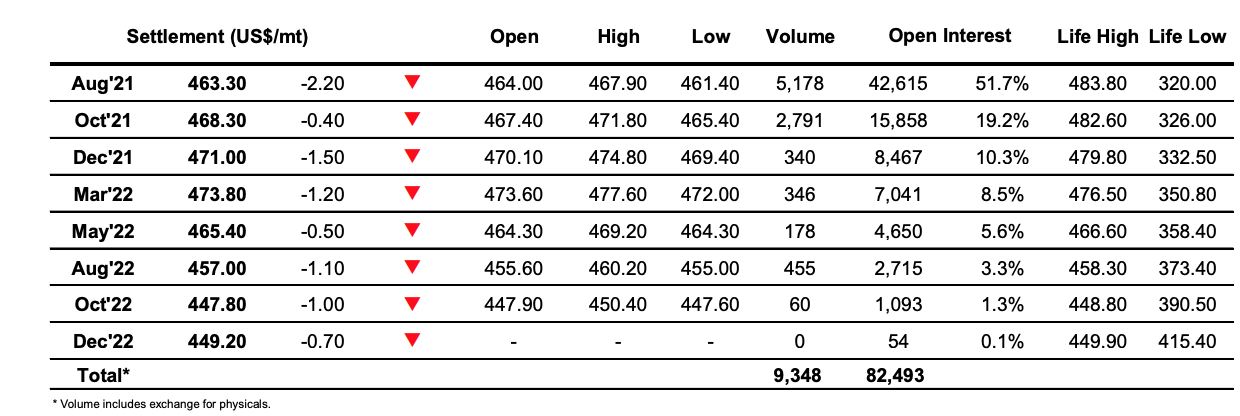

ICE Futures U.S. Sugar No.11 Contract

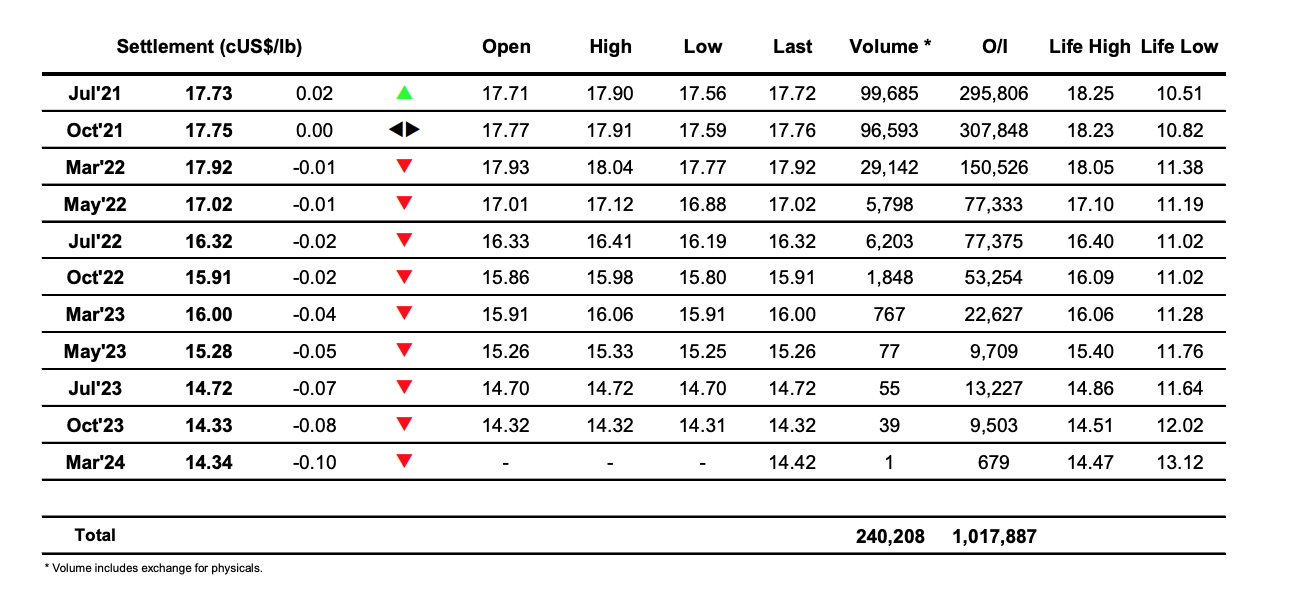

ICE Europe Whites Sugar Futures Contract