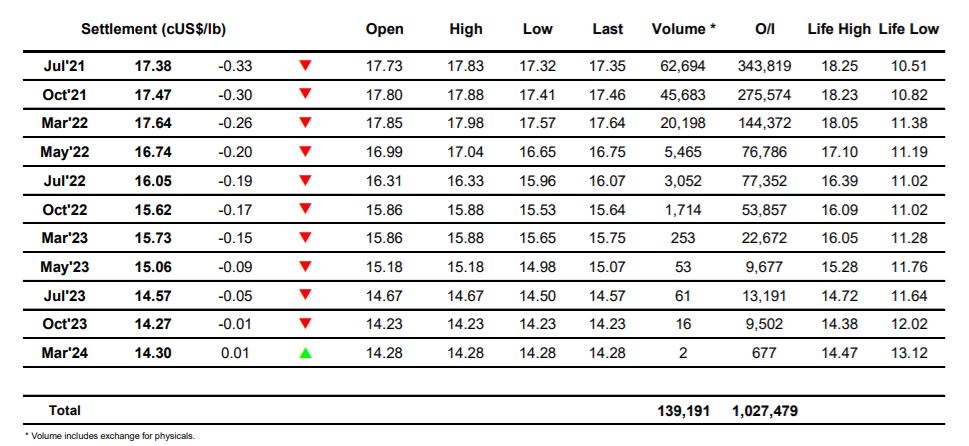

Sugar #11 Jul’21

The succession of daily highs between 17.74 and 17.93 over the past week has led to some questioning over the ability to push on beyond 18c and with Fridays COT report showing that the net spec long has grown back to 244,102 lots long another question mark has been placed into the equation. Initial activity this morning however showed no such concern as we edged along quietly either side of Friday’s Jul’21 closing value of 17.71, a mixed macro providing the perfect backdrop to hold and wait for the larger volumes that follow with the start of the US day. Arriving at mid-session the US based specs brought with them a little more selling that nudged prices back downward though still remaining within the confines of the past weeks range, lightening the load a little although the more sizable activity was emerging through the Jul/Oct’21 spread. Here we are entering the 5 day index rolling period and through the afternoon some of the recent gains began to erode with the differential moving to -0.09 points discount as the selling flowed in steadily. The afternoon saw continuing selling place nearby values under further pressure with the final three hours spent mostly in the 17.30’s, holding above last Thursdays low mark of 17.29 though struggling to climb far away as the spec rolling maintained the pressure on Jul’21. The spread moved only a touch more to -0.10 points later in the afternoon while the Jul’21 close at 17.38 leaves the last weeks range in tact though with much more index rolling to follow over the rest of the week further corrective action towards 17c may well be seen.

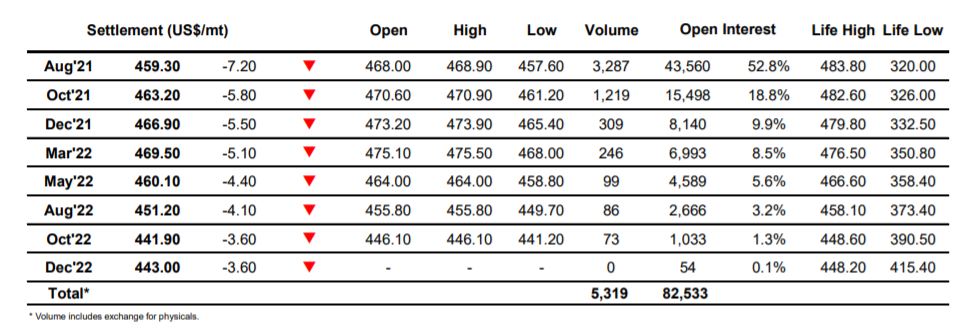

Sugar #5 Aug’21

Recent gains have been achieved on the back of the firmer No.11 market, emphasised by the weaker white premium values which now see the Aug/Jul’21 settled in the mid $70’s. For the flat price we started the new week quietly holding on to recent gains and making a daily high at $468.90 however in thin trading we gradually started to slip backwards into the recent range and were holding in the vicinity of $465 by noon. The lack of any significant pricing interest from end users/consumers at current levels leaves the market vulnerable when the specs step away and this factor led prices to slip further on low volumes as the afternoon moved on with very limited interest seen until we slipped beneath $460 where a little more buying was uncovered in front of last Thursday’s $457.00 low mark. This area between $460 / $457 provided support throughout the final three hours as we meandered at the lower end of the range, eventually settling at $459.30 following some end of day position squaring to continue within the recent broad range.

Closing white premium values showed little change for the day as we closed at $76.10 for Aug/Jul’21 with Oct/Oct’21 at $78.00 and March/March’22 at $80.60.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract