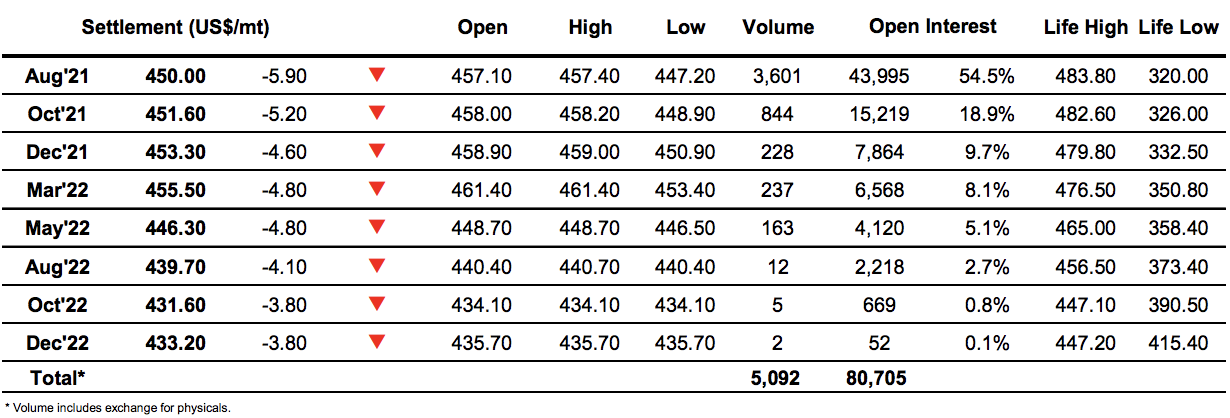

Sugar #11 Jul’21

Opening buying sent Jul’21 up to 17.13 during the first few minutes however it lacked substance and after just 30 minutes we had eased back to be just beneath settlement values. The push higher yesterday had seen some moderate spec interest from the long side and clearly those that had held onto positions overnight were nervy with a spike lower seen as we moved beneath 17c soon afterwards sending Jul’21 down to 16.88. Volume was fairly light through the rest of the morning and with the market unable to regain a 17c handle there was some further slow erosion in prices as we awaited the arrival of Americas based traders. Little changed ahead of the release of the latest UNICA numbers, which when published showed the crush at 41.065m tonnes, sugar production at 2.376m tonnes with a sugar mix at 46.15%, which while down a little on the same period last year were better than most estimates. Despite the numbers still being considered relatively neutral they did encourage some fresh selling that pushed Jul’21 down to 16.63 soon afterwards, though we recovered just as quickly with day traders covering their position s as it became apparent that there was no follow-on selling emerging. This placed us back to mid-range where we continued quietly through the closing stages, ending at 16.78 for Jul’21 with the range bound malaise continuing.

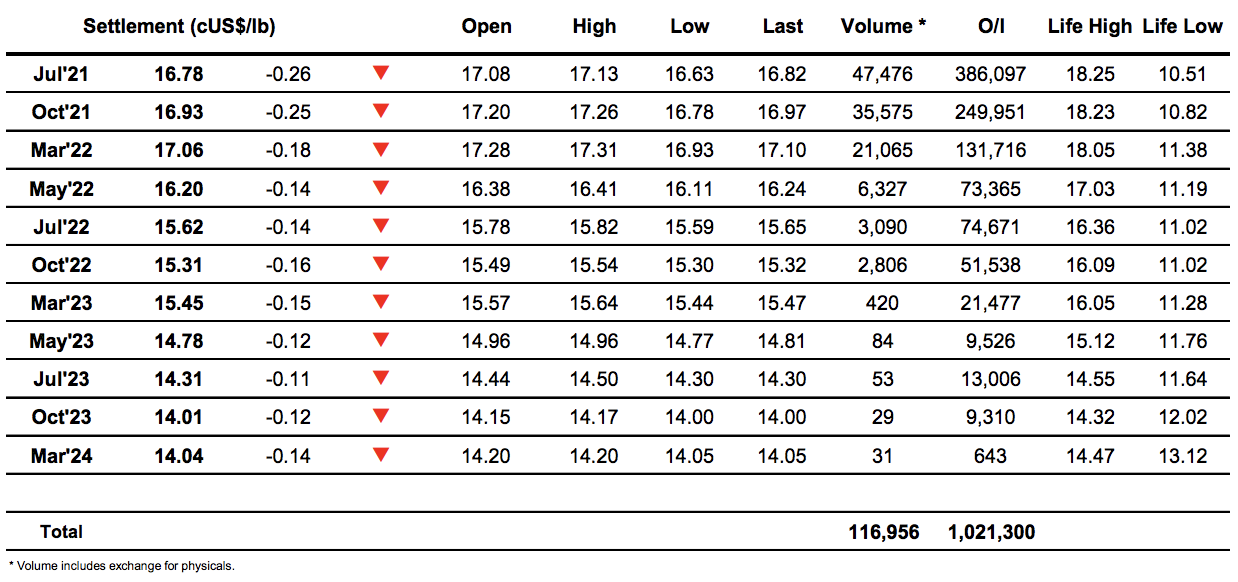

Sugar #5 Aug’21

Initial gains lasted for only a few minutes and morning trading then took on a negative leaning with moderate but steady selling sending Aug’21 down to $451.30 by noon to fill the small gap which was left from yesterdays opening. Having achieved this initial target a period was spent edging sideways but it seemed the failure to maintain gains yesterday has done nothing to reinstate the recent fragile confidence with the lack of buying leading prices to further erode during the early afternoon. The failure to rally was causing specs to look to the lower end once more and gathering some momentum from the No.11 following the publication of the UNICA figures in Brazil we slipped to a daily low at $447.20 before recovering to the centre of the range on subsequent short covering. Nearby spreads were little changed with volumes continuing to be incredibly light outside of the spot month, and moving through the final couple of hours price action was calm toward the centre of the range. Closing activity saw Aug’21 sold down to settle at $450, in the process pushing nearby spreads back from their highs.

Closing white premium values were similar to last night’s, showing Aug/Jul’21 at $80.00, Oct/Oct’21 at $78.40 and March/March’22 at $79.40.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract