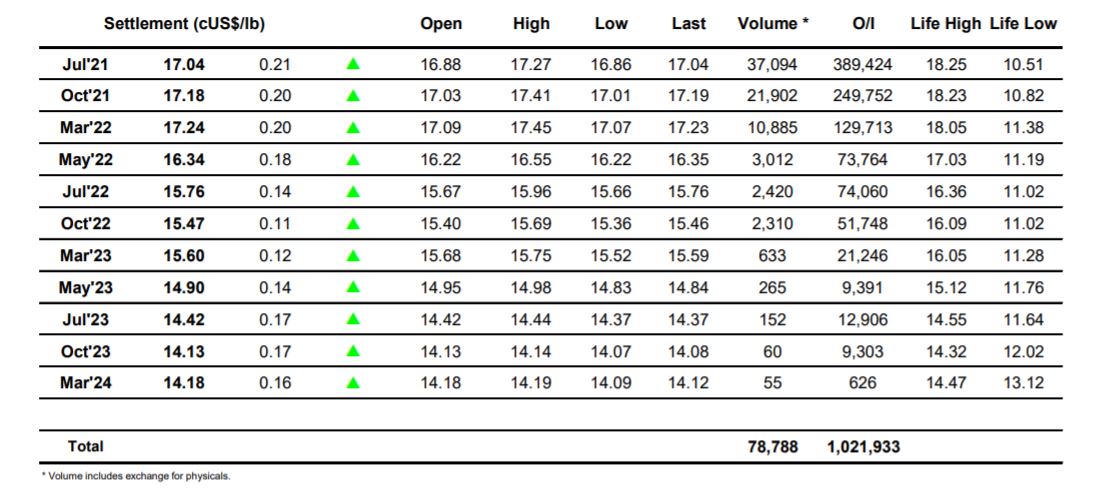

Sugar #11 Jul’21

A strong start to the session saw Jul’21 pushed up above 17c in quick time, showing the desire of specs to build upon yesterday’s recovery and end the recent malaise by getting things back onto a firm footing. Though the rally briefly faltered it was not too long before a fresh wave of interest extended the upside to 17.18 and in so doing generated sufficient breathing space that values were able to build a platform north of 17c from which to make further gains. Quiet trading prevailed through into the early afternoon but as more traders came online so the price gained fresh traction with an extension to 17.27 before the buying ran a little dry and sideways action resumed. Nervy selling from specs as earlier buying was liquidated sent values back to the 16.90’s however there was no obvious desire to hammer the downside and instead prices settled either side of 17c with volume falling away to very low levels. With the macro failing to provide any inspiration the last couple of hours dragged considerably and finally reaching the close we remained toward the centre of the range. A rather muted call was in keeping with what had passed before leaving values settling in the centre of the day’s range (Jul’21 17.04/ Oct’21 17.18) and suggesting we will remain in this area for a little longer yet.

Sugar #5 Aug’21

The market started positively with Aug’21 gapping higher to $454.70 before easing back to partially fill the gap in reaching $452.00. The momentum generated by holding in front of $$3.50 support yesterday was encouraging fresh interest from the long side and a mid-morning push sent the price up into fresh ground with the gains maintained during a period of consolidation. This set the tone for another push upward during the early afternoon and aided by spread support which saw Aug/Oct’21 trading up above -$1.00 the price extended to $459.90 before faltering with a return to the area of morning consolidation. As ever we find the thin conditions leading to some choppiness as day traders swing in and out of positions and this became increasingly evident during the final three hours as long liquidation sent the price back towards the session lows with others stepping in to haul back to mid-range soon afterwards. Activity continued to be slow through the latter stages and though some support for the white premium hauled the Aug/Jul’21 back to $80 late on we remained within the centre of the range with settlement at $455.90.

As mentioned above white premium values picked back up the range again today, closing firmer with Aug/Jul’21 at $80.25, Oct/Oct’21 at $78.00 and March/March’22 at $80.25.

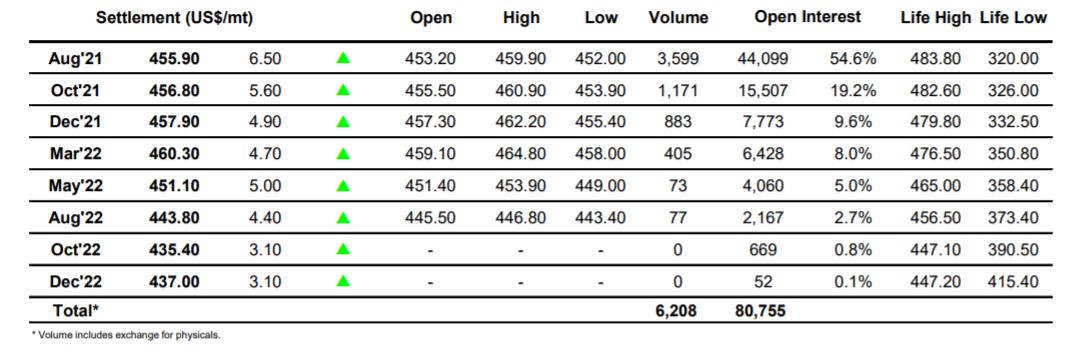

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract