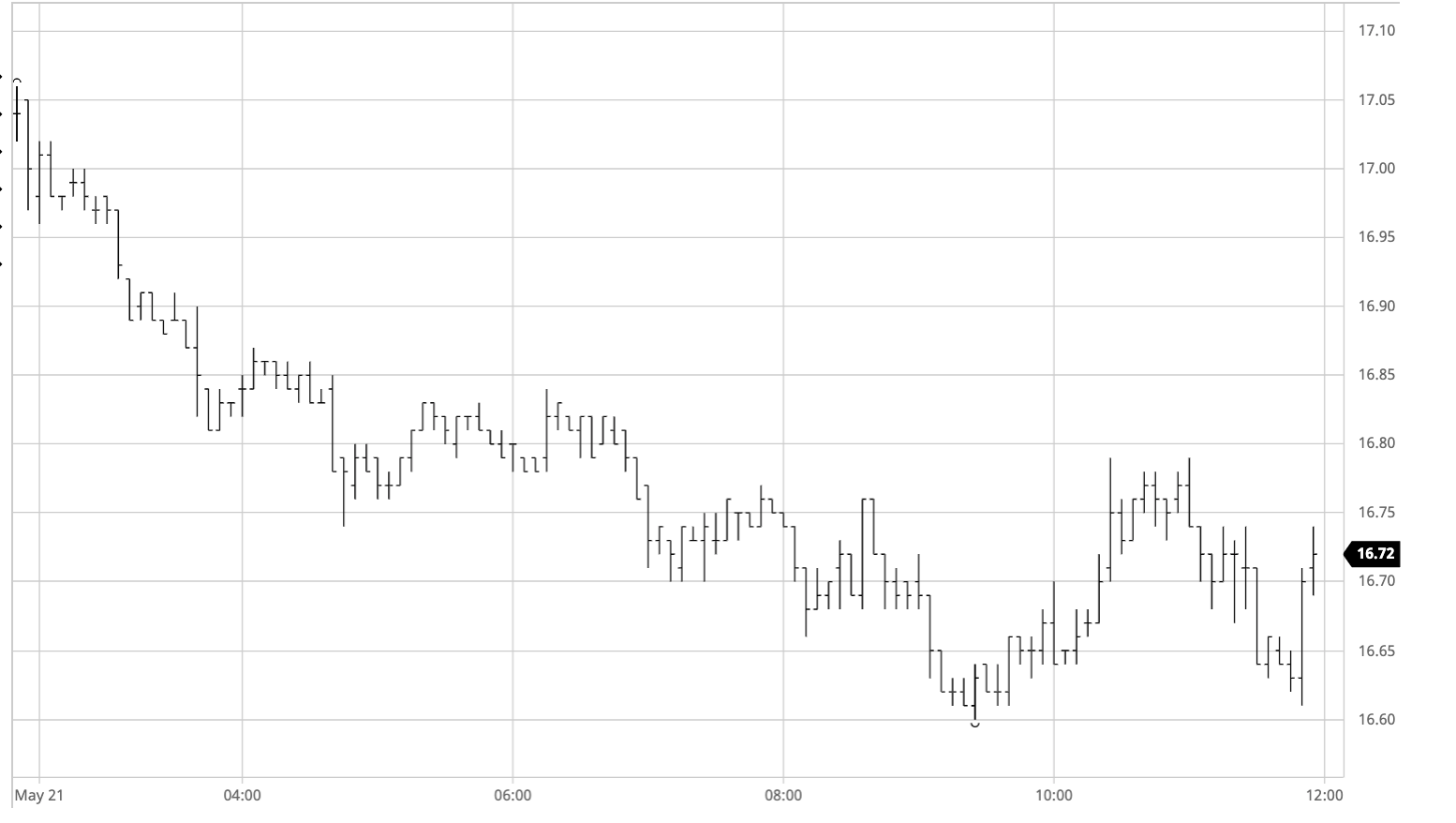

Sugar #11 Jul’21

A calm start to the session saw Jul’21 trading either side of 17c to be only marginally down however in the face of a weaker macro recent concerns were soon visible with specs showing from the short side to test back down into the recent support area ahead of 16.80. Progress was slow as befitting a market which continues to see only light volumes however following a brief pause at 16.81 the sellers gathered to give a push downward which extended the recent low to 16.74, a couple of small sell stops triggered in the process. With a more sizable chunk of buying showing in the lower 16.70’s there was a period of stabilisation which saw process holding wither side of 16.80 and this lasted through until mid-session and the start of the day across the Atlantic. A fresh show of selling from day traders and associated algo activity soon re-commenced the downward pattern and in unspectacular movement we slowly saw prices erode as far as 16.60 by mid-afternoon, by no means critical but asking questions of the support area which runs to the 16.46 low dating to 29th April. As ever with a spec dominated day we saw some position squaring/profit taking emerge which pulled values back away from the lower end, though the recovery stopped shy of 16.80 and in spite of an improved macro we returned towards the session lows ahead of the close. Another wave of position squaring ensured we ended the day without incurring additional damage, Jul’21 settling at 16.67 and showing vulnerability as we head into the weekend.

Sugar #5 Aug’21

A marginally firmer opening soon dissipated and in conjunction with a weaker macro the market started to work downward, moving to test this week’s low mark at $449.40. Some light support ahead of this level caused values to hold for a short while however it lacked substance and we soon cracked lower to $447.30 to add some technical pressure to the environment. Virtually all of the volume was being seen for Aug’21 with even the Aug/Oct spread trading only odd lots of volume and though the market did not collapse there was a sense of struggle with very little buying being seen. Moving into the afternoon prices began to slide a little further but still the action was relatively dull as the range extended to $445.50 to be just $2 above the low mark from end April which provides the next support. This area encouraged a little more buying from consumers while any shorts from day traders also began to be covered in as positions were tidied ahead of the weekend, leading the market to recover to the $450 area. With the covering complete prices edged back to the lower end of the range, before a choppy close concluded the week with Aug’21 settling at $447.40

White premium values chopped around the same recent range today, ending back at the upper end with Aug/Jul’21 closing at $79.90, Oct/Oct’21 at $77.25 and March/March’22 at $79.50.

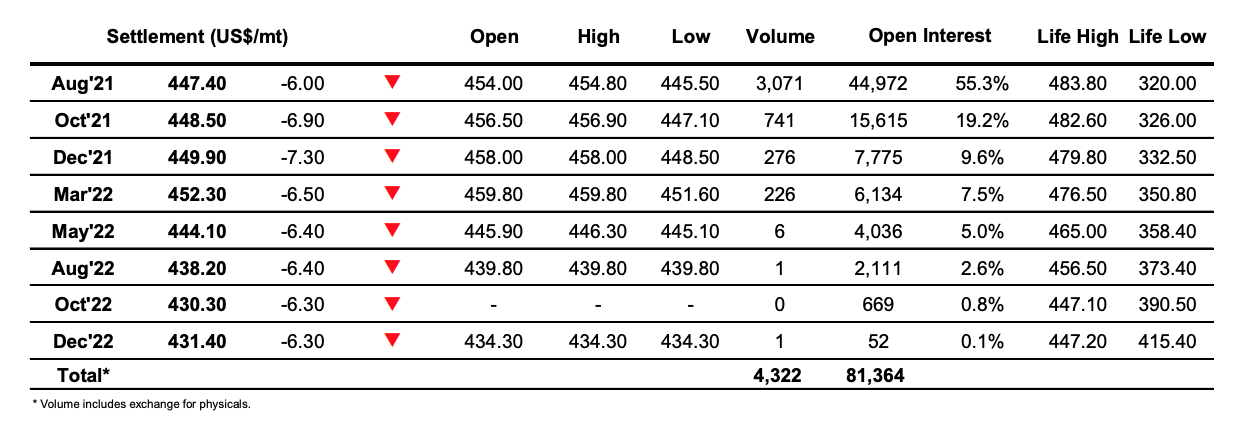

ICE Futures U.S. Sugar No.11 Contract

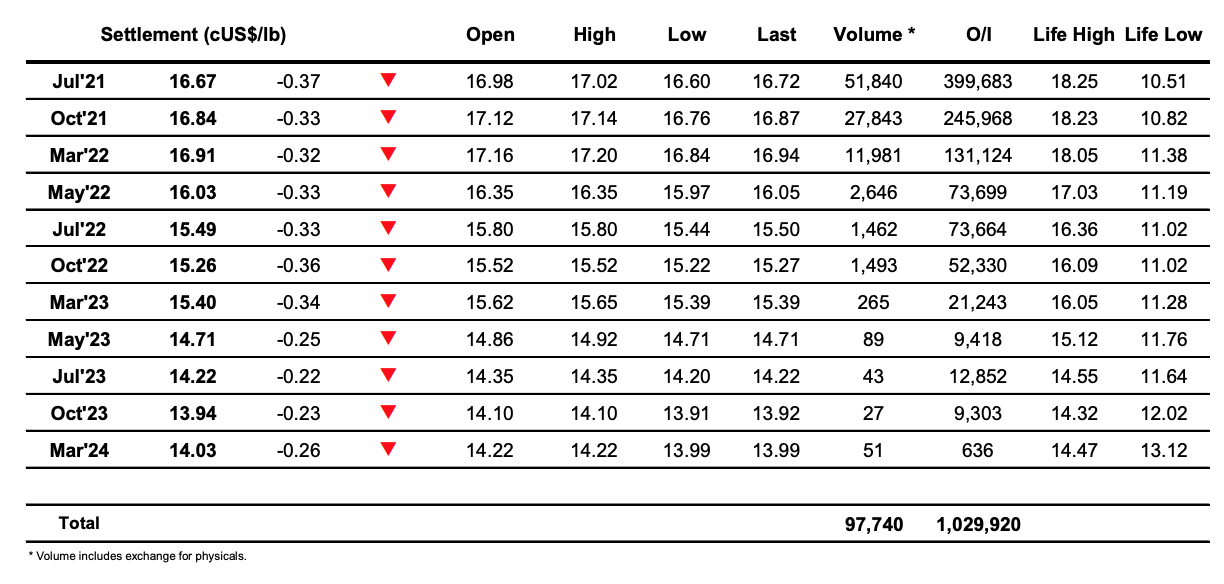

ICE Europe Whites Sugar Futures Contract