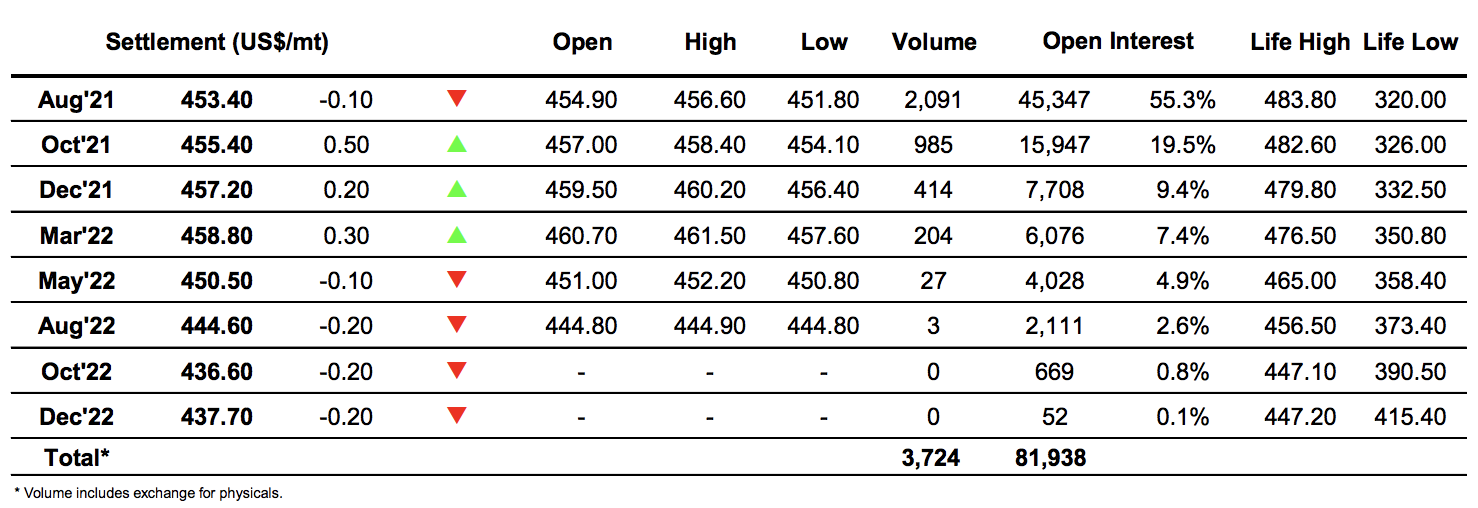

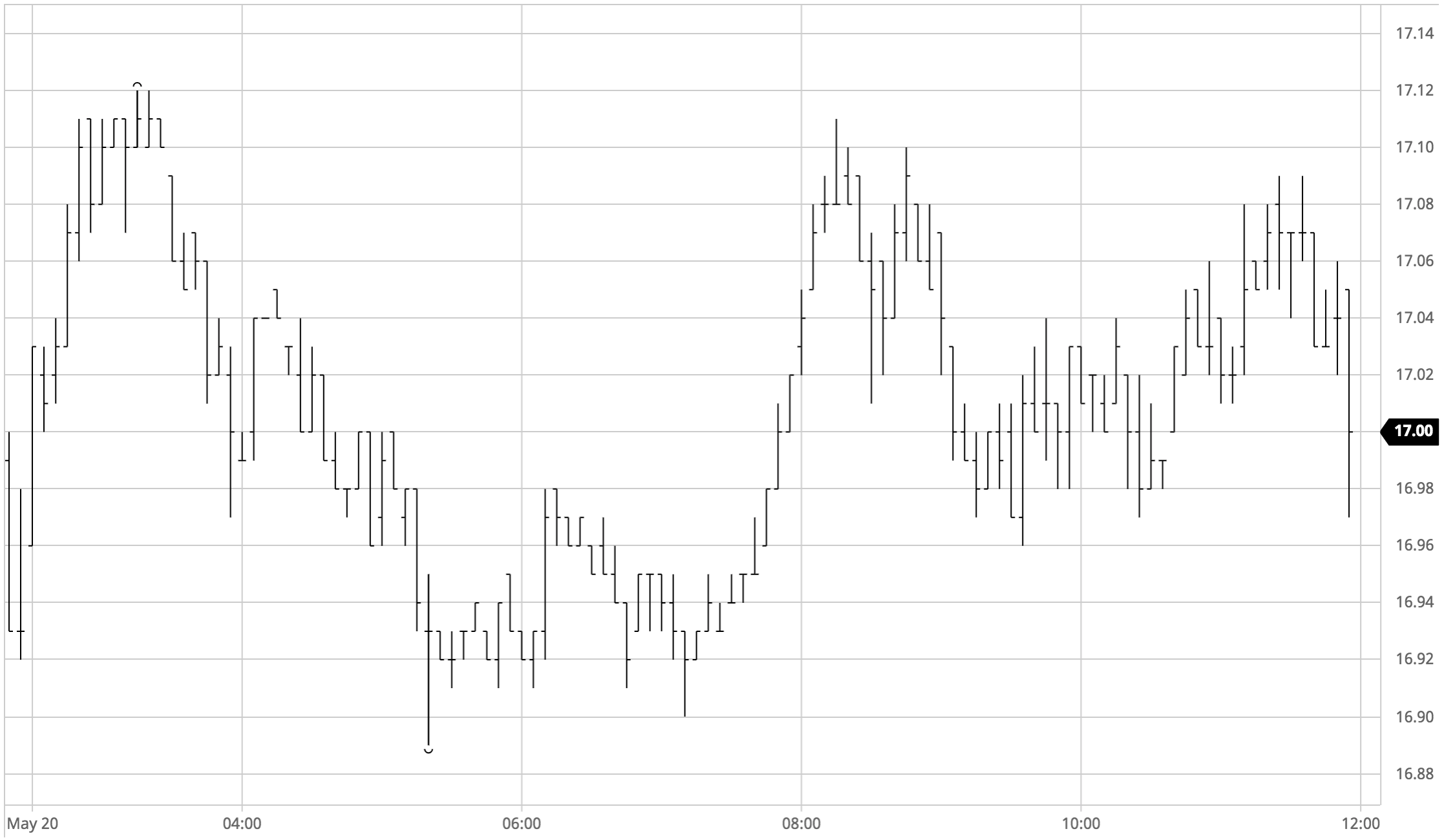

Sugar #11 Jul’21

There was some early buying for the market with the sub 17c settlement level having drawn in some consumer/end user pricing and this lifted Jul’21 to 17.12 during the first hour before topping out as the buying was concluded. A gradual drift lower followed on very light volume but as with recent sessions the decline only reached the 16.90 area before finding some light scale buying that was sufficient to hold prices comfortably in front of the recent 16.80 low. Prices continued just ahead of the lows as we moved into the afternoon with volume continuing at minimal levels, and though there was a small push from specs that took values back toward the morning highs this too seemed somewhat forlorn as the lack of substance failed to sustain the move and led prices back to the 17c yet again when positions were sold back out. Spreads saw a lower volume today as they showed only marginal change that saw Jul’21 gain a point or two over the rest of the board, while the second half of the afternoon proved as non-descript as that which had gone before with prices continuing toward the centre of the range. Closing values were a little higher as Jul’21 settled at 17.04, ending a slow day with the suggestion that there may well be more of the same to follow.

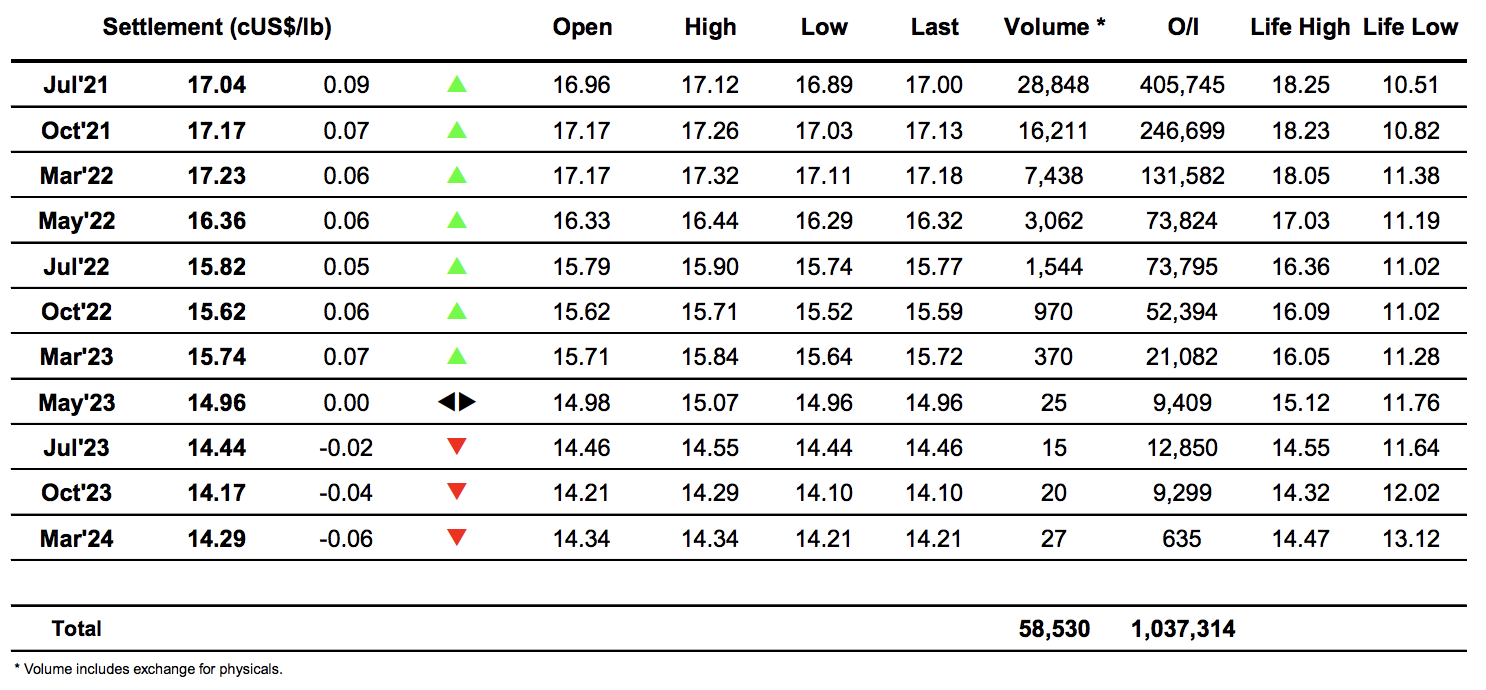

Sugar #5 Aug’21

In contrast to recent days which have seen USD volatility today began very calmly with the market opening only marginally firmer and holding a relatively narrow range either side of unchanged through the early part of the session. Such was the apathy that by late morning this range tightened further and with total market volume still beneath 1,000 lots as we moved into the afternoon it was difficult to see where any movement would appear from. A little more volume was seen as we extended the range upward to $456.60 though the move soon faltered when the buying came to a conclusion, returning the market back into the range to quietly drift once more. The relatoive movements for whites versus the No.11 meant that the premiums gave back the small gains achieved yesterday, though such was the nature of today that it didn’t really mean too much. Closing activity played out very near to unchanged levels with Aug’21 settling at $453.40 to conclude a day that will be best forgotten.

· White premium values were weaker on the day with closing values for Aug/Jul’21 at $77.75, Oct/Oct’21 at $76.90 and March/March’22 at $79.00.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract