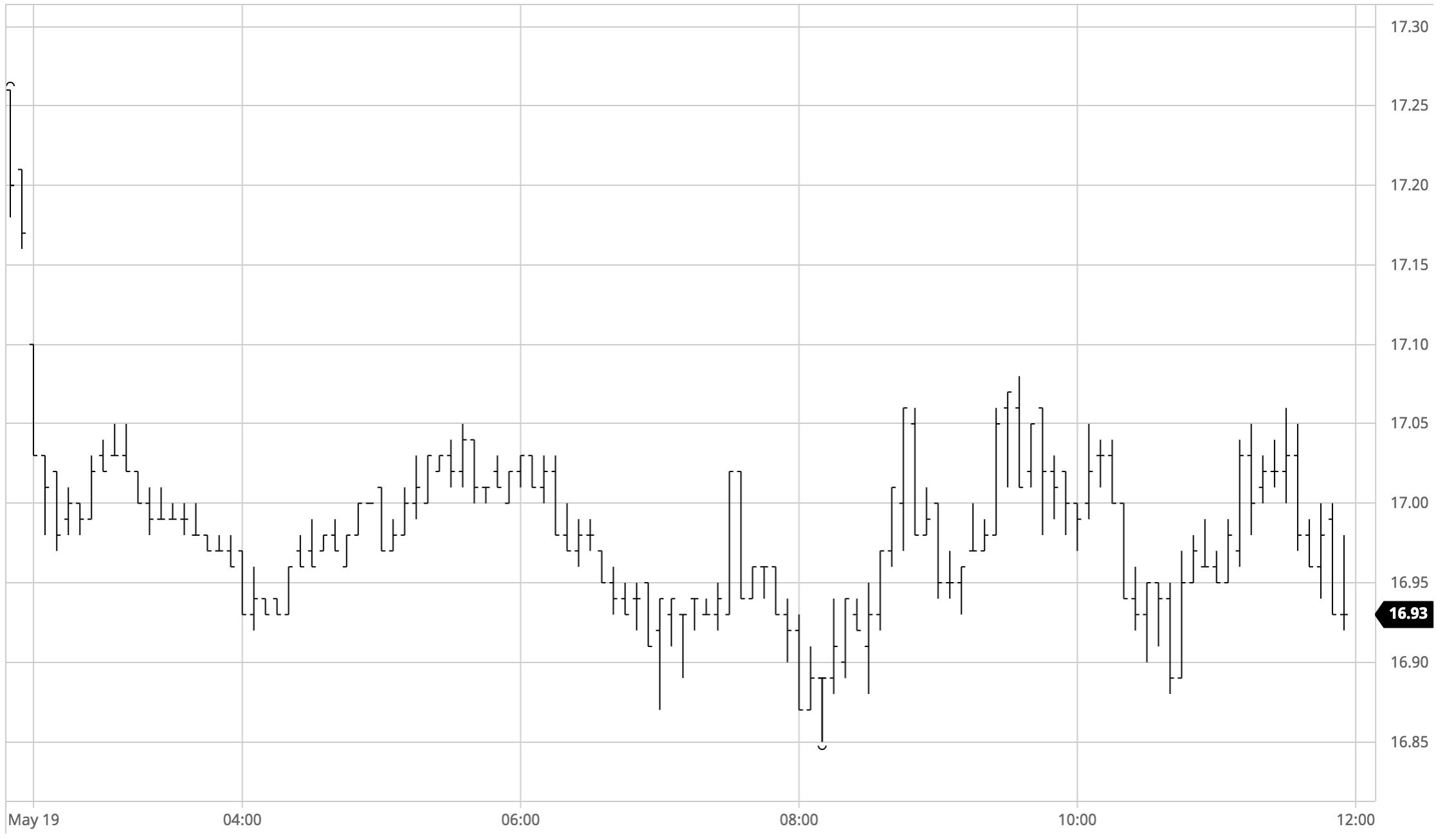

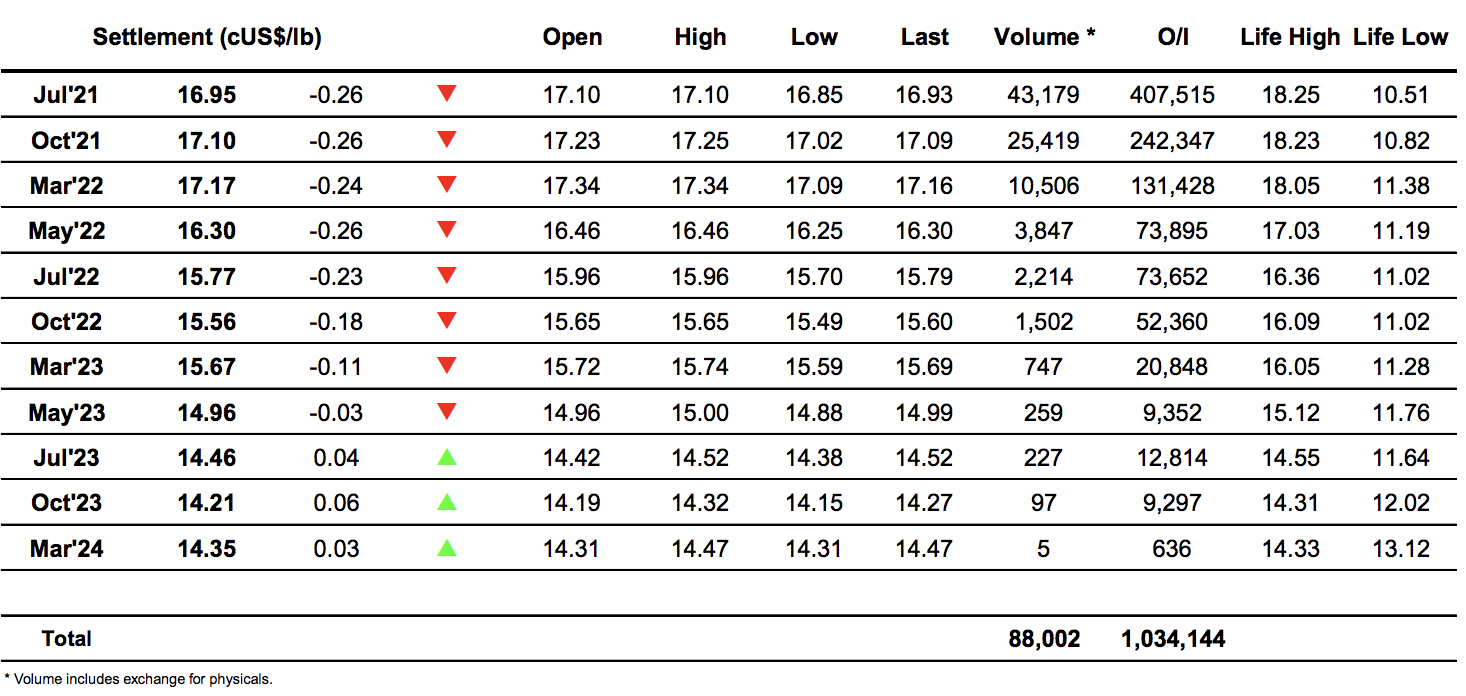

Sugar #11 Jul’21

A stronger USD was leading the macro to give back recent gains and in a reverse of yesterday’s action we saw Jul’21 quickly fall beneath 17c before finding some stability against consumer buying with the support emerging between 17.00/16.80, the same area that has provided recent support. The move served very much to highlight the lack of any sugar news in driving recent movements and across a low volume morning we continued in the 17c area with no desire to push against the macro tide and pull values back upward. The arrival of Americas based traders brought no change to the tedious environment and though there was a marginal widening of the range to 16.85 at the lower end we continued to hold above Monday’s 16.80 mark and so eliminated the prospect of further spec long liquidation. A reasonable proportion of the relatively light volume came from the Jul/Oct’21 spread which saw more than 16,000 lots change hands between -0.16 points and -0.12 points while the flat price seemed magnetised to the 17c area, quickly pinging back whenever there was hint it may venture away. In dull trading we continued sideways right the way through to the close to leave Jul’21 settling at 16.95 and eyes still trained on the USD and macro which remains the most likely source of near term direction.

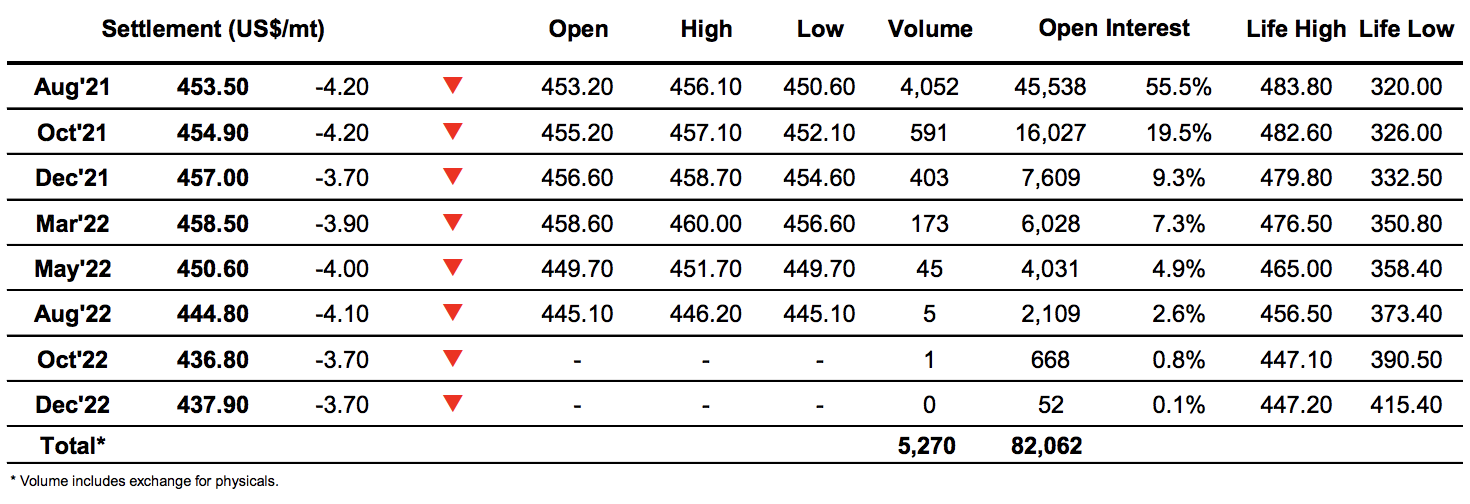

Sugar #5 Aug’21

With macro values including the No.11 already trading lower this morning as the USD recovers some ground it was no surprise that whites followed suit, quickly falling to the $452 area and then onwards to $450.60 with buyers few and far between. A modicum of stability followed through the rest of the morning and we slowly started to reduce the day’s losses though with the exception of a brief push up to $455.00 the movement was gradual and we remained weaker overall. For a while the afternoon saw no change to this pattern of sideway trading but the cycle was briefly broken as a little more buying emerged to send Aug’21 up to $456.10, in the process widening the Aug/Jul’21 white premium back to the $80 area before tailing off once again as some long liquidation took place. Falling back to the $453 area emphasised how we are so tied to the macro currently with the recovery unable to sustain while the commodity world remains under pressure and left values stuck towards the centre of todays narrower range moving into the final stages. Spreads saw their lowest volume for some time with only the Aug/Oct’21 and Oct/Dec’21 seeing more than 100 lots on the day, another sign of apathy from most participants at the present time. We continued within the range through until the close, ending the day at $453.50 to leave the broad sideways prognosis unchanged.

· White premium values ended the day near to session highs, Aug/Jul’21 closing at $79.80, Oct/Oct’21 at $77.90 and March/March’22 at $80.00.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract