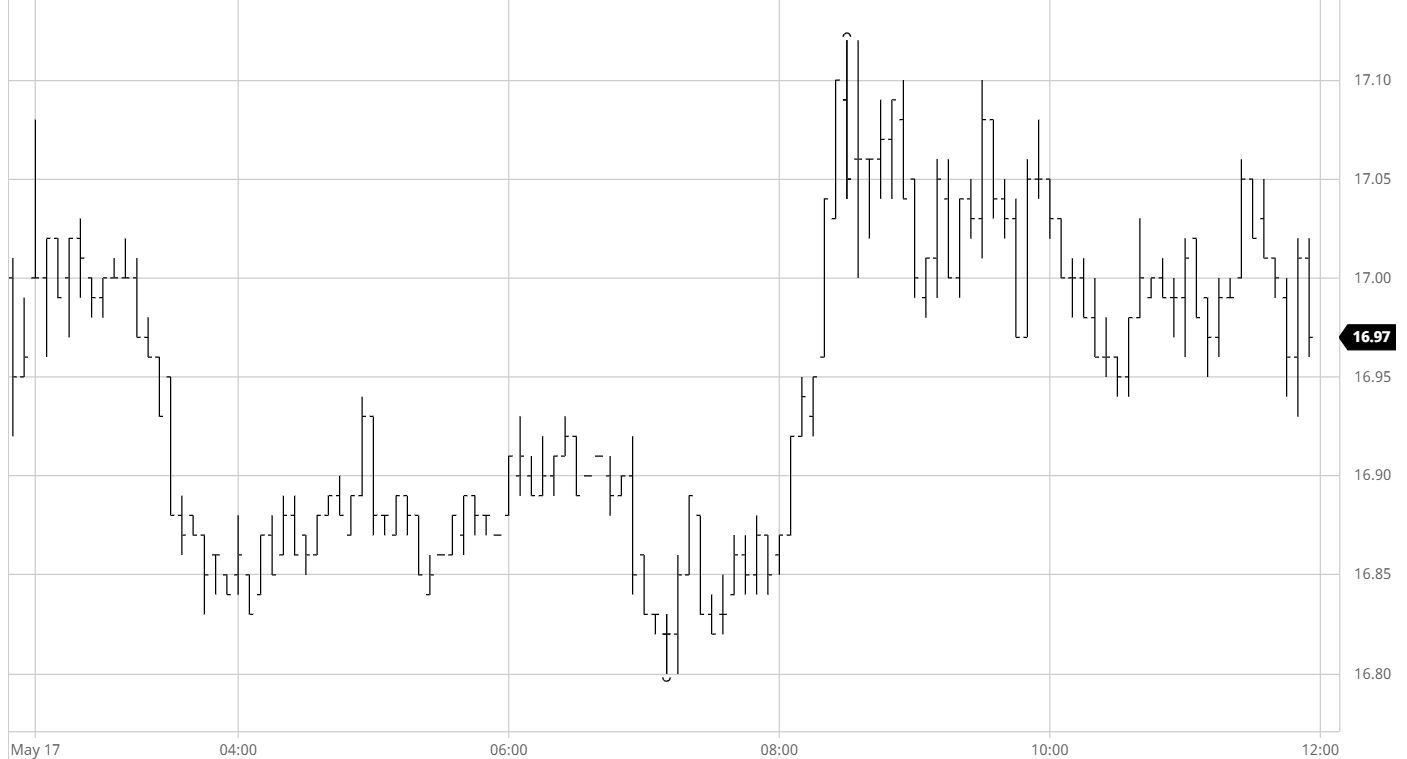

Sugar #11 Jul’21

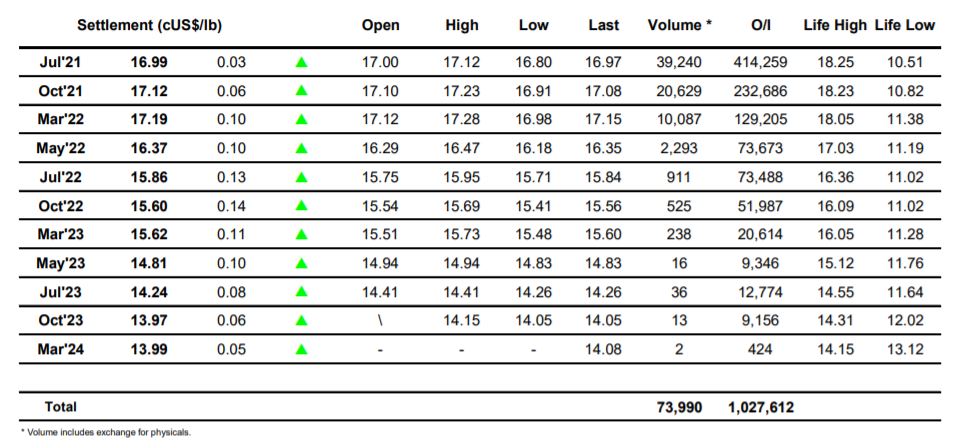

A positive start to the week saw Jul’21 trading up to 17.08 against initial hedge lifting though the move back above 17c did not last beyond the first hour with values then slipping back down and pushing beneath Friday’s 16.92 low mark. There were no obvious sell stops as we broke down and extended the recent lows into the lower 16.80’s and in thin trading the price action soon became confined to a band at the lower end of the range. Friday evening’s COT report showed that the net spec long had grown to 258,572 lots as at last Tuesday which represents the largest holding since October last year, and though there will have undoubtedly been some liquidation on the subsequent decline the number will still be sizable with many short term specs who have liquidated unlikely to be willing to re-enter to the long side immediately. Sugar’s recent woes were emphasised by the fact that we were lagging at the bottom end of a much firmer macro table and though we broke rapidly to new highs as some spec buying emerged in reaction to the relatively cheap macro value the move soon capped out at 17.12. The afternoon then became a return to quiet consolidation with values edging along near to 17c while the Jul/Oct’21 spread moved to -0.14 points discount in another hint that we are not set to recover the recent losses imminently. Given the slow nature of the session it was appropriate that we ended just 3 points higher at 16.99, concluding a performance that has provided a sign of some stability with maybe more of the same set to follow.

Sugar #5 Aug’21

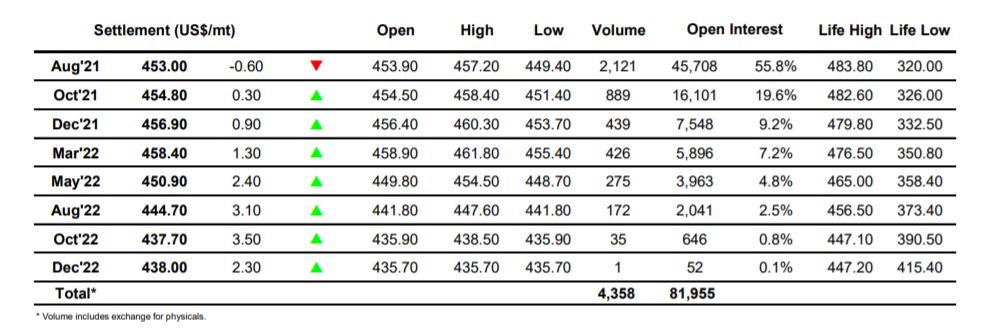

There was some light initial buying which ensured a marginally higher opening for Aug’21 as the new week got underway however the gains proved to be short-lived and it was not long before we slipped back to be testing underling support in the $450 area. As with the latter part of last week we found volume to be very thin with most participants reluctant to get involved in the current uncertain environment and for several hours as we struggled to get away from this $450 area the market felt almost comatose. A break from the tight band during the afternoon led prices to surge sharply to $457.20 on barely 150 lots in reaction to a spec push for the No.11 (which in turn was reacting to a generally firm macro picture), however the lack of substance led prices to retreat back into the range soon afterwards, suggesting that following the sharp decline last week it will take more than a positive day in the macro to get things going again. The rest of the session proved incredibly dull with very little movement for the flat price or the spread, leading us to conclude a very slow day only marginally lower as Aug’21 settled at $453.00.

White premium values were much calmer today in keeping with the nature of the market, trading a touch lower through the afternoon and ending in Aug/Jul’21 at $78.50, Oct/Oct’21 at $77.40 and March/March’22 at $79.50.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract