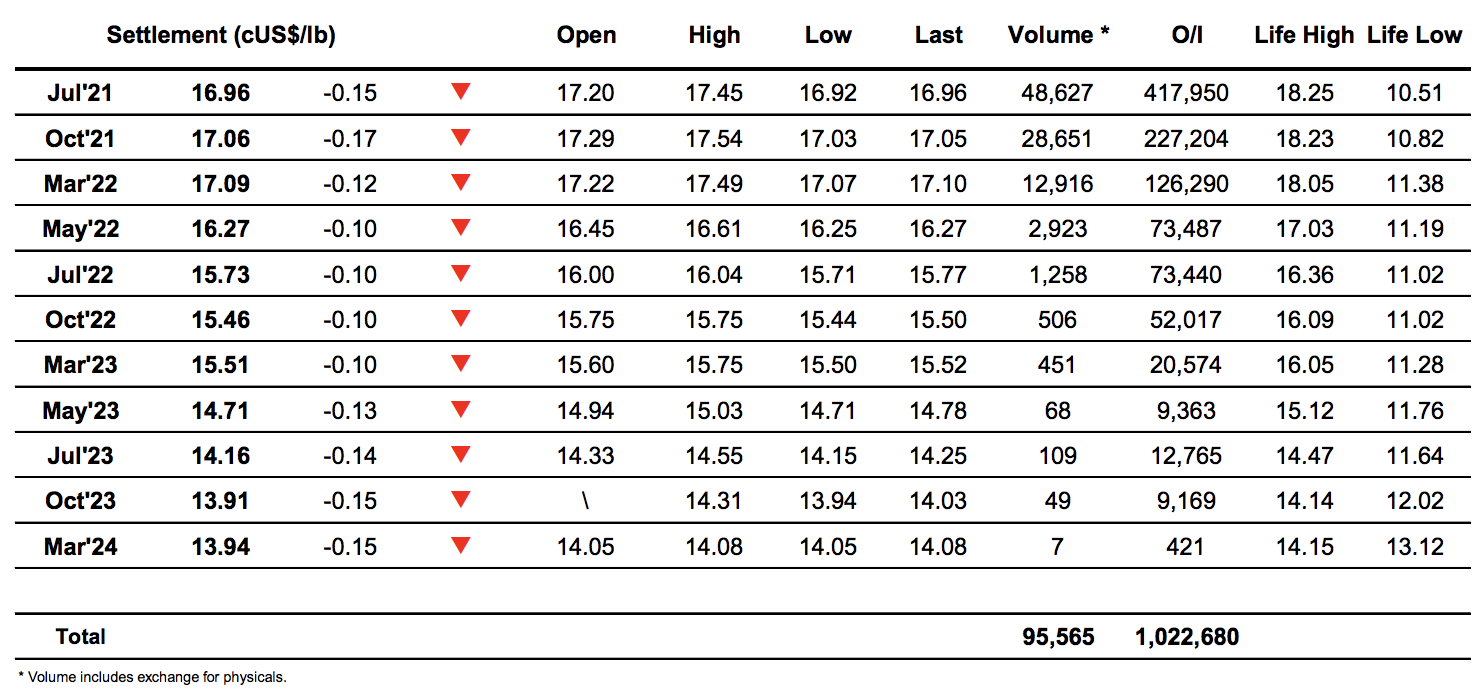

Sugar #11 Jul’21

The day began marginally higher as buying emerged in reaction to the sizable losses incurred yesterday and while the volume was light through this early period the thin environment allowed Jul’21 to surge up to 17.45 within the first 30 minutes before stalling. A period spent consolidating the 17.30’s failed to spark any additional interest in continuing higher and it did not take long before the lack of buying led values to further drift, making another step lower to hold either side of 17.20 as we moved through into the afternoon. The US morning did not bring any change to the picture with specs conspicuous by their absence and clearly as unwilling as most others to step in to such an unclear environment with no obvious clue which way things will now turn next. As we have alluded on many occasions recently the most concerning feature of the market is the ongoing contrarian performance of the front spread with Jul’21 failing to keep pace despite the rally and the lack of confidence reared its head as the afternoon wore on leading Jul’21 to dip back down towards 17c. A brief push through yesterday’s 17.01 low mark took the price to 16.97 but did not trigger any noticeable sell stops leading the sellers to quickly take their foot off of the gas and hold back from over committing. Moving into the final hour we saw another look to new weekly lows, pushing in to some moderate scale buying interest from consumers which has developed and though the price did not slide beneath 16.92 there was no defensive buying to pull the price back up and we closed just a few points above this level at 16.96. This provided a disappointing conclusion to a very volatile week and with the specs having stopped buying for the time being at least and tonight’s COT report anticipated to show a new largest long holding for this year it seems hard to see how we recover in the near term with a look at the end April lows seeming the more likely route.

Sugar #5 Aug’21

Often following a substantial fall we find buying emerge as consumers look to take advantage of the situation and today was no exception as Aug’21 instantly surged back above $460 despite the quantity of buying being extremely low. A high was recorded at $463.00 soon afterwards with the buying then fading away which allowed values to work back into the upper $450’s and begin filling the overnight gap on the intra-day chart. A calmer period ensued through into the early afternoon as we awaited some more conclusive direction, signs that many participants have been whipsawed in recent days and are keen to reach the weekend without incurring further damage. A mid afternoon push back up into the $460 area served to extend the Aug/Jul’21 white premium value back to $79.50 but little else and having failed to gain any traction we slipped back lower once again. Slipping beneath $457.00 triggered some very small sell stops with the resultant dip sufficient to fill what remained of the overnight chart gap, and with buyers hard to come by we continued at the lower end of the range moving towards the close. Some choppy trading on the call left Aug’21 settling just a dollar above the lows at $453.60 on a day which saw barely 2,000 lots traded for the front month, all of which suggests we may see additional weakness next week with the end April low at $443.50 coming further into view.

· White premium values had another choppy session though saw very little actual interest and were values a little higher to end the week with Aug/Jul’21 closing at $79.70, Oct/Oct’21 at $78.40 and March/March’22 at $80.30.

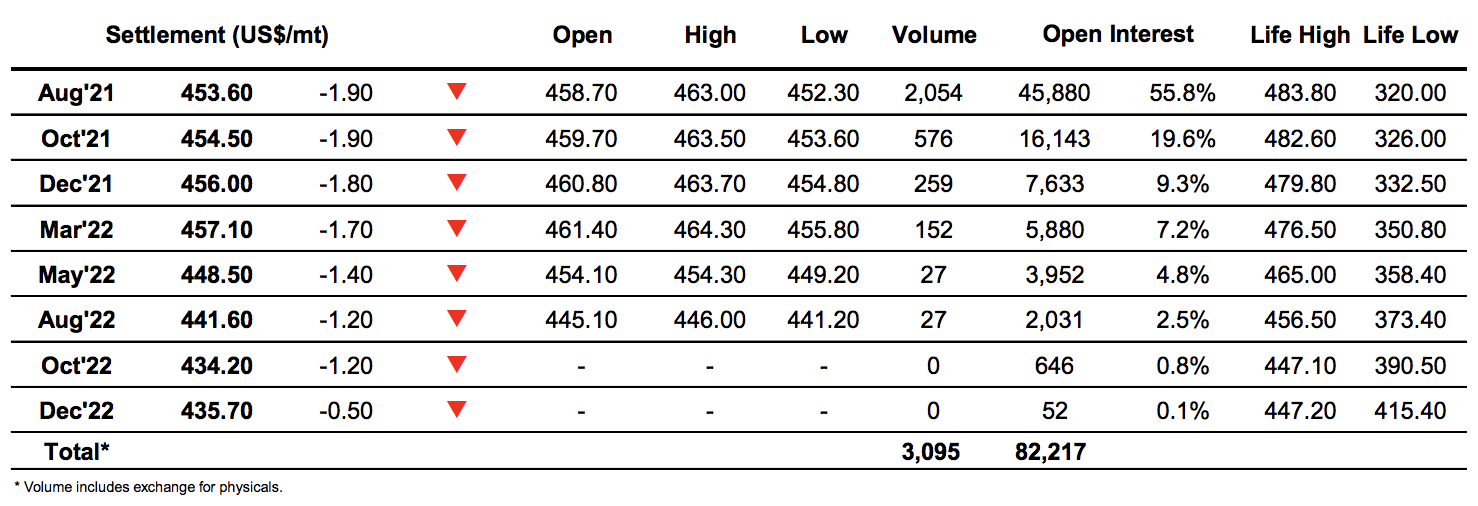

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract