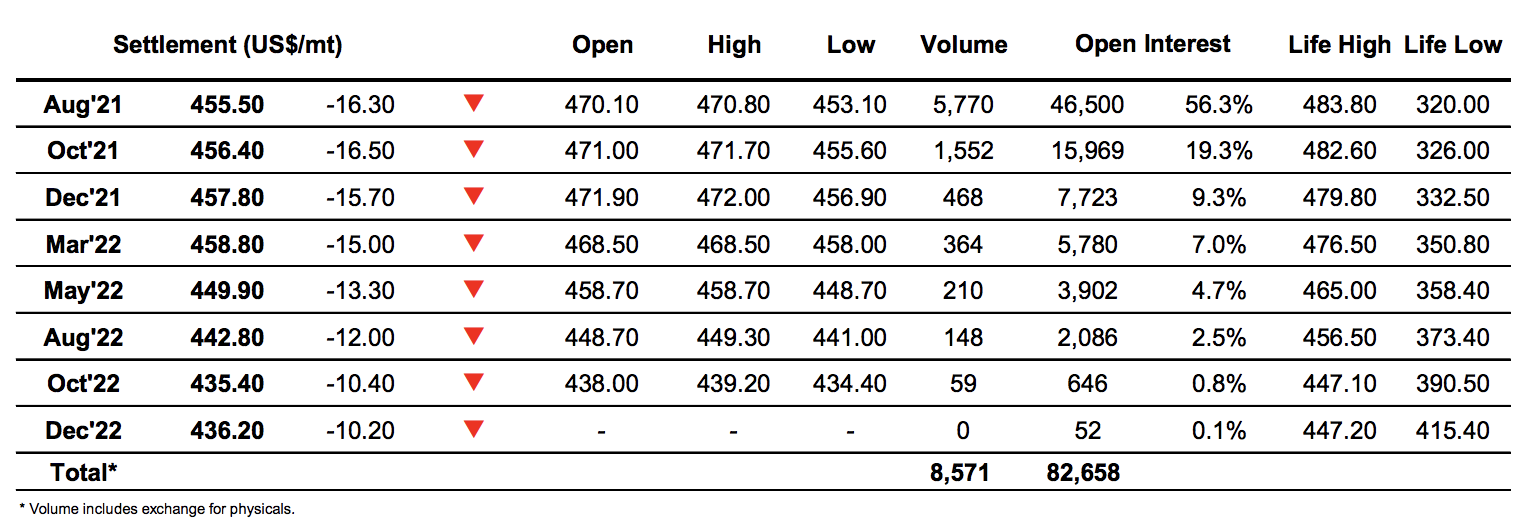

Sugar #11 Jul’21

The losses recorded yesterday set the tone for further weakness this morning, trading down to 17.71 in the opening moments and continuing lower to reach 17.31 before the morning was out. Losses of more that 50 pips so soon in the day would be expected to draw out some support and there was a little pricing interest from consumers starting to appear which allowed values to stabilise as we moved into the early afternoon by pulling back above 17.50. The baton was then passed to the larger specs to test their desire to try and protect the recent gains however it was clear that for today at least they had no desire to try and fight the tide and this left prices edging sideways near to 17.40 for a prolonged period, awaiting the next move. It was a long time in coming however the final 90 minutes saw renewed downside activity, set in motion by more spec selling and sell stops triggered as we moved beneath the morning low of 17.31 and also this weeks low mark of 17.26. Aided by a miserable looking macro picture (that we had already outperformed parts of in recent days) an increasing volume of the recently added longs was discarded and as we moved through the final hour of the session so the 17.00 mark came into clear sight, something most would not have envisaged when trading above 18c just 24 hours ago. Having flirted with 17c and recorded a daily low just a single point above the closing stages saw some short covering take place that pulled values a little away though Jul’21 settlement at 17.11 undoes all the recent technical strength and with Jul/Oct’21 falling to a new yearly low at -0.12 points it re-raises the question as to whether the flat price can sustain a rally in the face of spot spread weakness and if it cannot that would imply that further corrective action will likely follow.

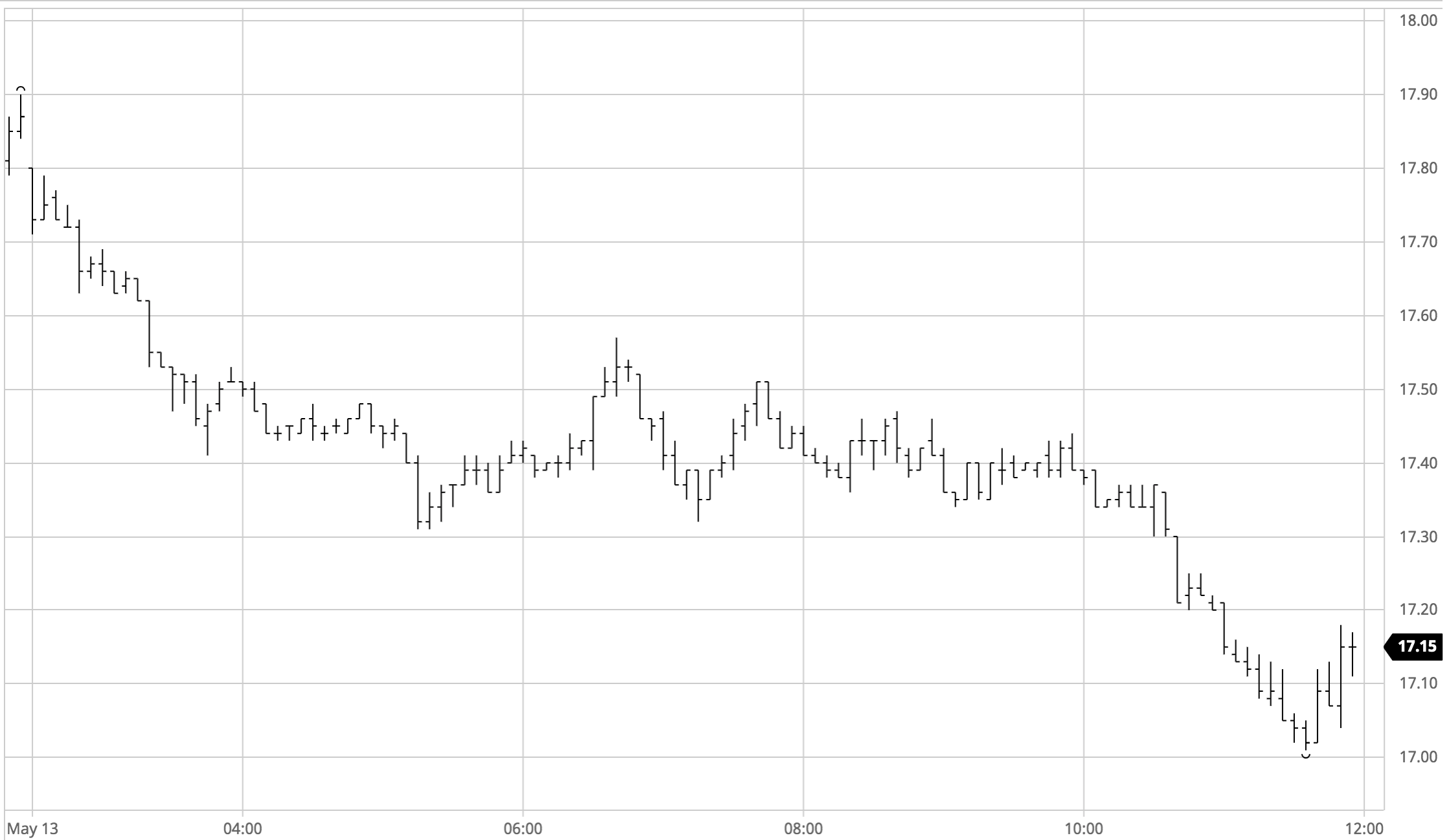

Sugar #5 Aug’21

Lower values elsewhere led to a weaker opening and with no obvious buying showing up the decline began to gather pace. It was only in the $461 area that we paused to take stock of the situation and for a while it appeared that we would try to build a base in this area, however a break to new daily lows triggered sell stops which in the thin conditions sent Aug’21 rapidly downward to $453.10 and in the process briefly narrowed the Aug/Jul’21 white premium in to $71. Prices soon bounced back from this low and climbed back above $460 where we saw buy stops (the earlier shorts getting whipped around possibly) take the price back above $465 and extend the white premium briefly above $80, a remarkable range for the differential within less than 90 minutes that further serves to emphasise the thin nature of the market currently which is becoming counter-productive as many traders stand aside for fear of getting caught out. Following such a volatile morning the afternoon proved top be rather more calm where with the damage done and specs no longer buying we resumed a slower downward path which led back to the upper $450’s. By the close we had slipped further to the $455 area though conditional remains calm and at no stage did we seem likely to test this mornings low. Settlement level for Aug’21 was at $455.50, some $28 beneath yesterday’s contract high, a rapid decline which severely damages the technical picture and will have any bears starting to eye up the $443.50 low from end April as a target that would likely draw our further spec liquidation.

· White premiums ended a very volatile session moderately lower with Aug/Jul’21 closing at $78.25, Oct/Oct’21 ending the day at $76.50 and March/March’22 at $79.50.

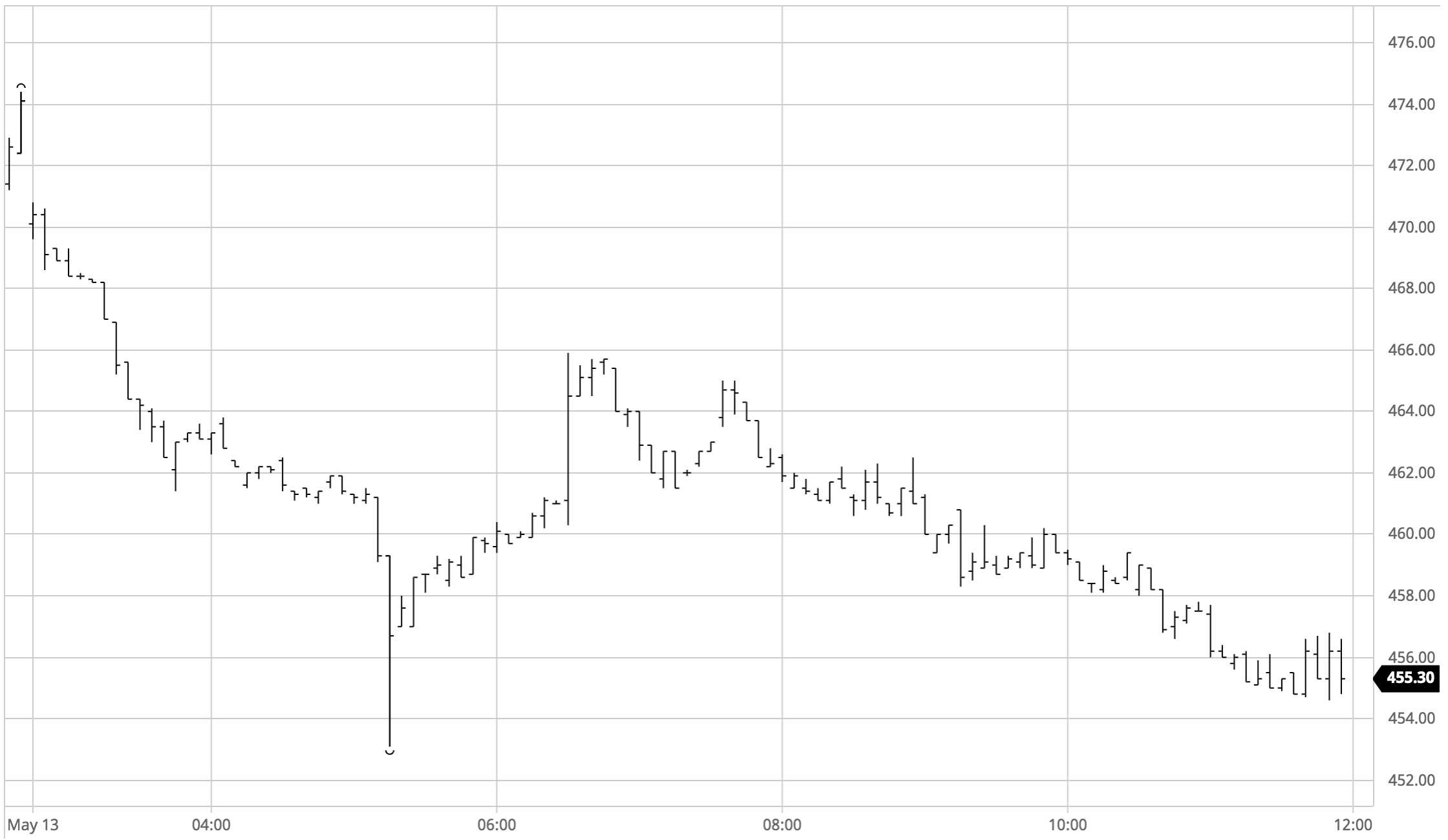

ICE Futures U.S. Sugar No.11 Contract

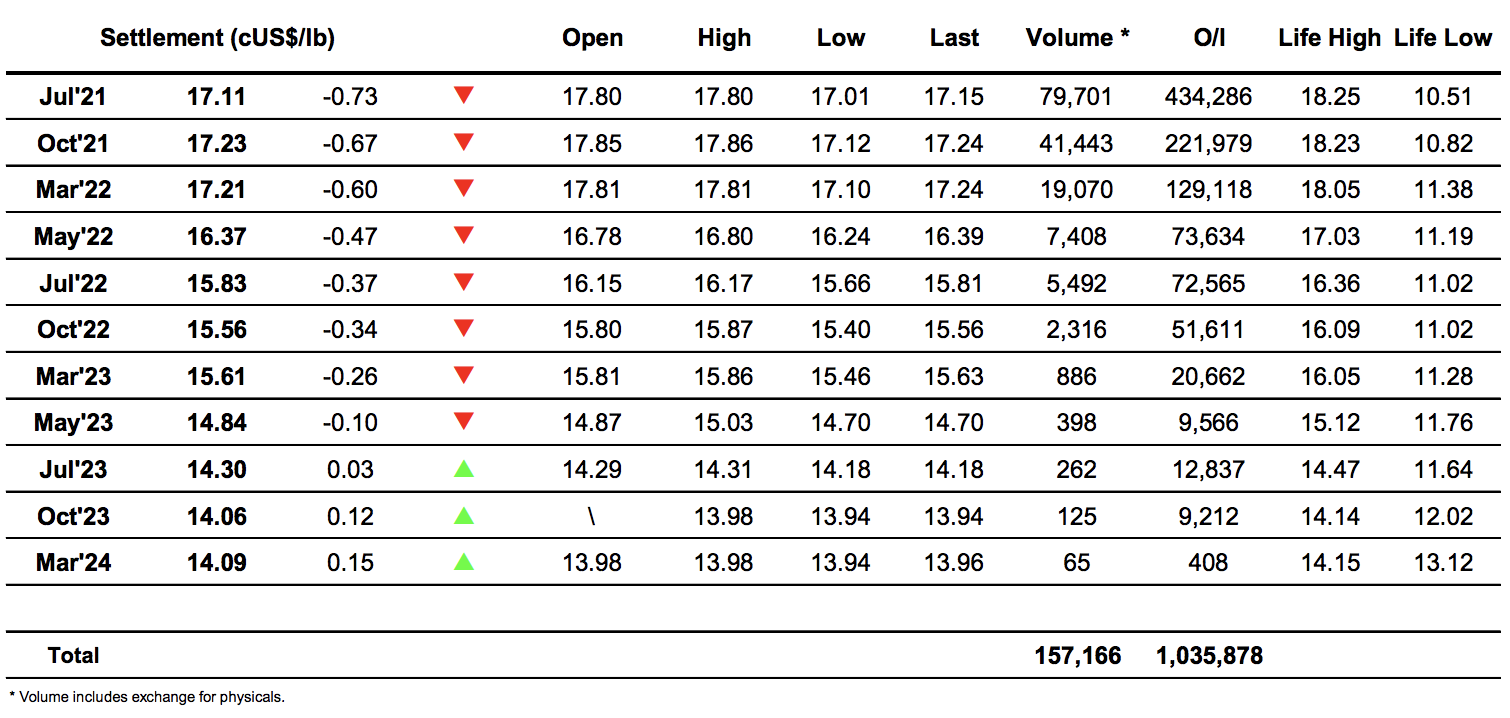

ICE Europe Whites Sugar Futures Contract