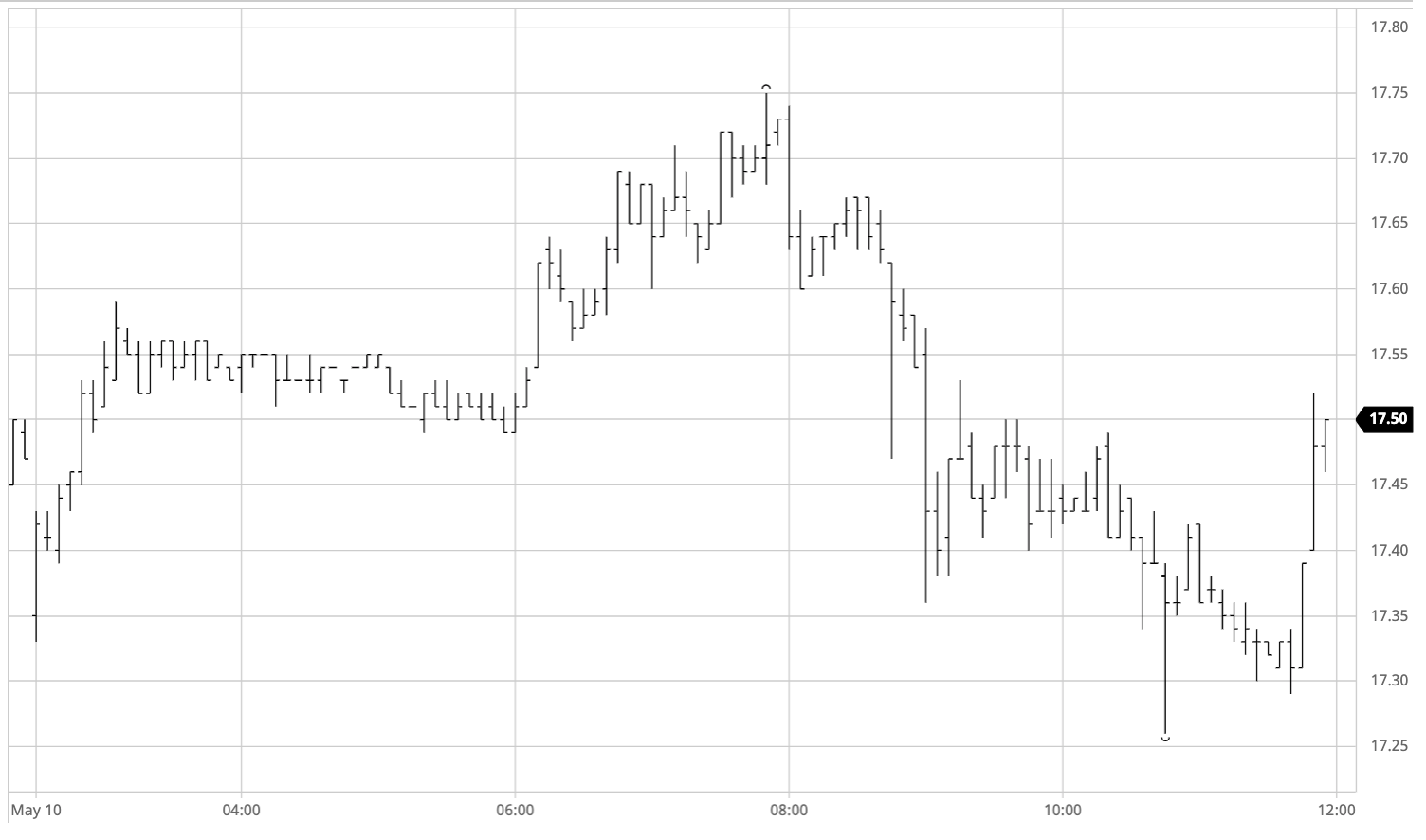

Sugar #11 Jul’21

A lower opening was soon reversed as traders looked to maintain the technical strength for outright values, and it was not long before we were trading up into positive ground with an initial high at 17.59 followed by a period of consolidation in the 17.50’s. A modest reduction in the spec long to 241,715 lots as at last Tuesday shows that most of the recent longs have been retained through a 5-day reporting period which showed a good deal of volatility, and with this in mind and the subsequent new contract highs we are likely still near to 250k lots long as a live position. With such a position there remains a strong desire to continue pushing upwards, particularly from the smaller specs, and with this in mind it was no surprise that the early afternoon saw values push ahead to 17.75, however it seems that with other support limited at the present time we will need to see funds/specs prepared to grow the long size to new yearly highs if the move is to continue in a sustained way and we are not instead to top out for the time being. The nature of the subsequent afternoon slide beards this out with limited buying seen as moderate liquidation provided a series of small downward spikes, culminating in a session low at 17.26. Values continued at the bottom of the day’s range until the final 15 minutes when defensive buying arrived to dress the close, ensuring an unchanged Jul’21 settlement price at 17.49 though not in itself doing anything more to convince of the longer term upward merits.

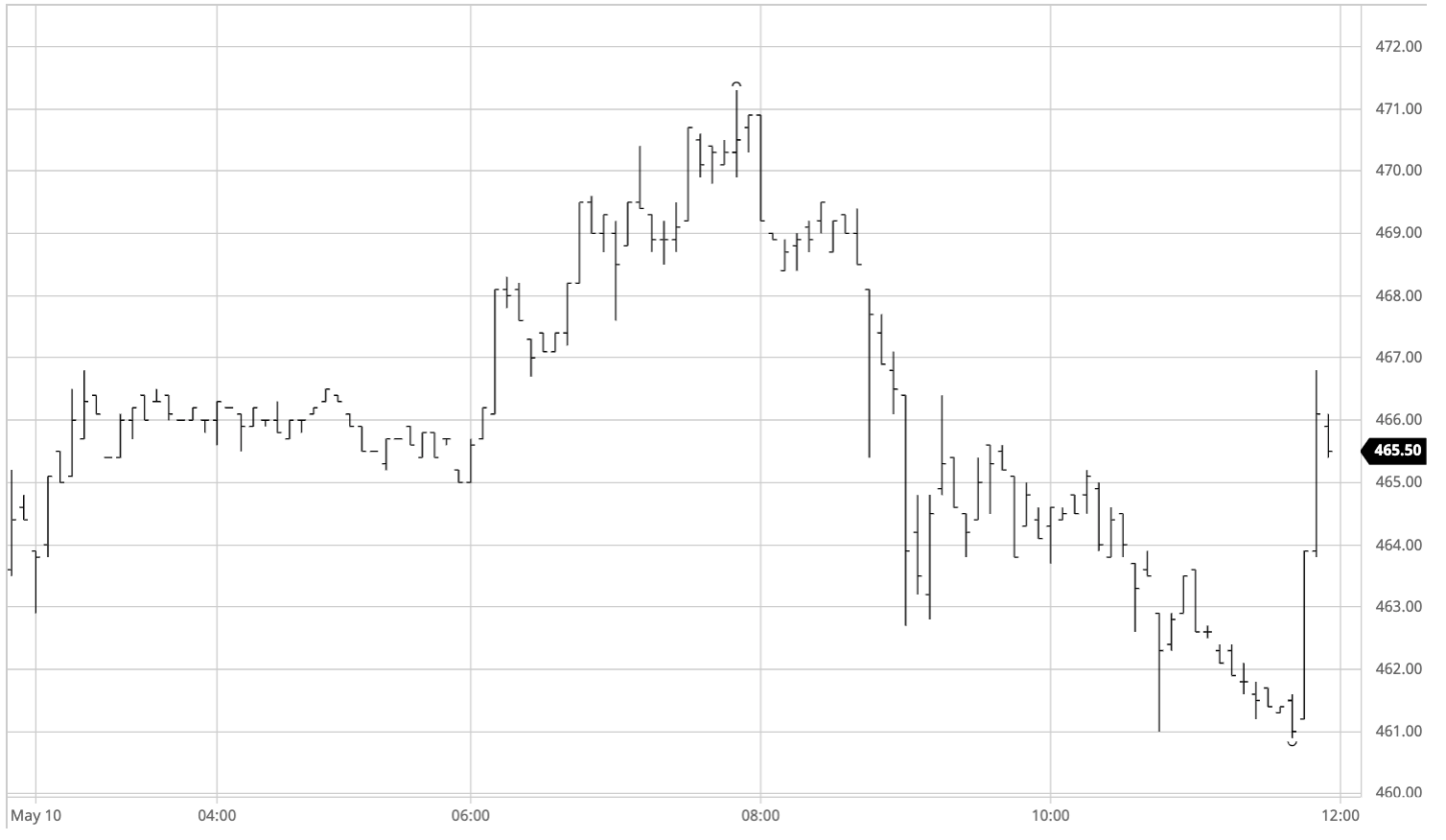

Sugar #5 Aug’21

A marginally lower start to the week was quickly erased and most of the morning was spent consolidating the $465/$466 area on low volumes, awaiting some input to get things going in either direction. It was not until the early afternoon that this arrived with the monotony broken by some spec buying which took Aug’21 easily upwards to $471.30 on relatively light volumes with selling still extremely limited at these levels despite now be being back to within $10 of the contract high. The thin environment of course works both ways and when the buying dried up soon afterwards and some long liquidation occurred the market fell rapidly with a mere 167 lots Aug’21 changing hands between $468.50 and $462.70 to show how tough things are for the short term traders at present. An attempt at stabilisation followed before further session lows were recorded and we continued at the bottom of the range moving into the final hour. Despite the outright prompts falling back there was the best showing from the Aug/Oct’21 spread we have seen in a while today with the differential rallying to -$0.50 intra-day though by the latter stages we had eased from the high’s to the -$1.50 area. White premiums meanwhile had shown strength again on the rally where Aug/Jul’21 showed out above $81 though was also unable to sustain its highs and fell back towards Fridays closing levels later in the day. A closing burst of defensive buying sent values surging by around $5 to a positive settlement value at $466.10, though the overall action was not fully convincing as to the longer term upside merits.

The late push ensured a positive close for white premiums leaving Aug/Jul’21 at $80.50, Oct/Oct’21 at $80.75 and March/March’22 at $81.50

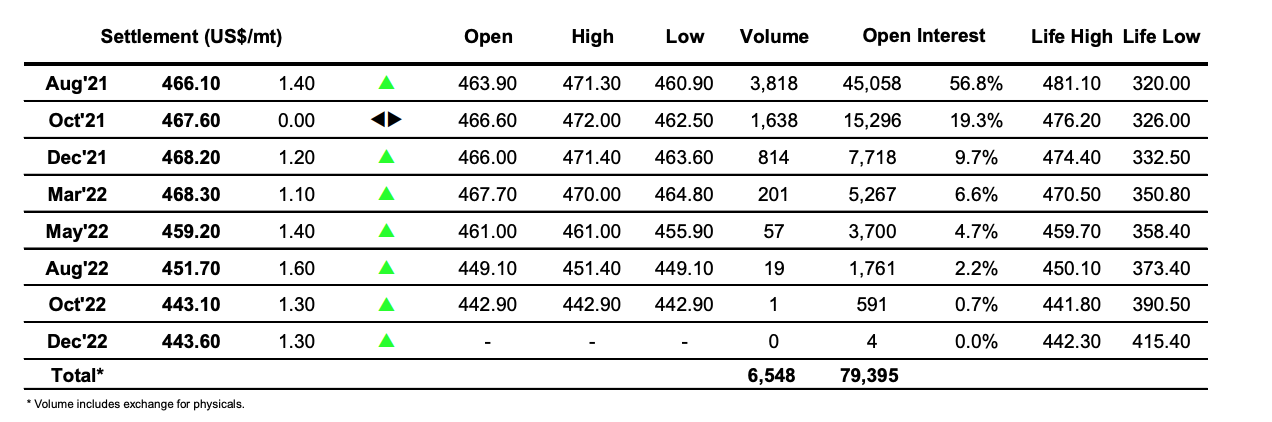

ICE Futures U.S. Sugar No.11 Contract

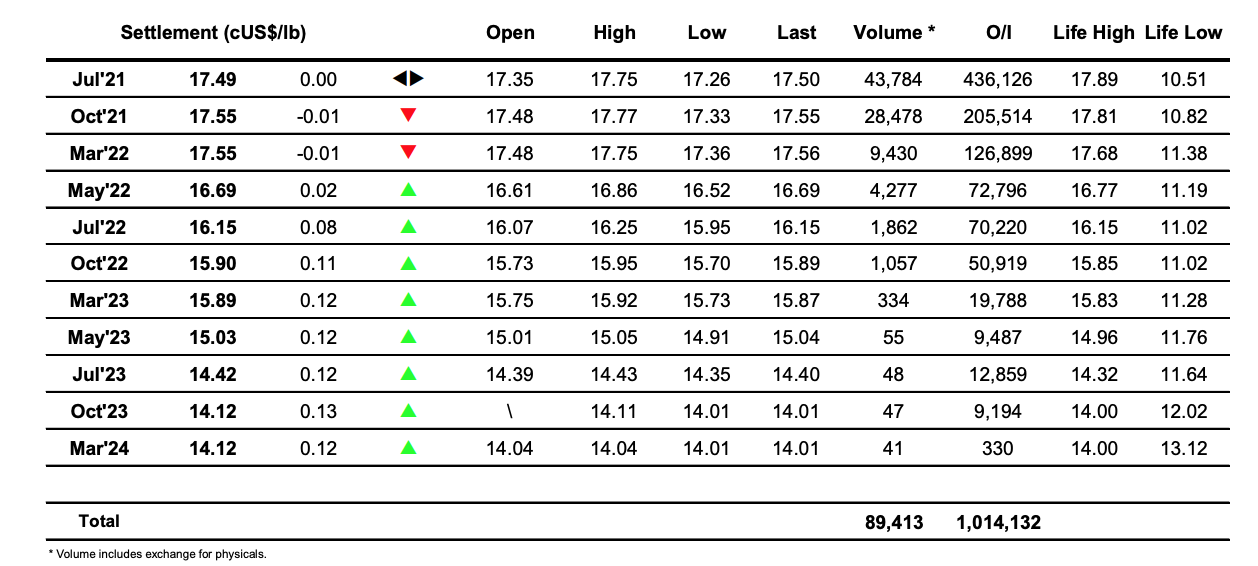

ICE Europe Whites Sugar Futures Contract